The price of corn surged in the spring of 2022 and was on the verge of a new all-time record shortly after Russia invaded Ukraine. It reached the vicinity of $8.30 per bushel in late April last year before falling to $5.80 three months later, in July. It has been hovering around $6.50 ever since and trades at just under $6.30 as of this writing.

Corn is among the most essential food commodities in the world. It is of vital importance when it comes to food security. Its price is determined by supply and demand factors, which in turn, are heavily affected by harvest quality, geopolitical and trade tensions, and even weather conditions. The good news is that all these factors still appear to produce recognizable Elliott Wave patterns with predictive value.

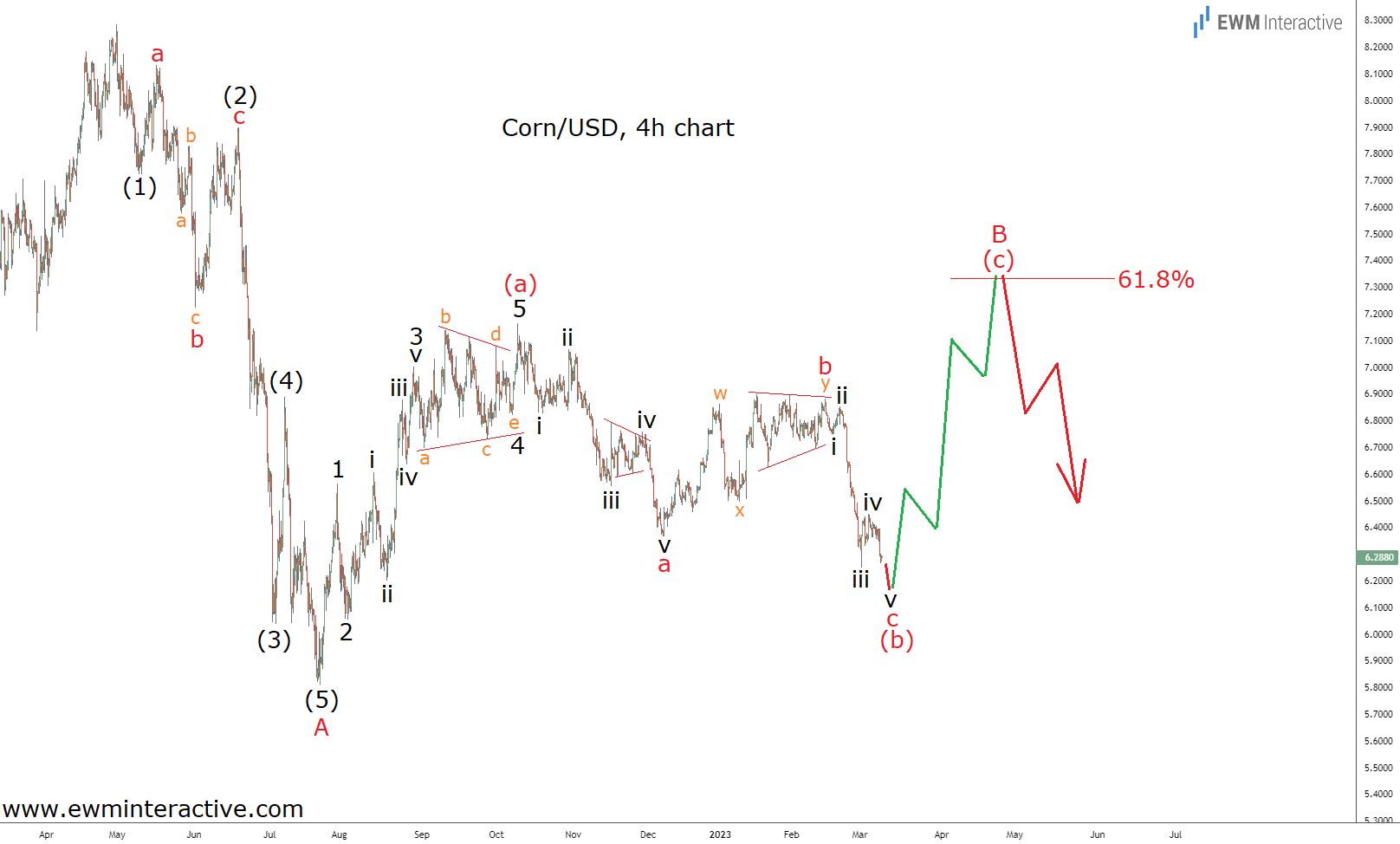

The 4-hour chart of corn visualizes the commodity’s fall from nearly $8.30 to $5.80 per bushel between April and July 2022. It can easily be seen as a five-wave impulse, labeled (1)-(2)-(3)-(4)-(5), where wave (2) is a running flat correction. The theory states that a three-wave retracement follows every impulse. Here, the impulsive decline in wave A was followed by a recovery to $7.17 in October 2022.

That recovery can also be marked as an impulse pattern, though. We’ve labeled it 1-2-3-4-5, where the five sub-waves of wave 3 are visible, and wave 4 is a triangle. Corn is most likely still in the corrective phase of its bearish 5-3 wave cycle. The top at $7.17 marks the end of wave (a) of B. The current weakness is a simple a-b-c zigzag in wave (b), whose wave ‘b’ is a w-x-y corrective combination with a triangle wave ‘y’.

If this count is correct, corn should start rising again in wave (c) of B soon. Wave (c) is supposed to exceed the top of wave (a), putting levels above $7.17 within reach. The 61.8% Fibonacci resistance level near $7.30 looks like a natural bullish target. Once reached, the 5-3 Elliott Wave cycle marked A-B would be complete. The downtrend should then resume in wave C to sub-$5.80 per bushel.