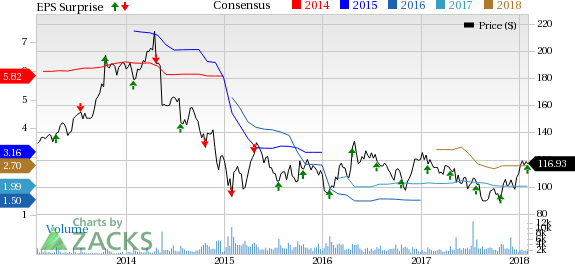

Core Laboratories N.V. (NYSE:CLB) reported fourth-quarter 2017 adjusted earnings of 58 cents per share, in line with the Zacks Consensus Estimate. The figure compared favorably with the prior-year quarter figure of 41 cents. Further, the EPS also witnessed a 20.8% rise sequentially. The results were driven by improved performance of the Product Enhancement segment.

Total revenues of $172 million also met the Zacks Consensus Estimate of $172 million. Revenues were up 14.9% from the prior-year quarter level of $149.5 million. The top line also improved 3.4% sequentially.

Segment Performance

Reservoir Description: Segment revenues were $104.6 million compared with $105.1 million in fourth-quarter 2016.

Operating income for the segment was about $17.3 million in the quarter compared with $18.9 million in the prior-year quarter. Operating margin of the segment was 17%.

Production Enhancement: Segment revenues were approximately $67.3 million in the quarter compared with $44.5 million in fourth-quarter 2016. Increased demand for the company’s advanced technology solutions helped in generating higher revenues.

Operating income for the segment was about $15.3 million in the quarter compared with $2.5 million in the prior-year quarter, reflecting a surge of 493.5%. Operating margins of the segment was 23%.Improved utilization and higher-technology services and products drove the margins.

Balance Sheet & Free Cash Flow

As of Dec 31, 2017, Core Laboratories had cash and cash equivalents of $14.4 million and long-term debt (including lease obligations) of around $227 million. The debt-to-capitalization ratio of the company was 60.4%.

Capital expenditures for the fourth quarter were $4.5 million. Full-year capex was $18.8 million, up around 65% from the prior-year level.

The company generated free cash flow of approximately $41.4 million in fourth-quarter 2017. Core Laboratories returned $33 million to shareholders, through $24.3 million as dividends and $8.7 million of share buybacks. The rest $7 million was utilized in paying off debt.

Quarterly Dividend

On Jan16, the board of directors announced a cash dividend of 55 cents per share. Notably, this is same as the previous payout. The dividend will be paid on Feb 16 to shareholders of record on Jan 26.

Guidance

For first-quarter 2018, Core Laboratories expects earnings to be around 56-58 cents per share. The company expects first-quarter revenues in the range of $168-172 million. The company expects operating margins of 19% in first-quarter 2018.

Zacks Rank and Stocks to Consider

Core Laboratories currently has a Zacks Rank #3 (Hold).

Few better-ranked players in the same industry are C&J Energy Services (NYSE:CJ) , ProPetro Holding Corporation (NYSE:PUMP) and Solaris Oilfield Infrastructure (NYSE:SOI) . All three companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

C&J Energy is expected to witness a year-over-year increase of 6,737.5% in 2018 earnings.

ProPetro is expected to witness a year-over-year increase of 451.43% in 2018 earnings.

Solaris delivered an average positive earnings surprise of 239.01% in the trailing four quarters.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Core Laboratories N.V. (CLB): Free Stock Analysis Report

Solaris Oilfield Infrastructure, Inc. (SOI): Free Stock Analysis Report

C&J Energy Services, Inc. (CJ): Free Stock Analysis Report

ProPetro Holding Corp. (PUMP): Free Stock Analysis Report

Original post