Covid-19 infections are surging. Will the price of gold surge too?

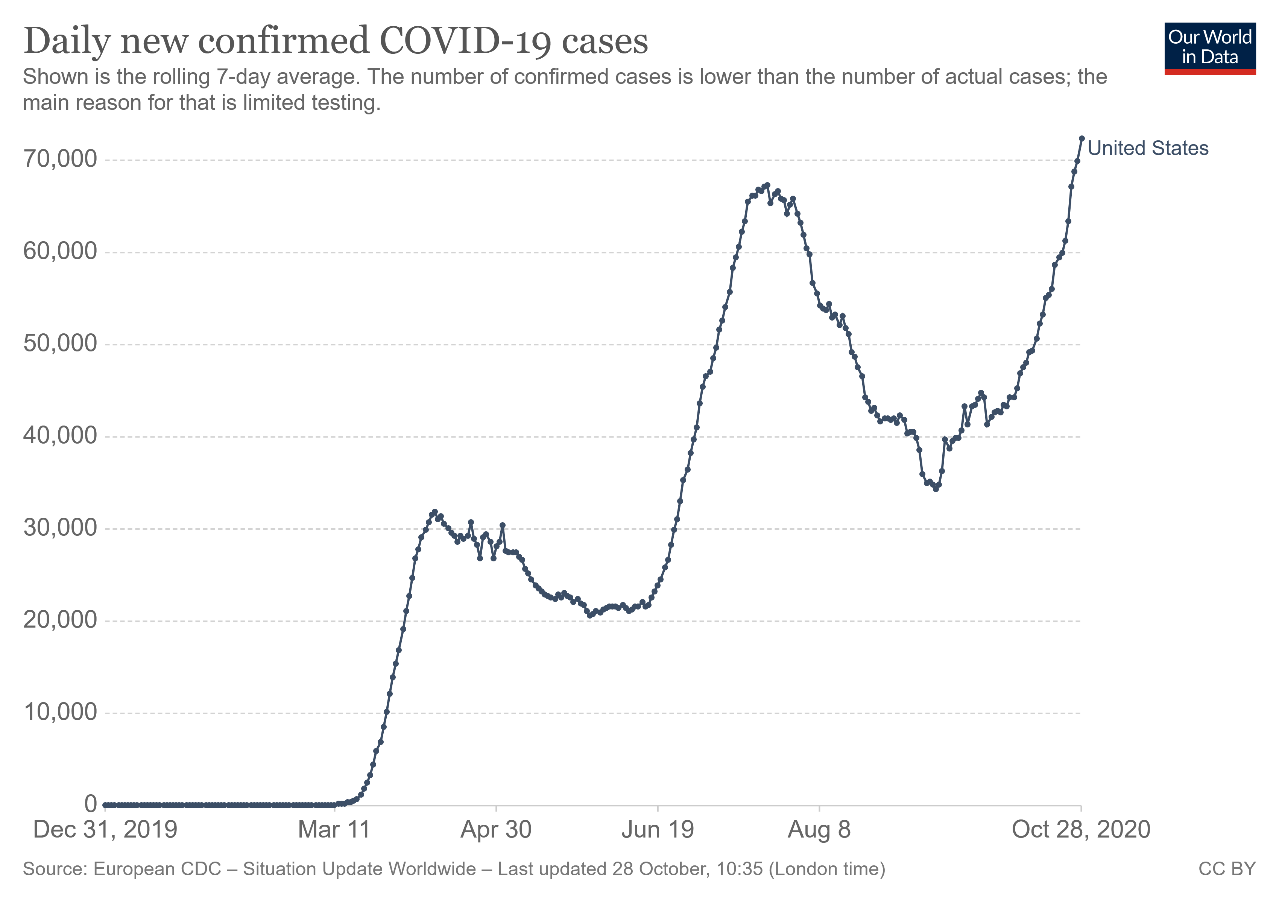

Things are not looking good folks. The epidemiological situation is worsening. As the chart below shows, the number of new daily cases (the rolling 7-day average) has recently reached a new record.

The record spread has brought the national total to about 8.78 million infections and nearly 227,000 deaths. What’s more frightening, with the recent spike, these numbers are only going to rise higher. Some epidemiologists even claim that the next several weeks will be the darkest period of this pandemic. As a reminder, the second wave of the Spanish Flu was the worst and most lethal – let’s hope that history will not repeat itself when it comes to the coronavirus infections.

However, what is really disturbing is that in certain states, the rising cases of Covid-19 are threatening the healthcare’s capacity that needs to deal with the pandemic. Therefore, we ask you to please stay careful and take care of yourself as your number one priority!

Moreover, the latest news about the delays in the vaccine tests suggest that a viable vaccine that has proved efficient and safe to a reasonable extent will not be produced on a full scale by spring 2021 at the earliest. Like the many times that I’ve warned you before - waiting for the vaccine is like waiting for Godot, who never arrives.

Unfortunately, counting on the vaccine has become the primary national strategy for dealing with the coronavirus. Thus, the risk remains that without a quick vaccine distribution, the epidemic will spiral out of control.

Implications for Gold

So, how will the Covid-19 cases surge affect the gold market? It seems that this time, people were expecting the second wave of the pandemic and are slightly less frightened. But, if the hospitalization rate increases further, the panic may set in again. The second wave implies more social distancing and a slower recovery. It is also an argument for somewhat larger than smaller financial stimulus.

All these reasons are fundamentally positive for the yellow metal, although the gold price has been trading around $1,900 so far, as one can see in the chart below.

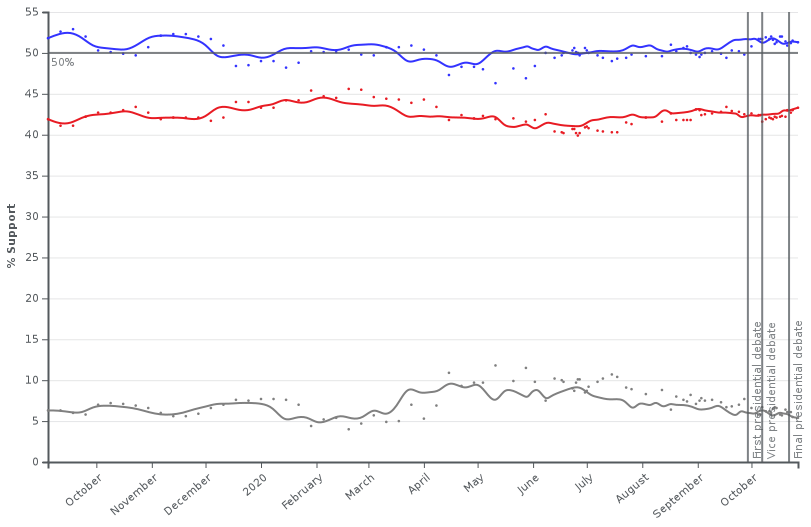

The US presidential election is another issue by itself. Rightly or not, some voters can blame the President for the rising number of infections. Thus, the pandemic increases Biden’s changes, whose potential victory is perceived as a more bullish scenario for gold (especially if Democrats also take full control of the Congress). As the chart below shows, he has an average polling lead of 8.0 percentage points over Trump. I would not bet my money on these polls (simply because they are inaccurate and respondents don’t want to give their genuine opinion about politics when polled), but nevertheless, the lead is pretty impressive.

Still, expect the unexpected. Although Biden is believed to be more inflationary and positive for the gold prices, as a response to the election results, the markets can behave unexpectedly, especially in the short-term. As a reminder, many analysts believed that Trump would be very bullish for the gold prices. Of course, gold gained significantly during his presidency, and, yes, it soared during election night, but it quickly reversed and went into a downward trend for months.

In any case, the elections may be of less importance than many people believe. After all, no matter who is elected, the next president will deliver a large financial stimulus, because the pressure from businesses, Wall Street, states, and people is simply too big. The increases in fiscal deficits, public debt, and the Fed’s balance sheet should support the gold prices.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.