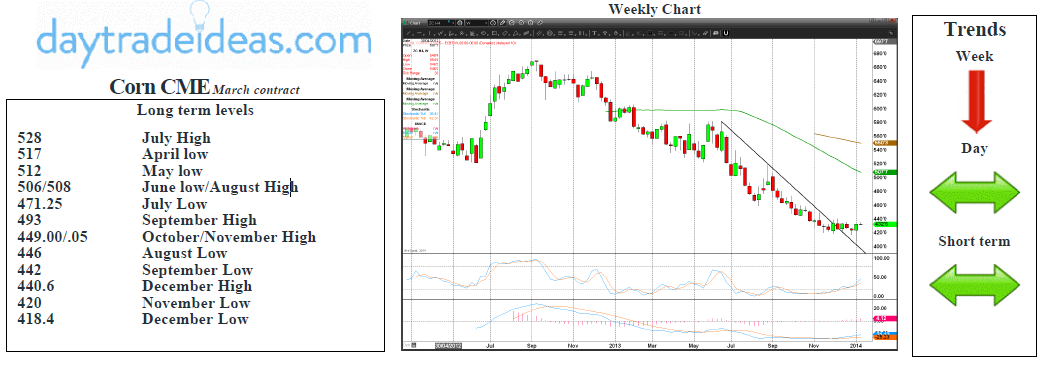

Corn meets 4 month trend line and short term Fibonacci support at 425/424 and being oversold, a low for the day is very possible here. However if we continue lower look for a buying opportunity at 418/417, with stops below 412.

Resistance at 431 then this week's high at 435/436 may hold a move higher again, but above here today a test of December highs and Fibonacci resistance at 440/441 is expected. A good chance this holds a move higher at this stage, but if we continue on look for a selling opportunity at 448/449. Exit longs and try shorts with stops above 453.