Copper prices remained pretty flat from August through November. However, last month they started to weaken. The LME 3-month price of primary copper dropped 2.9 percent, from $7,240 to $7,029 per metric ton.

That led to a 2.2 percent drop for MetalMiner’s monthly Copper MMI®, which registered a value of 89 in December, down from 91 in November.

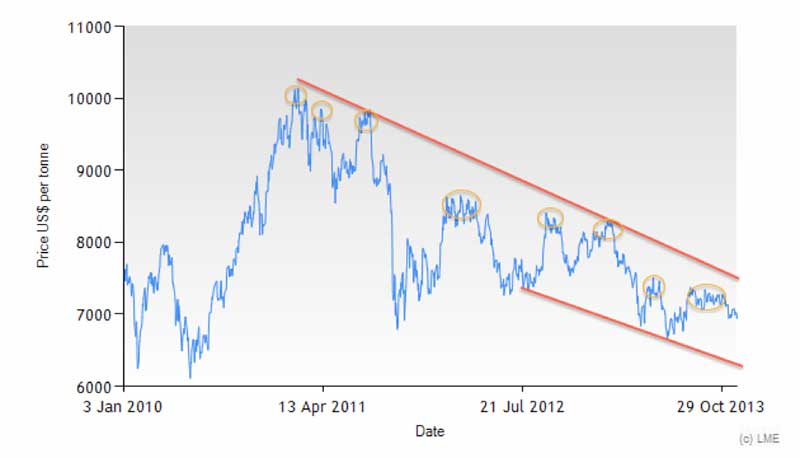

This move is not a big surprise. Prices topped last month at lower levels than the previous top reached during the month of May. This has been happening since copper prices peaked in the first quarter of 2011. Since then, copper prices remain in a long-term downtrend.

Looking at the medium-term picture, we see that prices are finding support and resistance levels during the past months. It’s hard to tell what copper prices will average next month. The break of any of the lines in these graphs might determine the next price levels.

So, what’s our outlook?

Copper Price Outlook

In either case, we expect prices to continue in the major trend, remaining below $7,500 per metric ton and wouldn’t be surprised to see prices reaching levels below $7,000 per metric ton, unless we see new positive demand indicators coming up – in particular, Chinese economic growth could strengthen the buying pressure.

Key Price Drivers of Copper Index

While LME copper 3-month prices fell 2.9 percent, LME cash copper prices dropped 2.9 percent as well, to $7,026 per metric ton. US copper producer grade 110 prices fell 2.3 percent after rising the previous month. After also rising the previous month, US copper producer grade 102 prices dropped 2.2 percent. The cash price of Chinese copper fell a slight 2.1 percent over the past month. Chinese copper wire lost ground as well, after dropping 1.9 percent.

However, Chinese bright copper scrap finished the month up 1.8 percent per metric ton.

Korean copper strip traded sideways last month. The cash price of primary Japanese copper remained unchanged.