We had higher hopes for copper after it broke out of its multi-month range. Yet, having failed its quest to hold above key support and trade back within range, bearish ears have perked up.

The break back below $2.87 has effectively invalidated a longer-term double bottom pattern, marking it as a failed breakout. Whilst the daily trend structure remains bullish above the $2.75 low, we think the breakdown and pause below resistance warrants a closer look.

Prices tumbled 4.5% from the $2.97 high within three sessions to show the bears were back in control. The $2.97 high marks a lower high, made up of a bearish engulfing / hammer reversal, which itself could mark the right-peak of a double-top pattern. If successful, the double top projects and approximate target around $2.76 which is just above the $2.75 structural low. That said, bearish momentum needs to return soon for this scenario to play out.

Currently consolidating below resistance, a direct break below $2.83 assumes the double top is playing out, whereas a break above $2.88 invalidates this bias. Therefore, keep a close eye on the $2.83-$2.88 range as a breakout of it could define its next directional move.

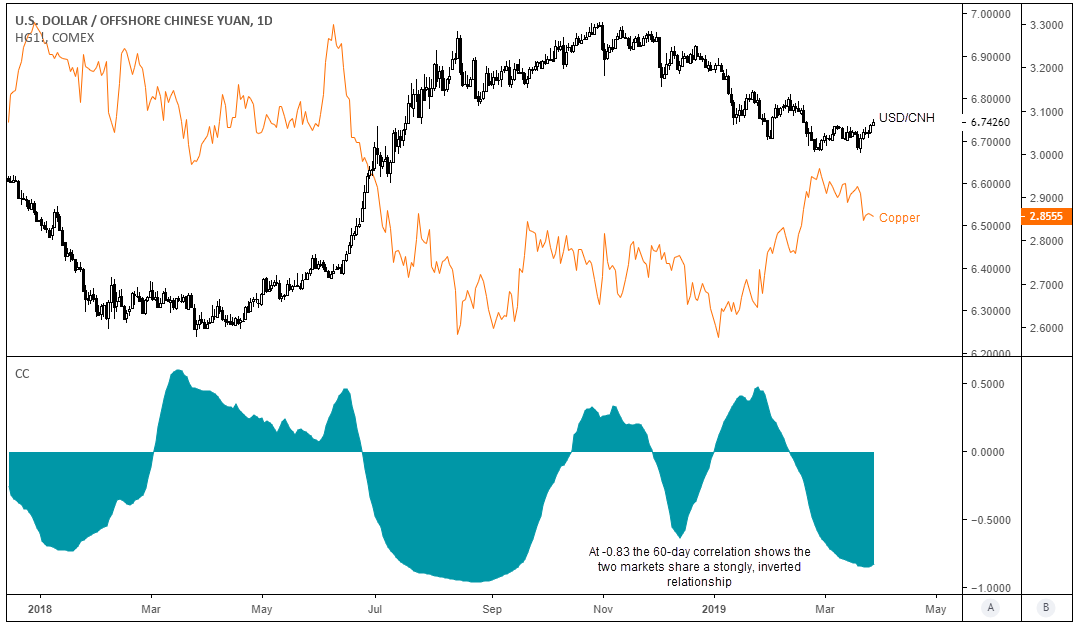

Keep in mind that whilst prices remain above the $2.75 low, the daily trend remains bullish – so this is a near-term bearish bias whilst we hold around current levels. That said, if a bullish reversal on USD/CNH is playing out we could see copper prices remain under pressure. Currently, the 60-day rolling correlation between copper and USD/CNY is -0.83 which means they share a strongly inverted correlation.