Copper Non-Commercial Positions:

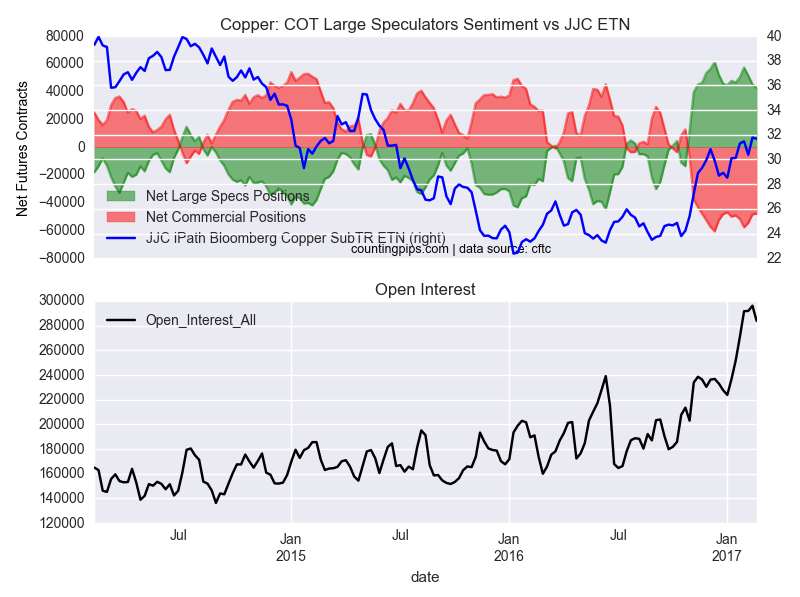

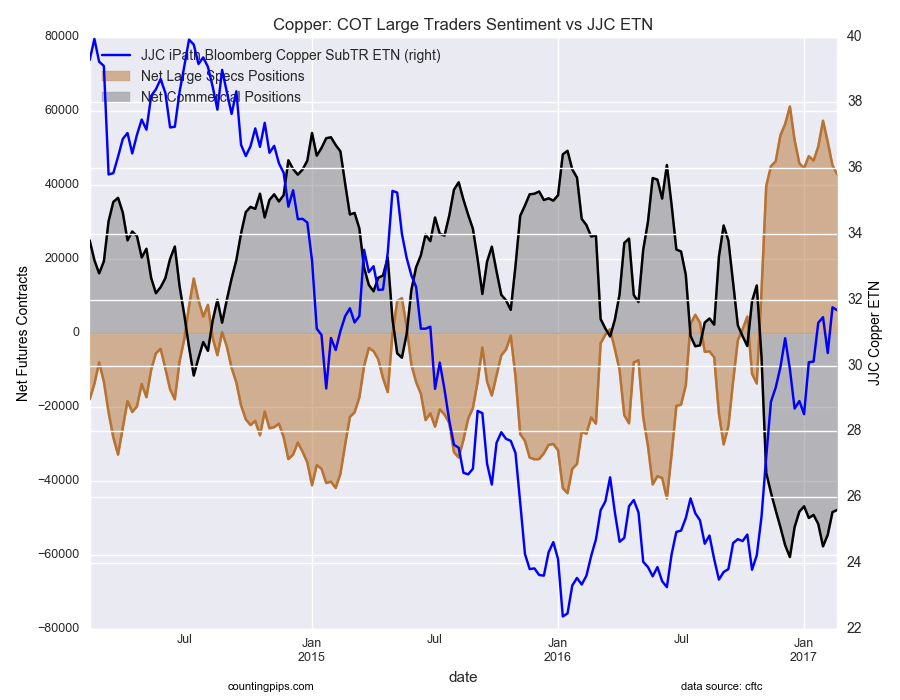

Large speculators and traders reduced their net bullish positions in the copper futures markets last week for a third consecutive week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of copper futures, traded by large speculators and hedge funds, totaled a net position of 42,794 contracts in the data reported through February 21st. This was a weekly decline of -2,449 contracts from the previous week which had a total of 45,243 net contracts.

Copper speculators have now decreased their bullish bets by -14,482 net contracts over the past three weeks after bullish positions reached a multi-year high on January 31st at 57,276 contracts.

Copper Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -47,918 contracts last week. This is a weekly change of 599 contracts from the total net of -48,517 contracts reported the previous week.

Copper ETN (NYSE:JJC):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the JJC iPath Bloomber Copper ETN, which tracks the price of copper, closed at approximately $31.68 which was a change of $-0.09 from the previous close of $31.77, according to financial market data.