Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

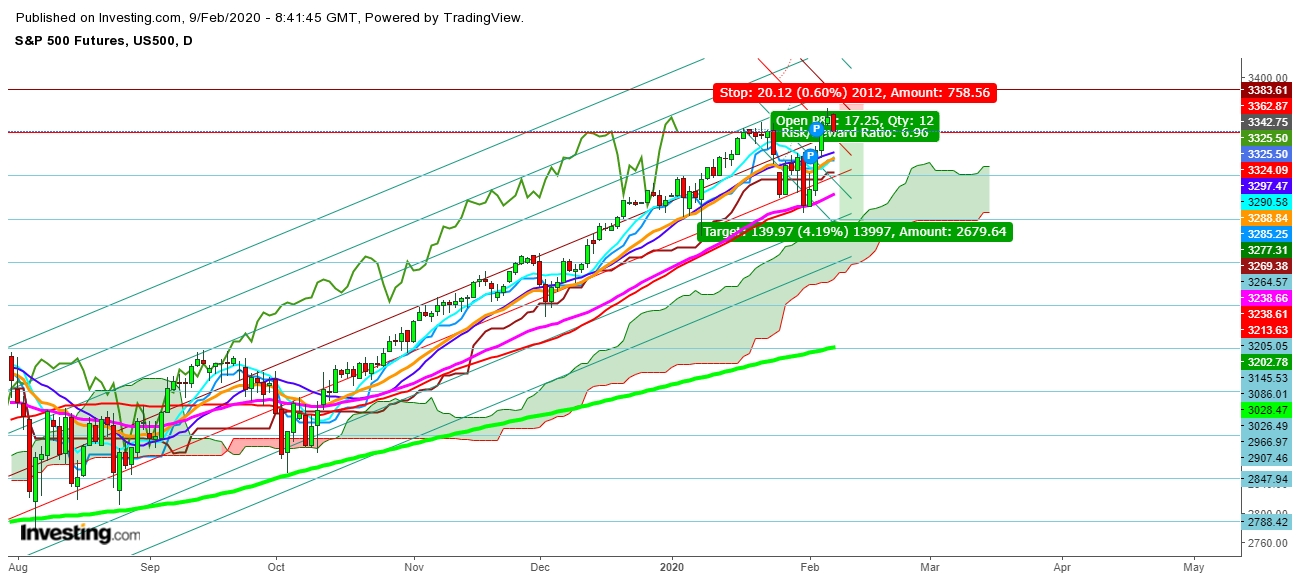

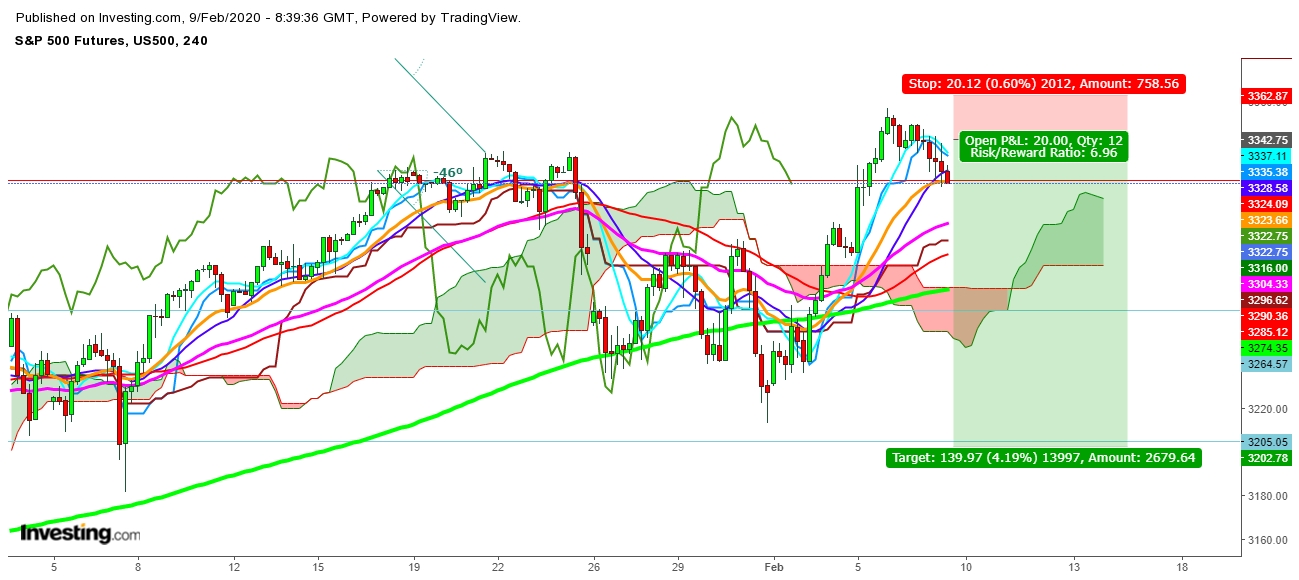

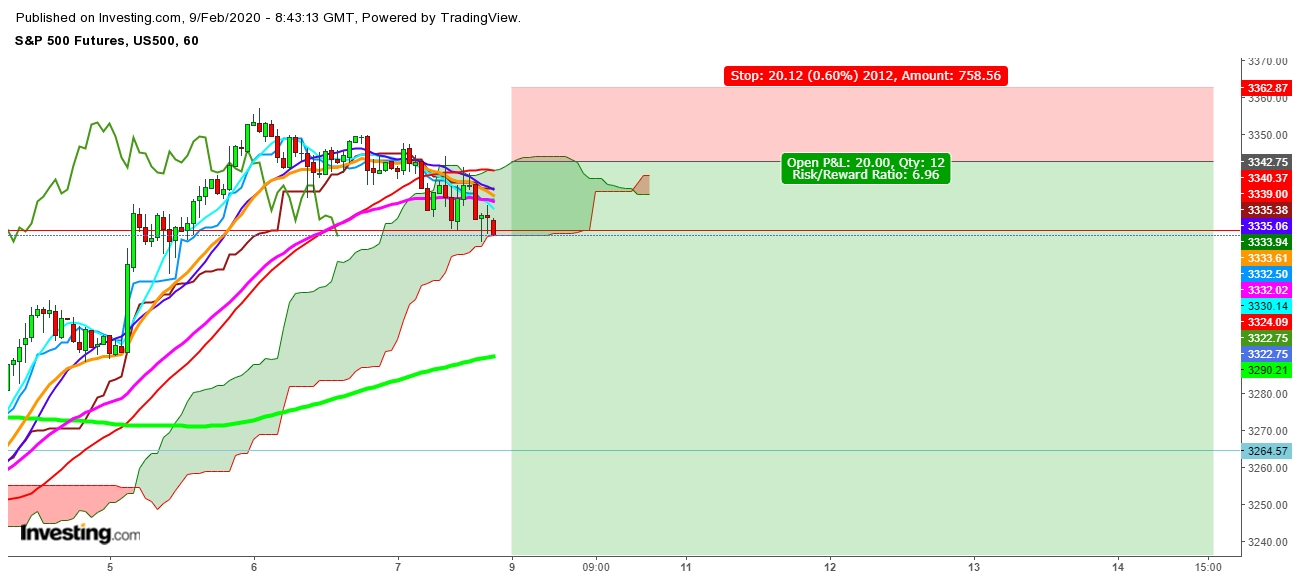

On analysis of the movements of S&P 500 Futures in different time frames, I find that the coronavirus outbreak looks evident enough to break bulls’ back at the global level amid growing fear of prevailing slowdown due to upcoming hurdles in global exports.

I find that a gap-down opening of S&P 500 Futures on the first trading session of the week of February 9th, 2020 will confirm the outbreak of the virus’s economic impact on global equity markets.

Finally, China’s decision to inject a heavy dose of monetary stimulus might prove one more attempt to extend the pile of debt on the economy; which has been constantly bearing the burden of tariff trade tussle since October 2019. Coronavirus appears ready to push the global equity markets dramatically downward.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.