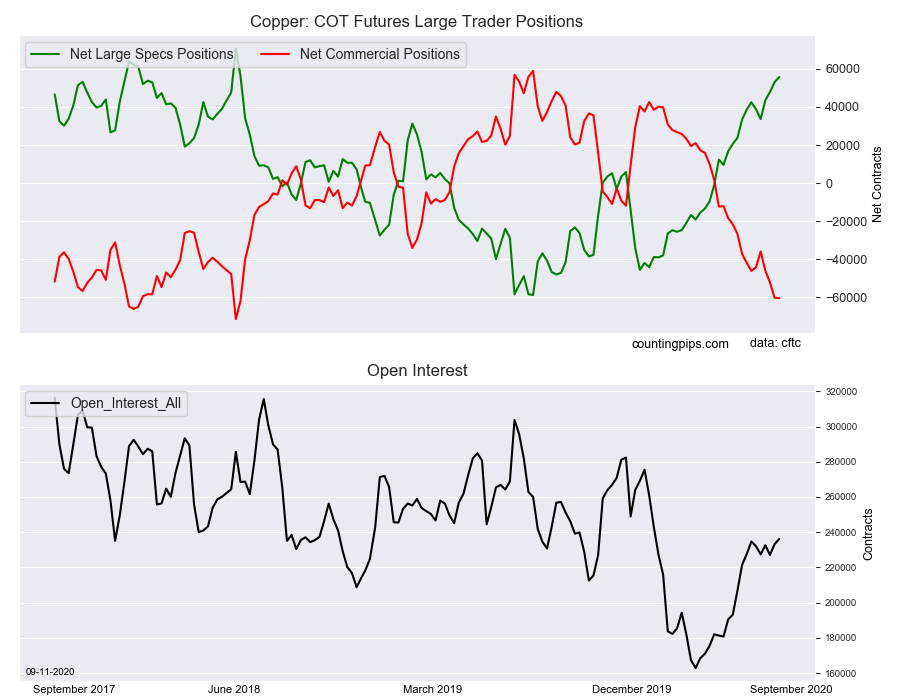

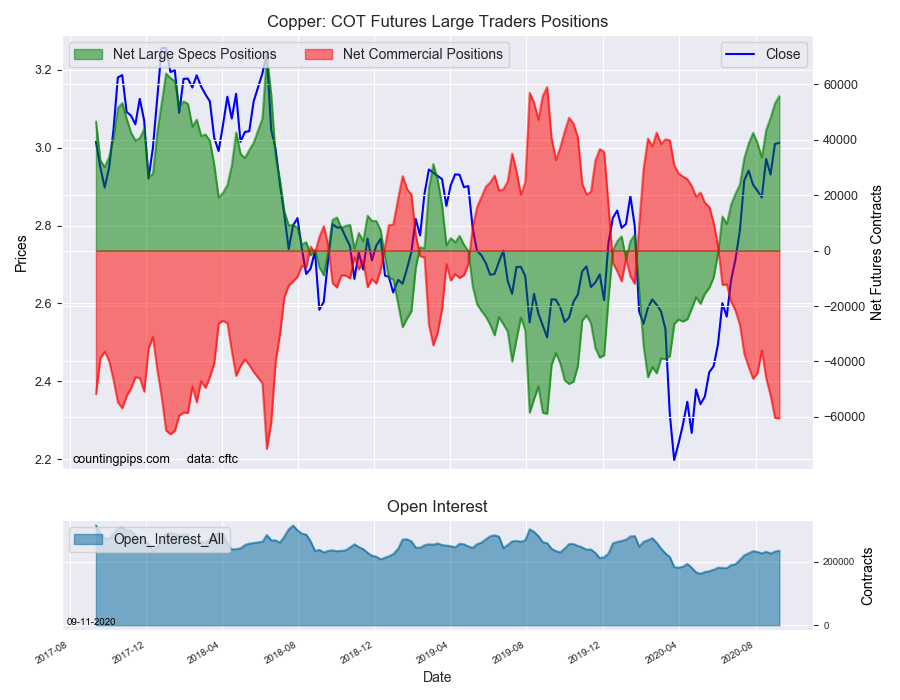

Large precious metals speculators boosted their bullish net positions in the Copper Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Copper futures, traded by large speculators and hedge funds, totaled a net position of 55,750 contracts in the data reported through Tuesday, September 8th. This was a weekly increase of 2,634 net contracts from the previous week which had a total of 53,116 net contracts.

The week’s net position was the result of the gross bullish position (longs) rising by 1,394 contracts (to a weekly total of 105,485 contracts) while the gross bearish position (shorts) fell by -1,240 contracts for the week (to a total of 49,735 contracts).

Copper speculators continued to push their bullish bets higher this week for the fourth straight week and for the tenth time out of the past twelve weeks. The copper sentiment has been on a strong run since speculator positions turned positive in early June and has now been in bullish territory for fourteen consecutive weeks. This week’s advance pushed the overall bullish level to the highest weekly standing since June 19th of 2018, a span of 116 weeks.

Copper Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -60,509 contracts on the week. This was a weekly shortfall of -194 contracts from the total net of -60,315 contracts reported the previous week.

Copper Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Copper Futures (Front Month) closed at approximately $3.0125 which was an uptick of $0.003 from the previous close of $3.0095, according to unofficial market data.