Copper Non-Commercial Speculator Positions:

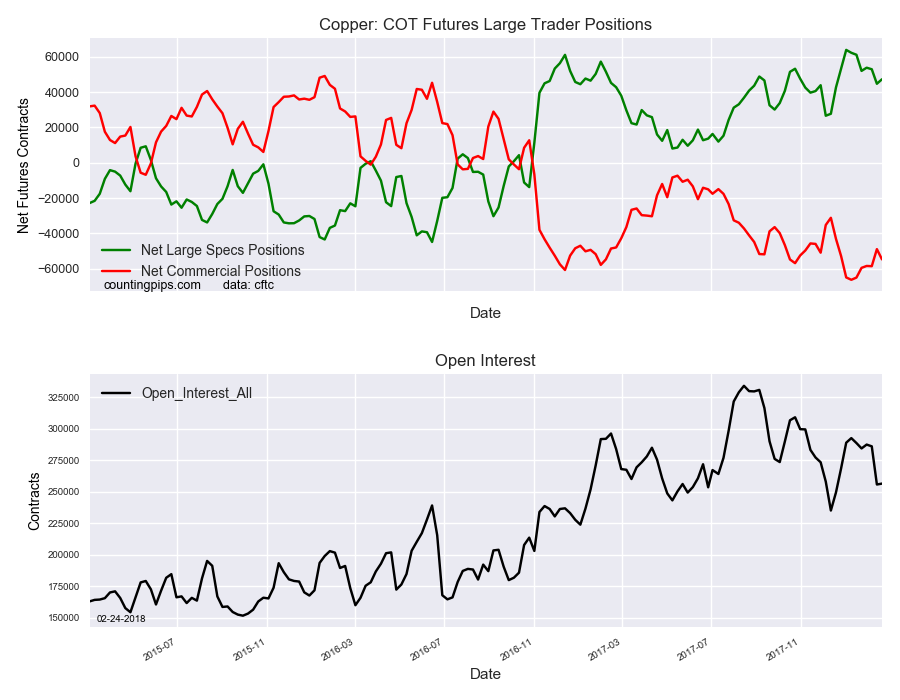

Large precious metals speculators increased their bullish net positions in the Copper futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Copper futures, traded by large speculators and hedge funds, totaled a net position of 47,301 contracts in the data reported through Tuesday February 20th. This was a weekly boost of 2,553 contracts from the previous week which had a total of 44,748 net contracts.

Speculative positions had fallen in each of the previous two weeks before this week’s gain. The overall net speculator position is now below the +50,000 net contract level for a second straight week after staying above that threshold for seven straight weeks.

Copper Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -54,690 contracts on the week. This was a weekly shortfall of -5,822 contracts from the total net of -48,868 contracts reported the previous week.

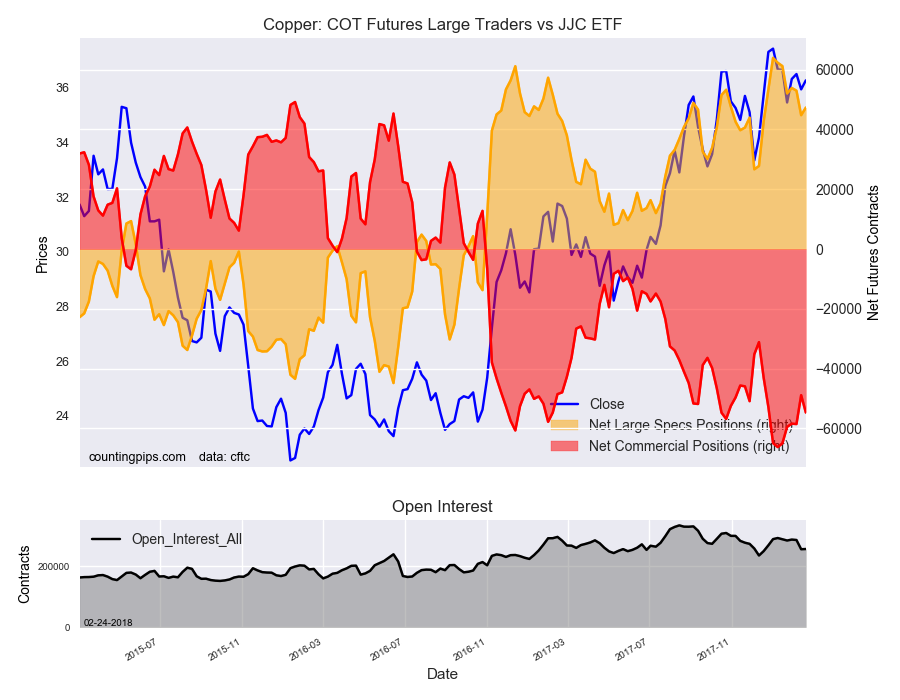

JJC ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the JJC iPath Bloomber Copper ETN, which tracks the price of copper, closed at approximately $36.28 which was an increase of $0.33 from the previous close of $35.95, according to unofficial market data.