Gold is flat this morning trading at 1252.50 after showing a small weekly gain last week. Precious metals recovered last week despite their modest fall on Friday following the release of the NF payroll report, in which 217K jobs were added during May, in line with markets projections. Even the decision of the ECB to implement a negative deposit rate didn’t stir up precious metals prices. This week, gold traders will be reviewing U.S economic reports including retail sales, JOLTS job opening PPI and jobless claims. In Europe, the UK industrial production report and Great Britain claimant count change will be released. In China, trade balance, CPI and new loans monthly updates will be provided. Let’s start with a quick recap of last week’s developments and then analyze the expected reports for this week.

U.S. stocks closed at all-time highs on Friday for a third week of gains after the May jobs report showed slow but steady improvement in the labor market. Asian stocks kicked off the week with gains following positive data releases from the region’s two biggest economies and a strong U.S. lead. Traders on the whole are seeking more risk, leaving the safe havens such as precious metals and the yen weakened.

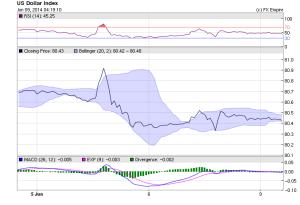

The US Dollar Index traded on a flat note last week on the back of a rise in risk appetite and market sentiments during the latter part of the week which led to a decline in demand for the low yielding currency. However, losses were wiped off owing to favorable economic data from the country. The currency touched a weekly high of 81.07 and closed at 80.43 on Friday. US Non-Farm Employment Change declined by 65,000 to 217,000 in May as against a rise of 282,000 in April. The unemployment rate remained unchanged at 6.3 percent in the month of May. Average Hourly Earnings were at 0.2 percent in the last month.

The ECB’s new stimulus measure lifted gold prices from a four-month low last week. The yellow metal closed at 1,253 up 0.2 per cent for the week. By cutting deposit rates to a negative 0.1 per cent, the ECB incentivized banks to lend money and checked the risk of the Euro Zone moving into deflation. Euro Zone inflation has been lingering below 1 per cent since October last year. Silver ended 1 per cent higher at 19.02; the week’s low was 18.66. Platinum closed at $1,452, up marginally.

Gold investor sentiment improved a bit. The SPDR Gold Trust (ARCA:GLD), the world’s largest gold backed ETF, saw a slight pick-up in demand for the second week in a row. The fund reported holdings of 787.8 tonnes, up from 785.28 tonnes a week ago.

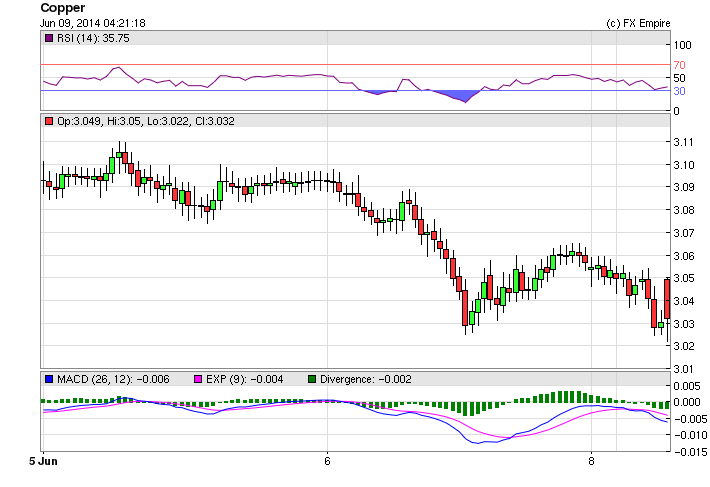

Copper is trading this morning at 3.03 down another 25 pips as traders move well away from the commodity after pushing it up to a new high just a week ago as copper neared the 3.18 price area, the bottom fell out over the scandal in the port warehouses and weak unbalanced trade data released this morning. China’s exports expanded more-than-estimated 7 percent last month, while imports fell, data showed yesterday.

China’s Qingdao Port is looking at whether companies offering copper as collateral for loans counted the same batches more than once. China and the U.S. are the world’s biggest copper users. The copper price dropped 3.5% last week after a weaker than expected gauge on manufacturing activity in China together with a probe into the use of metals in trade finance deals rattled the market.

Chinese authorities have begun an investigation into allegations that several companies pledged the same copper and other industrial metals held at the port of Qingdao as collateral for loans to different banks. Beijing is stepping up efforts to curb the country’s vast shadow banking system and the revelations could see a further clampdown on this lending practice which has been a key part of the commodities trade – particularly in iron ore and copper – for years. As these deals are being unwound it could lead to the dumping of copper into the market that would otherwise have been tied up in financing deals, leading to sharply lower prices. China consumes 42% of the world’s copper.