Copper Non-Commercial Speculator Positions:

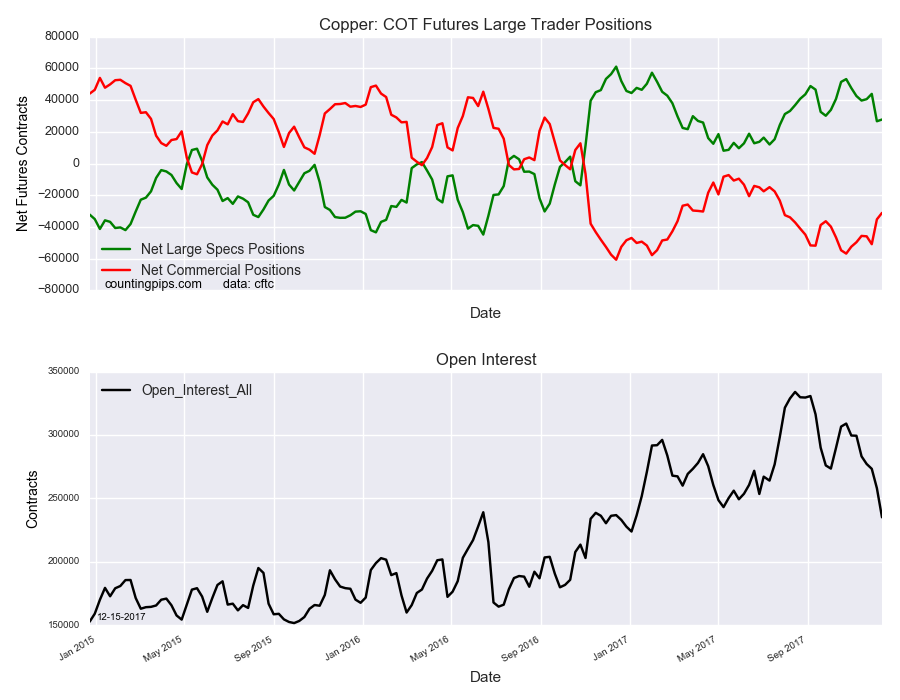

Large metals speculators slightly increased their net positions in the Copper futures markets this week following a sharp decline last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Copper futures, traded by large speculators and hedge funds, totaled a net position of 27,754 contracts in the data reported through Tuesday December 12th. This was a weekly increase of 1,101 contracts from the previous week which had a total of 26,653 net contracts.

The speculative positions took a hard fall last week with a drop of over -17,000 contracts before this week’s slight uptick. The overall net position remains below the +30,000 contract level for a second week.

Copper Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -31,129 contracts on the week. This was a weekly advance of 4,083 contracts from the total net of -35,212 contracts reported the previous week.

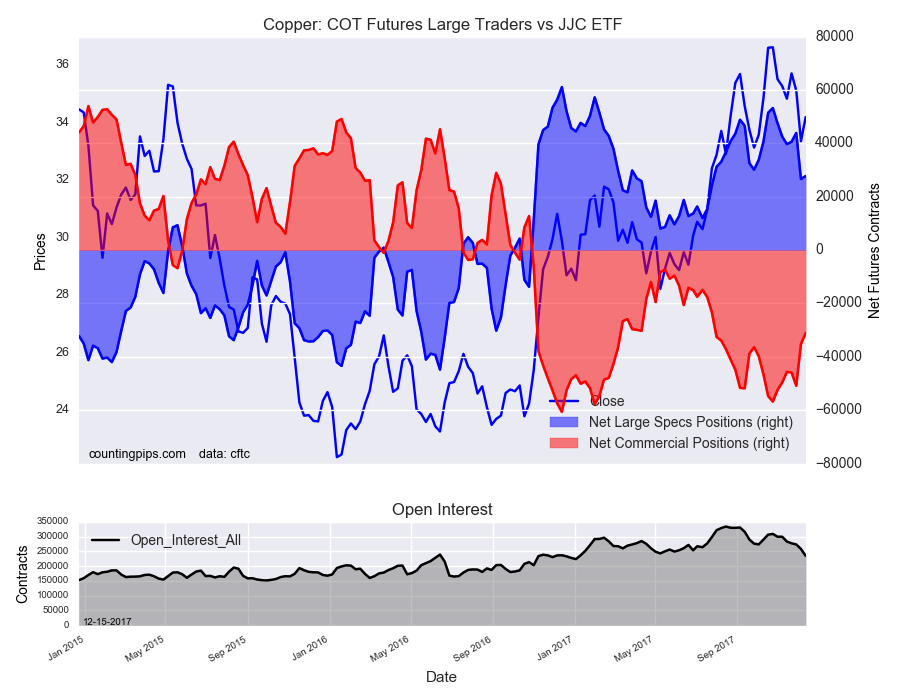

iPath Bloomberg Copper Subindex Total Return Exp 22 Oct 2037 (NYSE:JJC) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the JJC iPath Bloomber Copper ETN, which tracks the price of copper, closed at approximately $34.19 which was an uptick of $0.84 from the previous close of $33.35, according to unofficial market data.