Copper is, on the one hand, viewed by many as a bellwether of the industrial sector, yet at the same time, volatility is magnified on the other hand by copper’s popularity among investors, undermining the effect the fundamentals should have in dictating price.

As HSBC points out in a recent report, copper was a victim of risk selling in Q2 with the price falling. Yet exchange inventories tell us a different story; in spite of slowing global growth in Europe, Asia and of late the US, there has been no significant increase in total exchange inventories of copper.

Although GDP numbers are dropping, this has clearly not resulted in a pronounced destocking cycle. Assuming supply has remained constant, this should be telling us that global economic activity is in fact doing rather well. Stocks have risen slightly in the last month or so, but it is by no means a trend and levels are still well down on the first half of 2011.

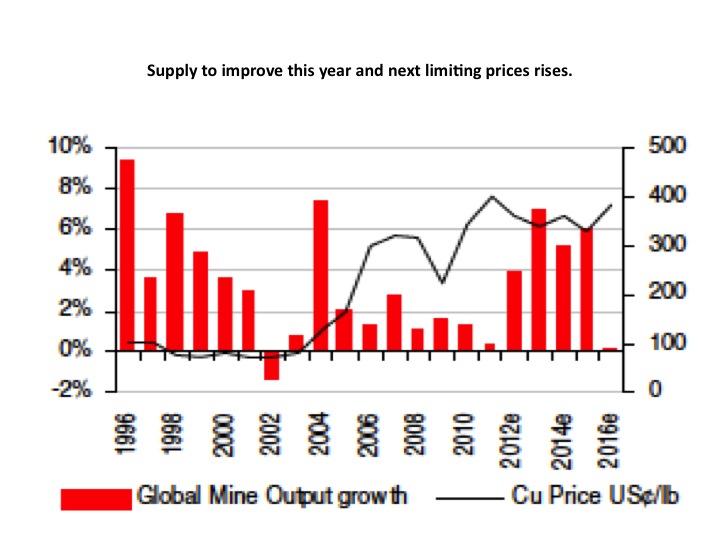

Much of the solid fundamentals picture for copper must come from supply. New mine supply has been slow to materialize. New mine supply promises, however, will likely still materialize as this graph from HSBC illustrates:

Notably, this will be made up of the re-expansion of Escondida (+250,000 tons) and a full year of expansion at Los Bronces (+250,000 tons), the delayed ramp-up at Esperanza (+70,000 tons) and higher production at Antamina (+110,000 tons).

BHP Billiton has now committed to Escondida, but the bank has removed Olympic Dam from estimates, as it is unlikely to happen before 2017.

As a result of the surprisingly solid demand, limited supply growth and the widespread hope that Europe will avoid a breakup this year, copper prices are not expected to fall further, but HSBC is suggesting it could be 2014 before they average above $8,000 per metric ton again.

This would suggest buyers can make the most of the depressed sentiment to secure good short-term deals as covering forward with fixed prices — or forward-covering — does not look like it will be a necessary safeguard for the next 6-12 months.

by Stuart Burns

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Copper Price Fundamentals Looking Steady

Published 08/09/2012, 03:29 AM

Updated 07/09/2023, 06:31 AM

Copper Price Fundamentals Looking Steady

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.