Corcept Therapeutics Inc.’s (NASDAQ:CORT) adjusted fourth-quarter 2017 earnings of 19 cents per share were in line with the Zacks Consensus Estimate. The reported figure improved from the year-ago adjusted earnings of 6 cents.

Revenues increased 123.8% from the year-ago quarter figure to $53.3 million and was in line with the Zacks Consensus Estimate.

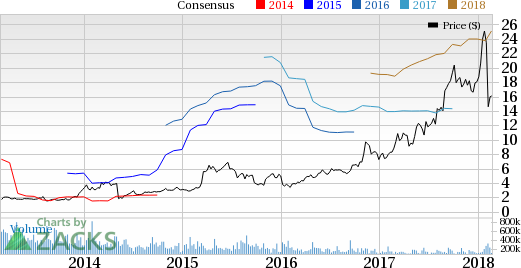

In the past one year, Corcept’s shares have returned 86%, as against the industry’s dip of 0.5%.

Research and development expenses improved 110.2% to $13.6 million. Likewise, selling, general and administrative expenses were up 42.8% to $16.8 million. In fact, the increase in operating expenses can be attributed to higher spending on the development of selective cortisol modulators including relacorilant, CORT118335 and CORT125281.

Pipeline Update

During the quarter Corcept reported interim results from phase II study of relacorilant, being evaluated to treat patients with hyperglycemia. Patients enrolled in the study, initially received 100 mg/day of relacorilant for four weeks, then 150 mg/day for four weeks and subsequently 200 mg/day for four weeks. The study showed that patients with hyperglycemia demonstrated improved glucose tolerance as measured by the oral glucose tolerance test. Levels of osteocalcin — a marker of bone formation — also improved. Results for both these measures grew as the dose of relacorilant increased, with the highest dose reaching statistical significance compared to the baseline. 45% of the patients with uncontrolled hypertension experienced five millimeters or greater reduction in blood pressure.

The company is continuing testing of higher doses with results expected in the second quarter of 2018. The phase III study is expected to commence in the second quarter of 2018.

2017 Results

For 2017, the company’s adjusted earnings per share came in at 51 cents per share, up from 15 cents in 2016. Results beat the Zacks Consensus Estimate of 43 cents.

Revenues in 2017 increased 95.8% year over year to $159.2 million and missed the Zacks Consensus Estimate of $159.7 million.

2018 Guidance

Corcept provided 2018 revenue guidance. The company projects revenues to be in the range of $275-300 million. The Zacks Consensus Estimate for 2018 revenues is $290 million.

Zacks Rank & Stocks to Consider

Corcept carries a Zacks Rank #3 (Hold).

A few better-ranked stocks from the same space are Regeneron Pharmaceuticals (NASDAQ:REGN) , Exelixis (NASDAQ:EXEL) and Enanta Pharma (NASDAQ:ENTA) . While Regeneron sports a Zacks Rank #1 (Strong Buy), Exelixis and Enanta Pharma carry a Zacks Rank #2 (Buy), each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings per share estimates have moved up from $20.46 to $21.56 for 2018 in the last 30 days. The company pulled off a positive earnings surprise in three of the last four quarters, with an average beat of 9.15%.

Exelixis’ earnings per share estimates have moved up from 73 cents to 77 cents for 2018 in the last 60 days. The company delivered positive earnings surprise in the last four quarters, with an average of 572.92%. Share price of the company moved up 33.9% over a year.

Enanta Pharma delivered a positive earnings surprise in three of the last four quarters, with an average beat of 373.1%. Share price of the company surged 179.7% over a year.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Enanta Pharmaceuticals, Inc. (ENTA): Free Stock Analysis Report

Original post

Zacks Investment Research