Corcept Therapeutics Inc. (NASDAQ:CORT) announced that it has dosed first patient in the phase III study of relacorilant, to treat patients with Cushing’s syndrome. The phase III study entitled “GRACE” is expected to enroll 130 patients with Cushing’s syndrome at sites in the United States, Canada and Europe. The study has a two-phase design.

In the initial, open-label portion, all patients will receive relacorilant for 22 weeks, with doses starting at 100 mg per day, then increasing by 100 mg to a maximum of 400 mg per day. After 22 weeks, patients who exhibit pre-specified improvements in glucose tolerance or hypertension, which are two of Cushing’s syndrome’s most common symptoms, will enter a double-blind, placebo-controlled, withdrawal phase lasting 12 weeks.

Half of the patients who enter this phase will continue to receive relacorilant. The rest will receive placebo. The rate and degree of relapse in patients receiving placebo will be measured against the same parameters in patients continuing with relacorilant.

Cushing’s syndrome is caused by excessive activity of the stress hormone cortisol. In the United States, an estimated 20,000 patients have Cushing’s syndrome, with about 3,000 new patients being diagnosed each year.

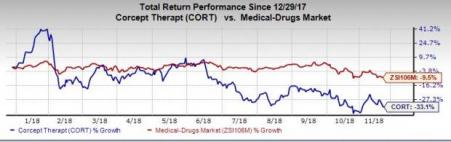

Shares of Corcept have lost 33.1% year to date compared with the industry’s decline of 9.5%.

In June, Corcept announced positive data from a phase I/II analysis on relacorilant in combination with Celgene's (NASDAQ:CELG) Abraxane (nab-paclitaxel) to treat patients with solid tumors. The data was presented at the 2018 American Society of Clinical Oncology (ASCO) Meeting in Chicago.

Findings from the study showed that four of the nine patients with pancreatic cancer and four of the seven with ovarian cancer exhibited durable disease control. The FDA granted relacorilant Orphan Drug status for pancreatic cancer.

The company also has other interesting candidates in its pipeline. Corcept is dosing patients in a phase I/II study that combines CORT125281 with Pfizer’s (NYSE:PFE) Xtandi for the treatment of metastatic castration-resistant prostate cancer.

The company is also developing selective cortisol modulator CORT118335. The compound is very potent in animal models of fatty liver disease, and both the prevention and reversal of weight gain caused by antipsychotic medications such as Lilly’s (NYSE:LLY) Zyprexa (olanzapine). The company is planning for phase II studies on patients with antipsychotic-induced weight gain and non-alcoholic steatohepatitis in the first quarter of 2019.

Zacks Rank

Corcept carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research. It's not the one you think.

Pfizer Inc. (PFE): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Original post

Zacks Investment Research