Investing.com’s stocks of the week

Copper's 3-month forwards prices at the LME moved up sharply by more than 1.60% and settled near $7050. This morning, the same was seen trading at $7050 with no major change overnight. We believe that prices rose a good amount as expected after concerns over Russian action against Ukraine settled down. Meanwhile, we were also anticipating that prices were continuously falling for over 9 consecutive trading sessions, which required a good amount of short covering or profit booking. We believe the same also took place yesterday while the substantial rise in the US equity market added further support to the commodity. We could see a similar impact on Indian copper prices as well, which recovered from the day’s low of Rs 438 and settled higher at Rs. 443.65. We believe that some more buying for the intra-day could be seen while we also suggest that the overall trend continues to be lower for the red metal.

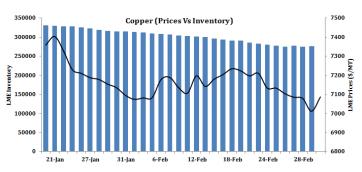

If we look at the inventory performance, the red metal showed a rise in the inventory by 1475 tons in a single day while the cancelled warrants ratio declined. This also indicates that the inherent trend is still down however, prices rose due to a good amount of profit booking and then the recovery in most of the asset classes.

Finally, looking into the P-V-OI scenario, we believe that the gains in prices were modestly supported by volumes, which indicates that prices may continue to advance at least during the Asian and European session though the gains may fade as the day progresses. Looking at the above scenario, we believe copper prices may initially trade higher though the gains might fade by the end of the day. Due to this, we suggest both buying and selling copper futures contracts.