Copper dazzled before the eyes of investors at the end of 2020, as vaccine breakthroughs and the promise of economic reopenings after the COVID-19 lockdowns made the price of the metal shine like its burning-red color.

Yet, just over a month into the new year, the rally in the world’s leading industrial metal has stagnated. Copper barely makes headlines these days. Even tin was all over the news last week after London prices for the metal hit six-year highs from the biggest supply squeeze since the 1990s caused by dwindling inventories, robust industrial demand and rising investor interest.

So, what’s the story with copper?

Since US-based mining behemoth Freeport-McMoRan (NYSE:FCX) company trimmed its 2021 copper sales volume forecast to 3.8 billion pounds from last October’s 3.85 billion, sentiment has dragged on the metal.

In recent weeks, new worries have surfaced in copper, much of it to do with the Biden administration’s $1.9 trillion COVID-19 relief plan.

Republican rivals to President Joseph Biden are objecting to the immense size of that package, trying to cut it down to a third. Biden says he wants bipartisanship but has vowed to bulldoze the bill through Senate if necessary, using a legislative process called “reconciliation,” that would only need the votes of Democrats colleagues who have a majority of just one in the assembly. The problem is not all Democratic Senators might back him, and that could deal a blow to the bill.

US Stimulus Key to Copper Rebound

As copper analyst Thomas Westwater noted in a blog post on Daily FX two weeks ago, the $1.9 trillion relief may be seen as a proxy to a more targeted infrastructure package down the road—which will key to boosting prices of building raw materials such as copper.

Adds Westwater:

“Democrats want a robust infrastructure bill focused on green energy, which is heavily dependent on copper and other industrial metals. Thus, the US political climate may be key for prices in the coming months.”

That’s not all. A stronger dollar in recent days has also weighed on copper and some commodities, including precious metals such as gold and silver. On Thursday, the Dollar Index hit more than two-month highs of 91.315.

All this has led to a drag on copper prices.

From a five-year high of $3.73 per lb reached in the first week of January, the spot copper contract on New York’s COMEX has turned sluggish, rounding out last month with just a 1% rise compared with December’s climb of more than 2% and November’s whopping gain of nearly 13%. On Thursday, the spot price hovered at $3.57.

This does not mean there isn’t a positive outlook for copper.

China Demand A Major Pillar For Copper

China, the world’s biggest metals buyer, remains a lifeline for copper. While Chinese copper imports slowed towards the end of 2020, it still bought a record 6.68 million tonnes of the metal.

And strong import demand from China is likely to continue from Beijing’s own stimulus efforts and infrastructure related spending. The IMF’s latest outlook projects the Chinese economy to expand 8.1% this year on an annual GDP basis, supporting a robust recovery.

Global copper consumption is forecast to rise 6% to 24.76 million tonnes this year after a 1.3% drop last year, Citigroup analyst Oliver Nugent told Reuters recently, adding:

“We are seeing some outright growth in developed market metals consumption in the construction, consumer appliances, and automotive sectors, as covid-19 drives home renovations and new home demand.”

Nugent expects the copper market to shift into a deficit in the second half of the year, resulting in a small surplus overall for 2021 followed by deficits in 2022 and 2023.

Technicals Support $4 Copper Eventually

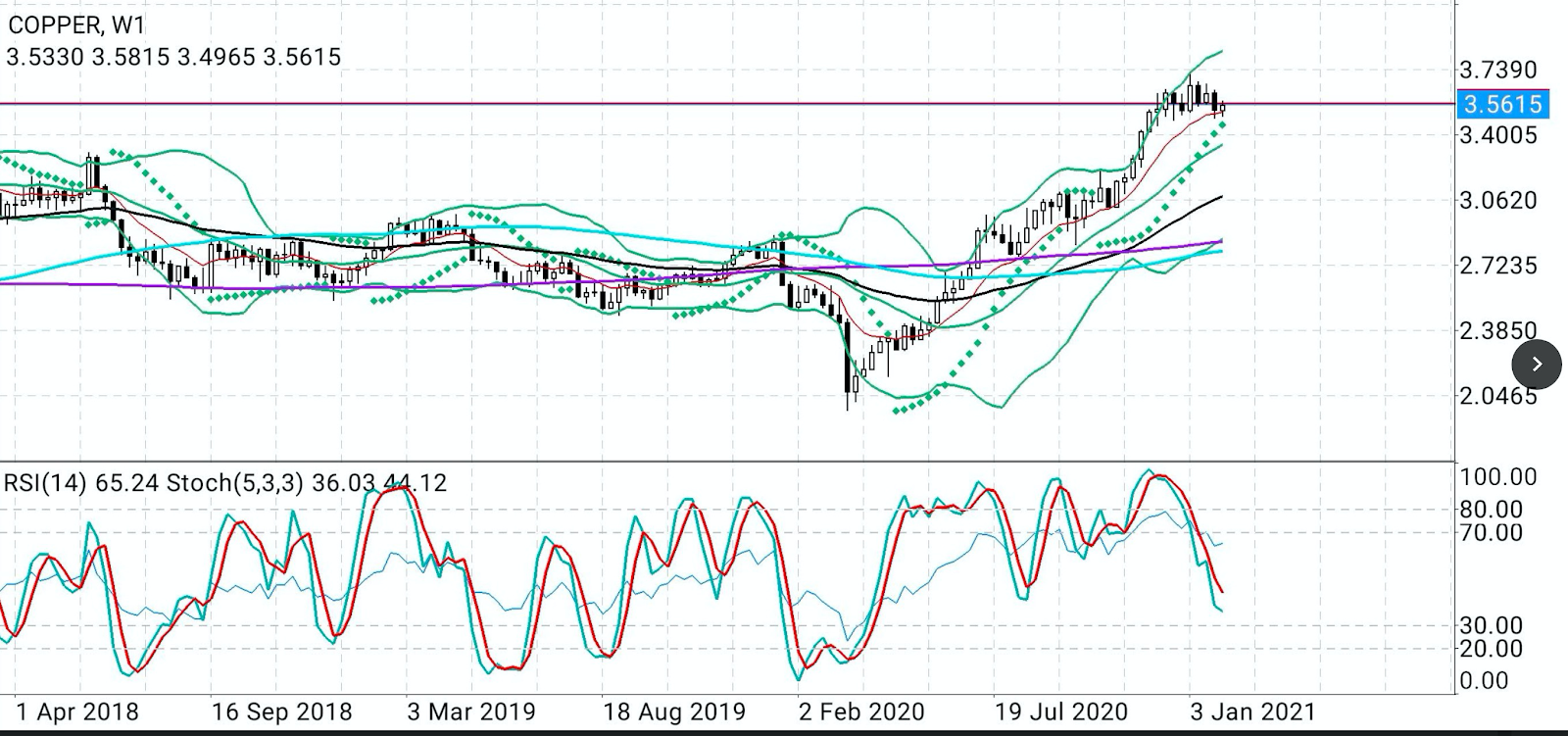

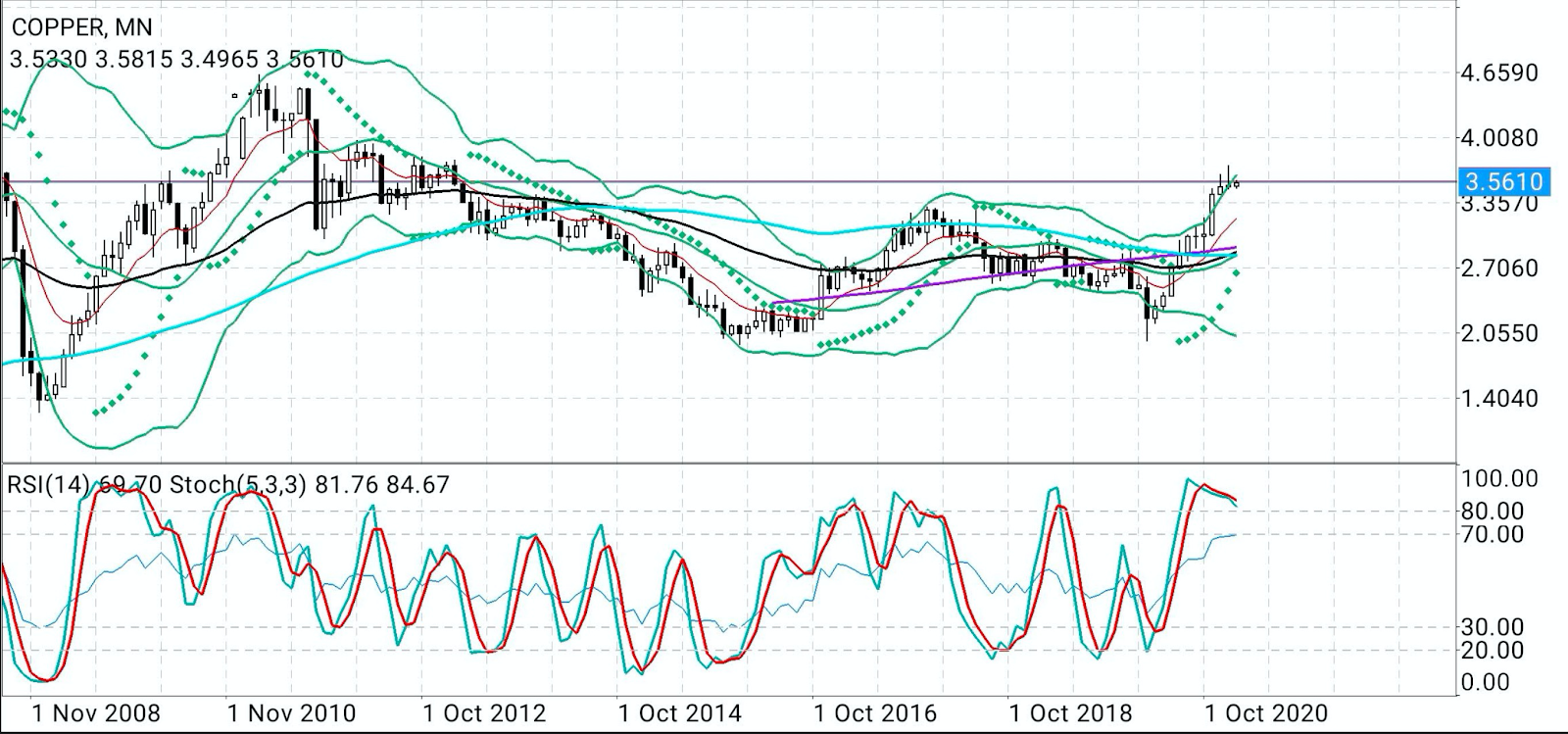

Charts courtesy of SK Dixit Charting

From a technical perspective, COMEX copper’s consolidation can be broken with a retest of the $3.70 highs that could take it to peaks of $4.50 and beyond, said Sunil Kumar Dixit of SK Dixit Charting in Kolkata, India.

Adds Dixit:

“Copper appears to be in a sideways to down move which, broadly speaking, is a consolidation and distribution phase after a strong rally. The first decisive breakout above $2.90 was confirmed by the 50-week Exponential Moving Average crossing over the 100 week-EMA. The next stronger breakout above $3.10 was confirmed by the 50-week EMA crossing over the 200-week EMA, resulting in the rally to $3.73.”

Lately, buyers have surfaced during dips seen at between $3.50 and $3.48, Dixit said, cautioning that further corrections could push the spot price to the $3.30 - $3.10 levels.

But such lows could also energize a strong rebound, he said.

“Consolidation and accumulation at $3.48 and further reversal can help copper retest $3.70 and reach for between $3.90 and $4.10, before an eventual target at $4.50.”

Investing.com’s own Daily Technical Outlook has a “Neutral” call on COMEX copper.

Should the market break out, a three-tier Fibonacci resistance has been forecast, first at $3.574, then $3.590 and later at $3.617.

In the event it reverses, then a three-stage Fibonacci support is expected to form, first at $3.521, then $3.504 and later at $3.478.

In any case, the pivot point between the two is $3.547.

As with all technical projections, we urge you to follow the calls but temper them with fundamentals—and moderation—whenever possible.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. He does not own or hold a position in the commodities or securities he writes about.