However the positivism on the inventory front is being negated by the cancelled warrants, wherein the orders to take out the metal from the warehouses declined from 270,400 MT to 190,900 MT.

--Copper ended the yesterday`s trading marginally lower by 0.3% taking negative cues from the slight negative Chinese GDP data which declined to 1.8% from 2.2% on a quarter on quarter basis.

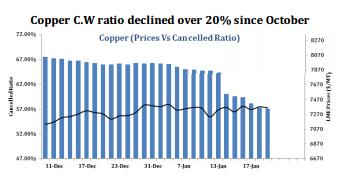

--Copper stockpiles in the warehouses monitored by LME declined by 0.4% to 334,550 MT tons which is the lowest level since Nov ember 2012. However the positivism on the inventory front is being negated by the cancelled warrants, wherein the orders to take out the metal from the warehouses declined from 270,400 MT to 190,900 MT.

--During the day, we recommend selling copper from the higher levels as the commodity might take negative cues from the marginally negative Chinese GDP data which declined to 1.8% from 2.2% on a quarter on quarter basis. Copper might also get further pressure from the fact that overnight market rates in China surged over 6% due to excess demand for liquid cash ahead of the Chinese New Year holidays which may indirectly have a negative impact on copper.