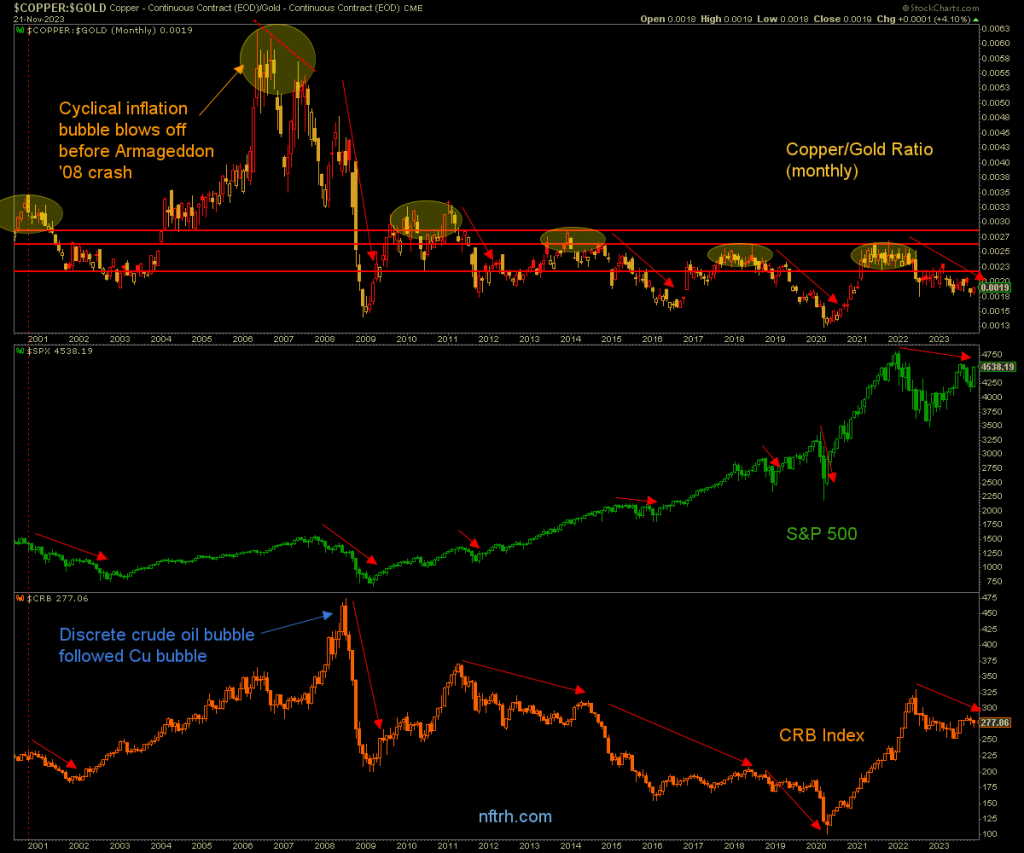

The Copper to Gold ratio has been indicating an oncoming counter-cyclical environment since breaking down in June 2022.

Copper: Cyclical, inflation sensitive, and a material of positive economic progress.

Gold: Much more counter-cyclical, less inflation sensitive, and a ‘liquidity haven’ material of long-term monetary value.

I have not posted the monthly chart of the Copper/Gold ratio probably since last year, as 2023 has been all about a disinflationary Goldilocks recovery, rather than a deflationary liquidity crisis. However, as Goldilocks matures into old age, it is worth keeping tabs on the original thesis, which is Inflation > Disinflationary Goldilocks > Deflation scare/liquidity crisis.

I realize that everybody now knows that a recession is coming, which would argue against one coming any time soon. But the chart is the chart and it has been the chart for about 1.5 years. The chart, in this case, is a gauge of a counter-cyclical environment, and though stocks have rallied (on cue per this now public NFTRH+ subscriber update from January that was correct in its thesis, but not liberal enough in its timeline as the rally labors on into Q4) in 2023, and commodities – with the help of OPEC+ oil price manip – have rallied to a lesser degree, the counter-cyclical signal is not only still in place, it has become more pronounced.

Aside from illustrating the clownery of Copper/Commodity promoters who’ve remained steadfastly bullish the whole while *, the signal is right in line with the 2023 Goldilocks ‘disinflation’ view and it is burrowing southward looking ahead to the next link in our chain, deflation and/or liquidity crisis.

In the event this analysis expires in favor of an inflationary option sooner than currently expected, the Copper/Gold ratio (along with other indicators we use in NFTRH) should give a signal well ahead of time. Meanwhile, regardless of whether the stock market’s Goldilocks-flavored rally continues on to test or even marginally exceed the 2021 high, the negative signal by Copper/Gold is intact and waiting.

* To many inflationists, commodity super-cyclers and supposed “metals” experts, there is little difference between the macro characteristics of gold and copper, because to understand and manage the differences requires difficult as opposed to easy to understand (by the herd) analysis.