- Dollar extends advance ahead of core PCE data

- Dollar/yen stays on intervention watch

- S&P 500 secures strongest Q1 in five years

- Gold stretches to new record high

Will PCE data point to sticky inflation?

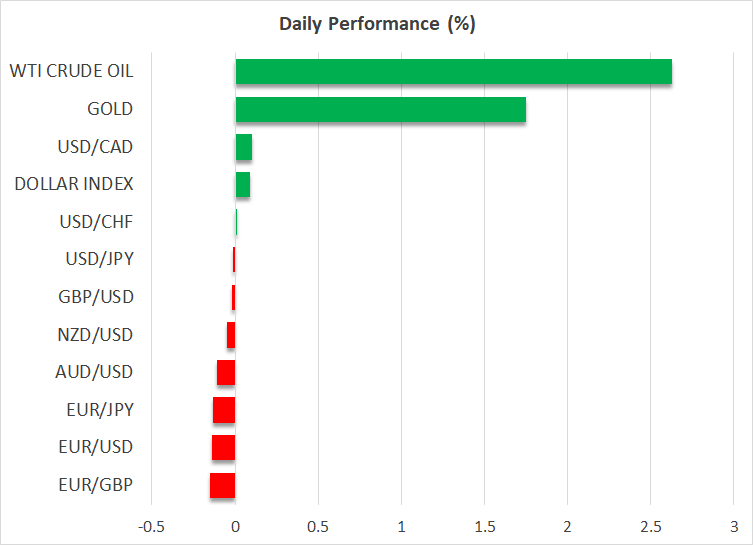

The US dollar continued outperforming most of its major peers on Thursday as the upside revision of the US GDP data for Q4 added more credence to Fed Governor Waller’s view that the Fed should not rush into lowering interest rates.

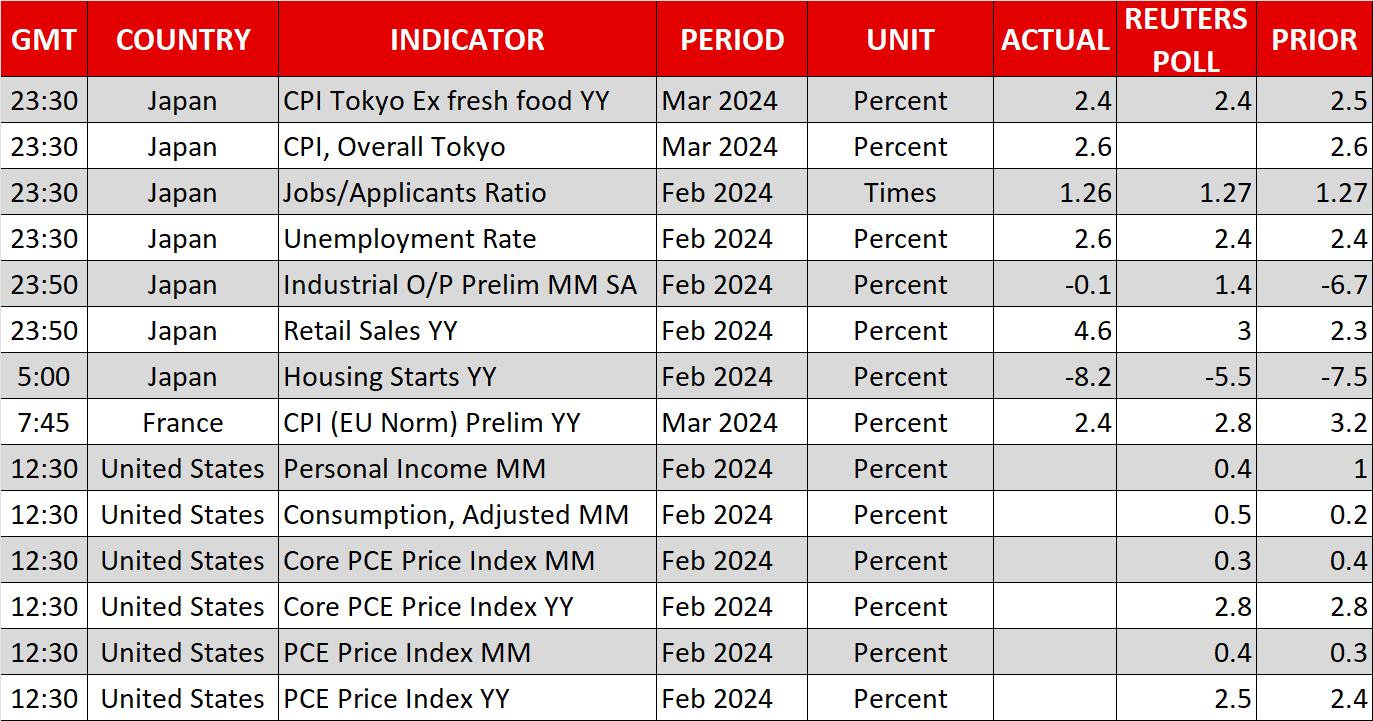

Today, dollar traders have turned more cautious, avoiding large positions ahead of the all-important PCE inflation numbers later today. The spotlight is likely to fall on the core PCE rate, as it is considered the Fed’s favorite inflation metric, with the forecast pointing to an unchanged y/y rate of 2.8%.

Given that the Atlanta Fed GDPNow model is suggesting that the US economy continued faring well during the first quarter of 2024, another release pointing to sticky inflation may prompt market participants to further reduce their June cut bets, and thereby add more fuel to the dollar’s engines.

Is yen intervention a matter of time?

It is worth noting that most bond and stock markets will be closed for the Good Friday holiday today and thus due to thin liquidity conditions, FX volatility may be higher than usual. Another round of dollar buying may push dollar/yen above the critical ceiling of 152.00 and perhaps trigger intervention by Japanese authorities.

Even if officials do not press the intervention button immediately, they could intensify their warnings about one-sided speculative moves in the Japanese currency and perhaps scare yen sellers out of the market. If traders do not blink, they might put the 155.00 zone on their radars.

Loonie gains as oil rebounds

The Canadian dollar did not fall victim to the dollar’s advance, benefiting from the Canadian GDP data, which revealed that the economy staged a stronger-than-expected rebound in January.

The rebound in oil prices may have also helped the commodity-linked currency. Although there was no clear catalyst for the latest advance in oil prices, recent headlines that the OPEC+ group is unlikely to proceed with any output changes until June, as well as supply disruptions due to geopolitical conflicts, are keeping the black gold supported.

Wall Street subdued, gold soars to new all-time high

Wall Street traded subdued on the last trading day for Q1, with the Dow Jones and the S&P 500 finishing slightly in the green, and the Nasdaq losing some ground. That said, yesterday’s trading locked the strongest first quarter for the S&P 500 since 2019.

Today, Wall Street will stay closed, but any PCE-related impact will probably be reflected on Monday’s activity. If the data confirms that inflation in the US is stickier than previously expected, Wall Street may open Monday’s session with a negative gap.

Gold is soaring today, entering uncharted territory again and getting closer to the $2,245 zone which is the 161.8% Fibonacci extension of the May-October decline. Although the US Treasury market will be closed today, a stronger dollar on the back of strong PCE data could result in a retreat from near that zone.

However, with central banks continuing to increase their purchases in an attempt to diversify their FX reserves and geopolitical uncertainty remaining elevated, the likelihood of another leg north, and perhaps a break above the technical zone of $2,245, is high.