The dollar was rebounding Wednesday morning in Europe with gains of over 0.1% vs SEK, NOK, NZD, AUD and GBP. It continued to ease against both CAD and JPY, however. EUR/USD was virtually unchanged from its European opening. In the absence of any market-affecting indicators, the US budget settlement overnight was the main factor affecting sentiment in the markets. European stock markets were almost all higher even though Asian markets closed lower (except for Thailand). That would explain the movement in USD/JPY but it doesn’t explain why NZD and AUD are lower as they have been correlated with stock market movements. AUD’s correlation with the Eurostoxx index has been coming down recently; the 52-week weekly correlation peaked at 0.73 back in September and is now 0.65, still about the highest of all major currency pairs (surpassed only by -0.66% for USD/CAD). AUD saw a fall in the Westpac Consumer Confidence index for December and tomorrow’s unemployment data are expected to show a rise in unemployment in November. As for NZD, the Reserve Bank of New Zealand’s meeting tomorrow is likely to result in at least some comments about how the NZD is overvalued. After the September meeting, Gov. Wheeler said that “the exchange rate remains high. A lower rate would reduce headwinds for the tradables sector and support export industries.” The biggest mover of the morning was copper, which gained on both improved sentiment towards base metals generally and a fall in LME stockpiles to below 400k tones more specifically.

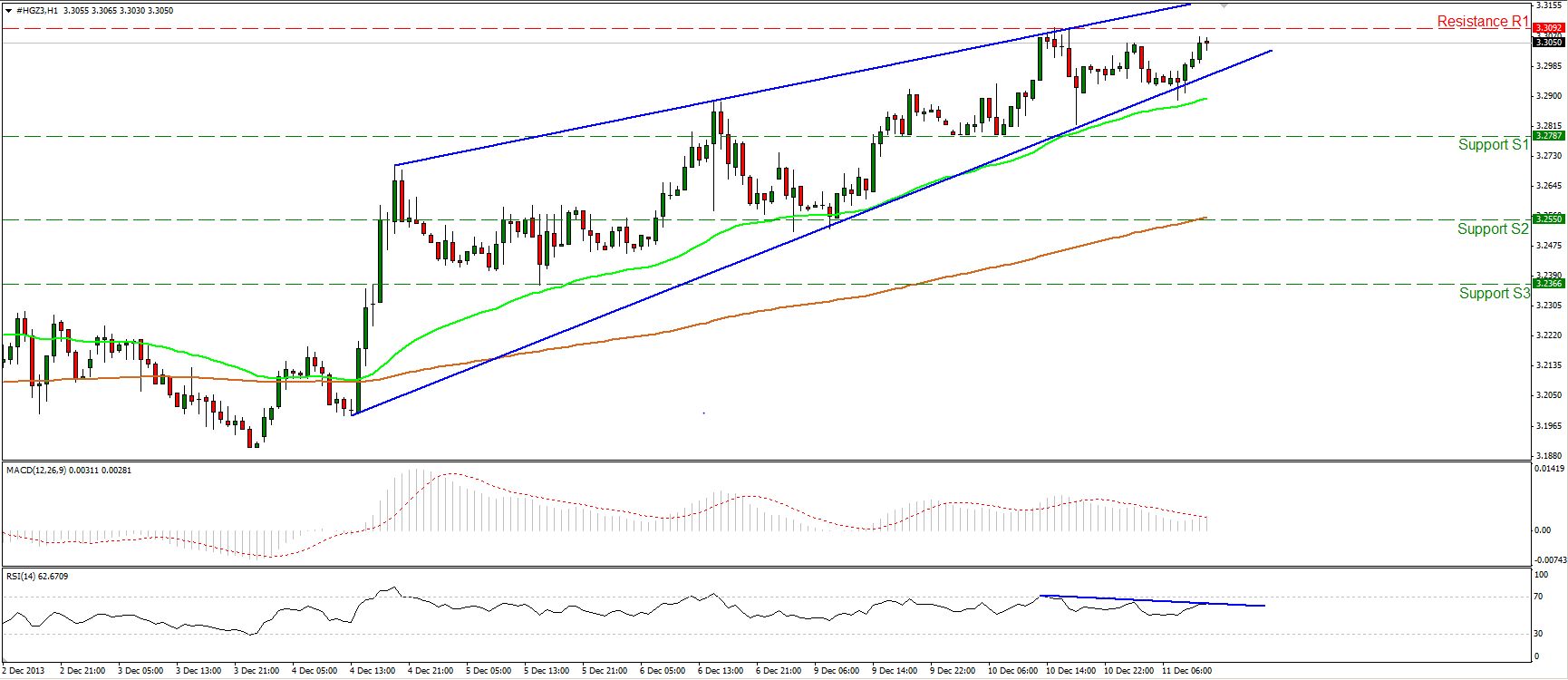

• Copper has been forming higher highs and higher lows since the beginning of December on the one hour chart. However, the uptrend line and the return line are converging, raising the possibility of a rising wedge formation. A rising wedge has bearish implications most of the time. This would be confirmed by a dip below the trend line and a break below the support at 3.2787 (S1). On the other hand, if the longs overcome the previous high of 3.3092 (R2), I would expect further advance towards next resistance areas. Our momentum studies confirm the mixed picture of the metal. The MACD oscillator seems ready to cross above its signal line, while the RSI is following a downward path. At the moment, I consider the uptrend to be valid, since the price is trading above the both moving averages with the 50-hour one providing reliable support to the lows of the trend.

• Support: 3.2787 (S1), 3.2550 (S2), 3.2366 (S3)

• Resistance: 3.3092 (R1), 3.3246 (R2), 3.3522 (R3)

Disclaimer: This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients’ orders. This material is just the personal opinion of the author(s) and client’s investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited. Risk Warning: Forex and CFDs are leveraged products and involves a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. IronFx Financial Services Limited is authorised and regulated by CySEC (Licence no. 125/10). IronFX UK Limited is authorised and regulated by FCA (Registration no. 585561). IronFX (Australia) Pty Ltd is authorized and regulated by ASIC (AFSL no. 417482)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Copper On Rising Trend But Forming A Rising Wedge

Published 12/12/2013, 06:54 AM

Updated 07/09/2023, 06:31 AM

Copper On Rising Trend But Forming A Rising Wedge

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.