Copper Non-Commercial Speculator Positions:

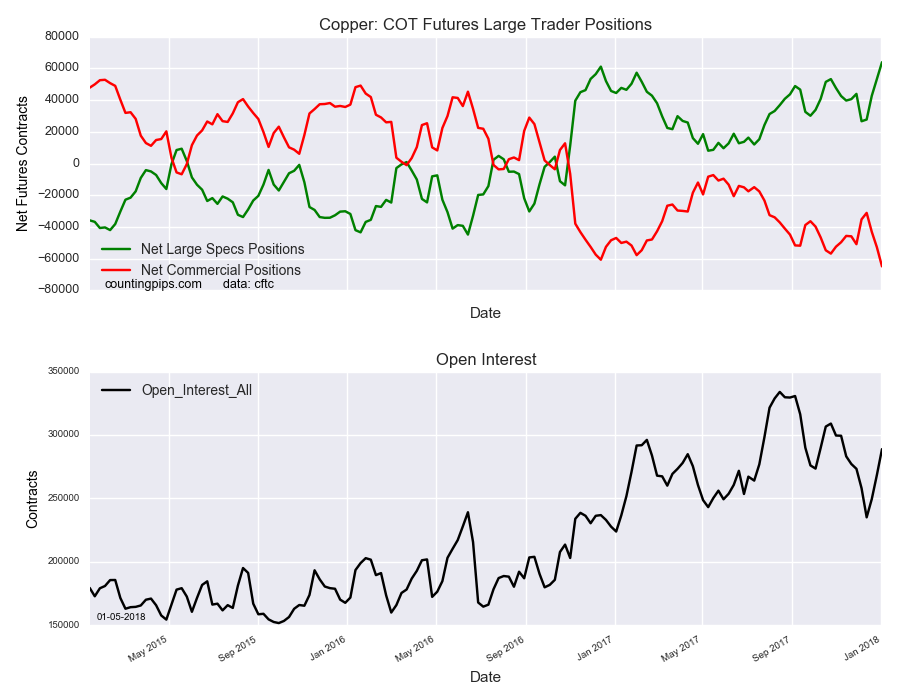

Large metals speculators sharply increased their bullish net positions in the Copper futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Copper futures, traded by large speculators and hedge funds, totaled a net position of 63,912 contracts in the data reported through Tuesday January 2nd. This was a weekly advance of 10,643 contracts from the previous week which had a total of 53,269 net contracts.

Speculative positions have risen for four straight weeks with the past three weeks seeing sharp raises (gains of over +10,000 each week).

Copper Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -64,883 contracts on the week. This was a weekly decrease of -12,070 contracts from the total net of -52,813 contracts reported the previous week.

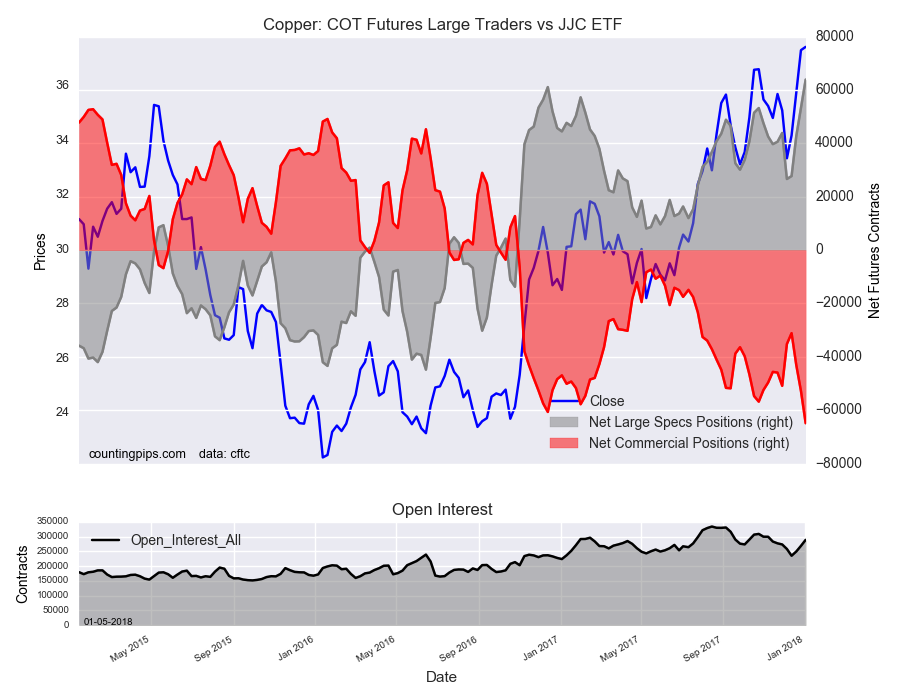

iPath Bloomberg Copper Subindex Total Return Exp 22 Oct 2037 (NYSE:JJC) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the JJC iPath Bloomber Copper ETN, which tracks the price of copper, closed at approximately $37.44 which was an uptick of $0.12 from the previous close of $37.32, according to unofficial market data.