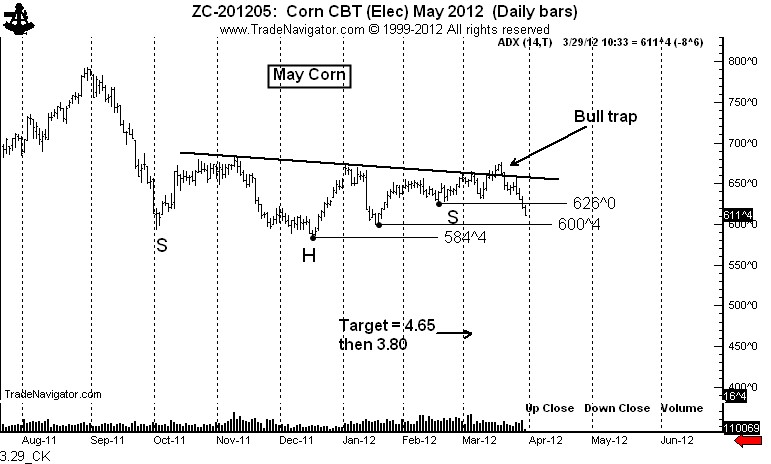

I have commented for many weeks that the 6-month congestion in Corn was due for a decisive resolution. The ADX index reached a level of 10 in late February, a level that normally precedes a major trend. Often the first thrust after a low ADX reading is the false move, followed by the real trend in the opposite direction. This is exactly what happened with the upward bull trap breakout in mid March.

The decline below the Feb. 16 low at 626 was the official sell signal in Corn. The target is now 4.65, and then 3.80. There may be rallies along the way - and the first rally could occur after the grain stocks report on Friday. A rally back into the 626 area would be a shorting opportunity.

Confirmations for this bear trend will occur by closes below 6.00 and then 5.84. May Corn should not close back above 6.34 or this analysis is placed into question.

Disclaimers:

- I currently have a short position in Corn.

- My trading approach generates approximately 30 to 40 signals per year as candidates for the Best Dressed List. Half of these signals fail to materialize in a sustained trend.