Copper Non-Commercial Speculator Positions:

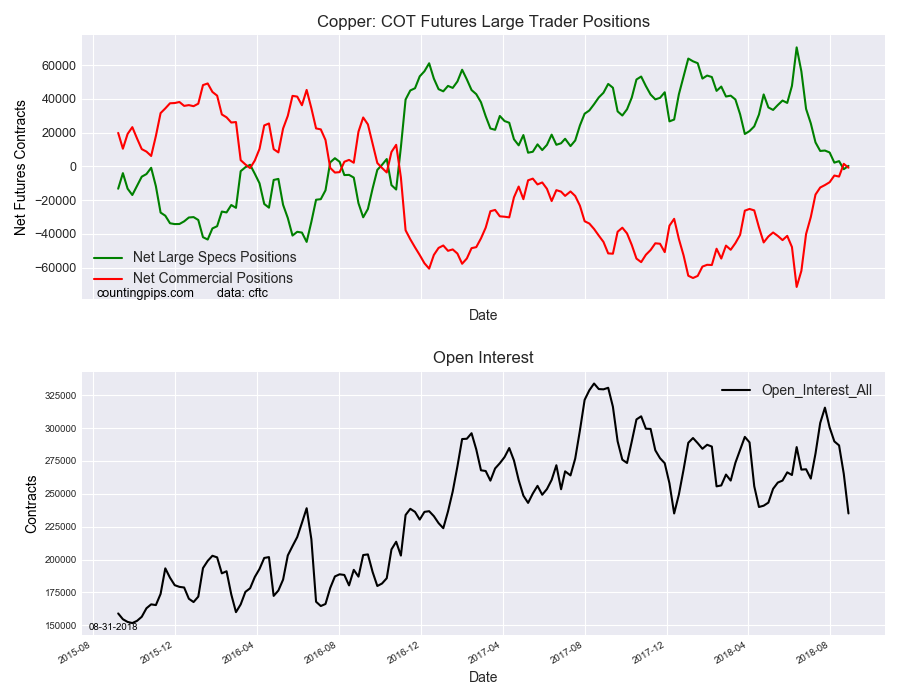

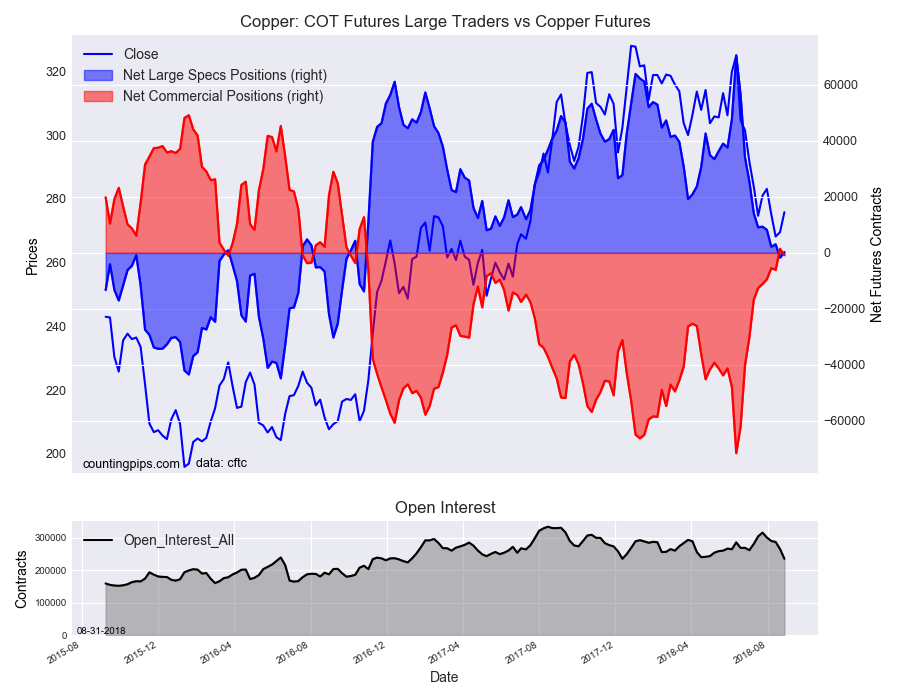

Large precious metals speculators raised their bullish bets in the Copper futures markets one week after seeing positions fall into an overall bearish level, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Copper futures, traded by large speculators and hedge funds, totaled a net position of 291 contracts in the data reported through Tuesday August 28th. This was a weekly boost of 1,990 contracts from the previous week which had a total of -1,699 net contracts.

Speculative positions saw a modest increase in net positions this week which brought the overall standing out of a small bearish position (-1,699 contracts) and back into a very slight bullish level (291 contracts). Last week’s fall into bearish territory was the first time since October 25th of 2016 that copper spec positions were net bearish.

Copper Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -825 contracts on the week. This was a weekly fall of -2,301 contracts from the total net of 1,476 contracts reported the previous week.

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Copper Futures (Front Month) closed at approximately $275.85 which was a boost of $6.30 from the previous close of $269.55, according to unofficial market data.