The coronavirus crisis has led to surging gold prices on the back of demand for safe-haven investments. Gold prices are currently at $1,635.31 an ounce, yielding a year-to-date return of 8%. The plunge in oil prices sent gold shooting above the level of $1,700 an ounce on Mar 8 —levels last seen in December 2012. The combination of higher gold prices and lower oil prices, which make up significant portion of a miner’s costs, will translate into improved operating margins and higher free cash flow for miners.

Global Oil Price War

Saudi Arabia slashed its official selling price, and boosted its oil production significantly in retaliation to Russia’s refusal to lower its crude production at the OPEC meeting. This triggered the steepest drop in oil prices since the 1991. The state-owned producer, Saudi Aramco (SE:2222), recently announced it would raise the maximum production rate to record highs of 13 million barrels a day. The United Arab Emirates' state-owned Abu Dhabi National Oil Co. followed suit and plans to raise production to 4 million barrels per day in April. Notably, oil prices were already under pressure due to the coronavirus outbreak, which led to travel restrictions and consequently impacting demand for fuel.

On Mar 11, Brent oil futures were down 3.8% to $35.79 per barrel, losing 48% so far this year. Crude oil was at $32.98 per barrel on Mar 11, down 4% in a day and 48% year to date.

Coronavirus Declared a Pandemic

The World Health Organization (WHO) has officially designated the coronavirus outbreak as pandemic. The virus has spread across more than 100 countries and per WHO’s situation report as of Mar 11, 2020, the total number of confirmed coronavirus cases is at 118,327. In China, the confirmed cases stand at 80,955. Meanwhile, 37,371 cases have been confirmed outside China, with three countries — Italy, the Republic of Korea and Iran — accounting for 70% of these. With the alarming number of cases in Italy, the country has been put on lockdown in an attempt to put a check on the spread.

The impact of the outbreak on customer spending, travel restrictions, factory closures in China, disruption in global supply chains, among others, are expected to weigh on the global economy. In fact, per the Organisation for Economic Cooperation and Development (“OECD”), an escalation in the coronavirus outbreak could cut global economic growth in half and push several countries into recession. The organization projects meager growth of 2.4% in the world economy this year — the lowest rate since 2009. The growth rate of China is anticipated to be below 5% this year, suggesting a decline from 6.1% reported last year — the weakest growth rate in almost 30 years.

Rising Gold Prices, Lower Oil Prices to Aid Miners’ Margins

This scenario has fueled the demand for safe-haven assets like gold. The yellow metal has been gaining steadily this year — starting with the U.S-Iran tensions and now the coronavirus-scare. Also, earlier this month, the U.S. Federal Reserve lowered the benchmark U.S interest rate by 0.5% as a pre-emptive measure to cushion the economy from the threat of the coronavirus outbreak. This fueled the yellow metal’s prices as gold tends to attract buyers in a low interest-rate environment. The precious metal was also boosted by a weaker greenback.

The processing of the gold ore is highly energy intensive. Mining companies are major consumers of energy with around 50% of their production costs closely linked to energy prices. While higher gold prices will boost gold miner’s top-line performance, lower oil prices will aid margins.

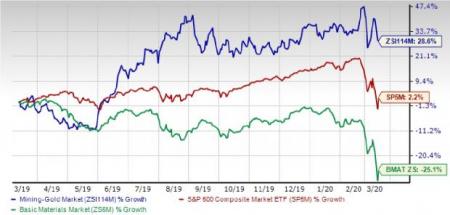

The Gold Mining industry has rallied 28.6% over the past year compared with the S&P 500’s growth of 2.2%. Notably, the industry falls under the broader Basic Material sector, which declined 25.1%. The industry currently carries a Zacks Industry Rank #27, which places it at the top 11% of 256 Zacks industries.

Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential. In the past year, the industry’s earnings estimates for the current year have been revised upward by 20%.

We thus believe that the time is right for investors to add some gold stocks to their portfolio. We have employed the Zacks Screener to pick four top-ranked gold stocks. Our research shows that stocks with the combination of a VGM Score of A or B and a Zacks Rank #1 (Strong Buy) or 2 (Buy) offer good investment opportunities.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Alamos Gold Inc. (TSX:AGI) : Based in Toronto, Canada, this company has a Zacks Rank #2 and a VGM Score of B. The Zacks Consensus Estimate for 2020 earnings indicates year-over-year growth of 25%. The estimate has moved north by 14% over the past 60 days The company has a trailing four-quarter positive earnings surprise of 9.82%, on average.

Gold Fields Limited (NYSE:GFI) : The Zacks Consensus Estimate for 2020 earnings of the Sandton, South Africa-based company suggests year-over-year growth of 21.4%. The estimates have also moved up 28% over the past 60 days. This Zacks Ranked #2 stock has a VGM Score of A at present.

Barrick Gold Corporation (NYSE:GOLD) : The Toronto, Canada-based company currently has a Zacks Rank #2 and a VGM Score of B. It has an estimated long-term earnings growth rate of 2%. The Zacks Consensus Estimate for its 2020 earnings has moved up 12% over the past 60 days and indicates year-over-year growth of 49%. The company has a trailing four-quarter positive earnings surprise of 17.9%, on average.

Kinross Gold Corporation (NYSE:KGC) : Based in Toronto, Canada, the company presently has a Zacks Rank #2 and a VGM Score of A. The Zacks Consensus Estimate for 2020 earnings has moved up 19% in the past 60 days, indicating an improvement of 47.1% year over year. The company has a trailing four-quarter positive earnings surprise of 182.5%, on average.

Harmony Gold Mining Company Limited (NYSE:HMY) : Based in Randfontein, South Africa, the company currently has a Zacks Rank #2 and a VGM Score of A. The Zacks Consensus Estimate for 2020 earnings indicates year-over-year growth of 221%. Further, the estimates have moved up 18% over the past 60 days.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Gold Fields Limited (GFI): Free Stock Analysis Report

Barrick Gold Corporation (GOLD): Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY): Free Stock Analysis Report

Alamos Gold Inc. (AGI): Free Stock Analysis Report

Original post

Zacks Investment Research