Cornhas two powerful setups unfolding. Triple upside alignment that favors the bulls, but a massive distribution that favors the bears. Triple alignment is straight forward. All trends agree - UP.

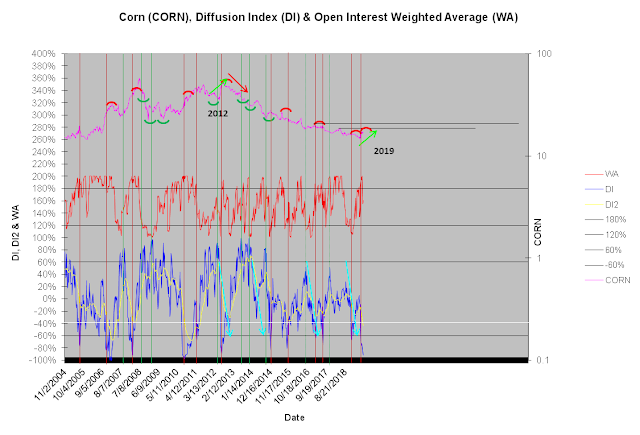

Corn's distribution of leverage, however, suggests the invisible hand is not confirming the alignment. DI and DI2, two measures that define the energy behind the trend, are -92% and -43%. -92% is only a few ticks above the strongest distribution reading of -100%. -43% is a low number, but there's been lower reading over the past 10 years. Either way, these reading create one powerful blocking dome, which according to the fundamentalists no longer matters because of all the damage to the corn crop. Maybe so, but the invisible hand has a consistent track record, and distribution did not lighten up as prices decline recently. It only intensified. Maybe the invisible hand has lost its mind, or maybe it knows something the chasers cannot see. It's wrong periodically, but it's not wise to make a big bet against it.

It might be wise to watch this one from the sidelines.

Corn DI