Copper moves lower

The dollar was generally firm at midday in Europe. The main mover was the pound, which was quite volatile. It rose slightly in the morning in anticipation that the minutes of the Bank of England’s November Monetary Policy Committee meeting would show a hawkish tilt to opinion on the committee, then fell sharply when on the contrary the minutes showed continuing concern about the fragile economy. But, the move didn’t last long and within an hour the GBP/USD was back above where it was before the minutes came out. The rebound demonstrates to me the strength of the market’s conviction in the UK recovery. Market participants looking for a way to play the GBP strength should consider the GBP/JPY, in my view.

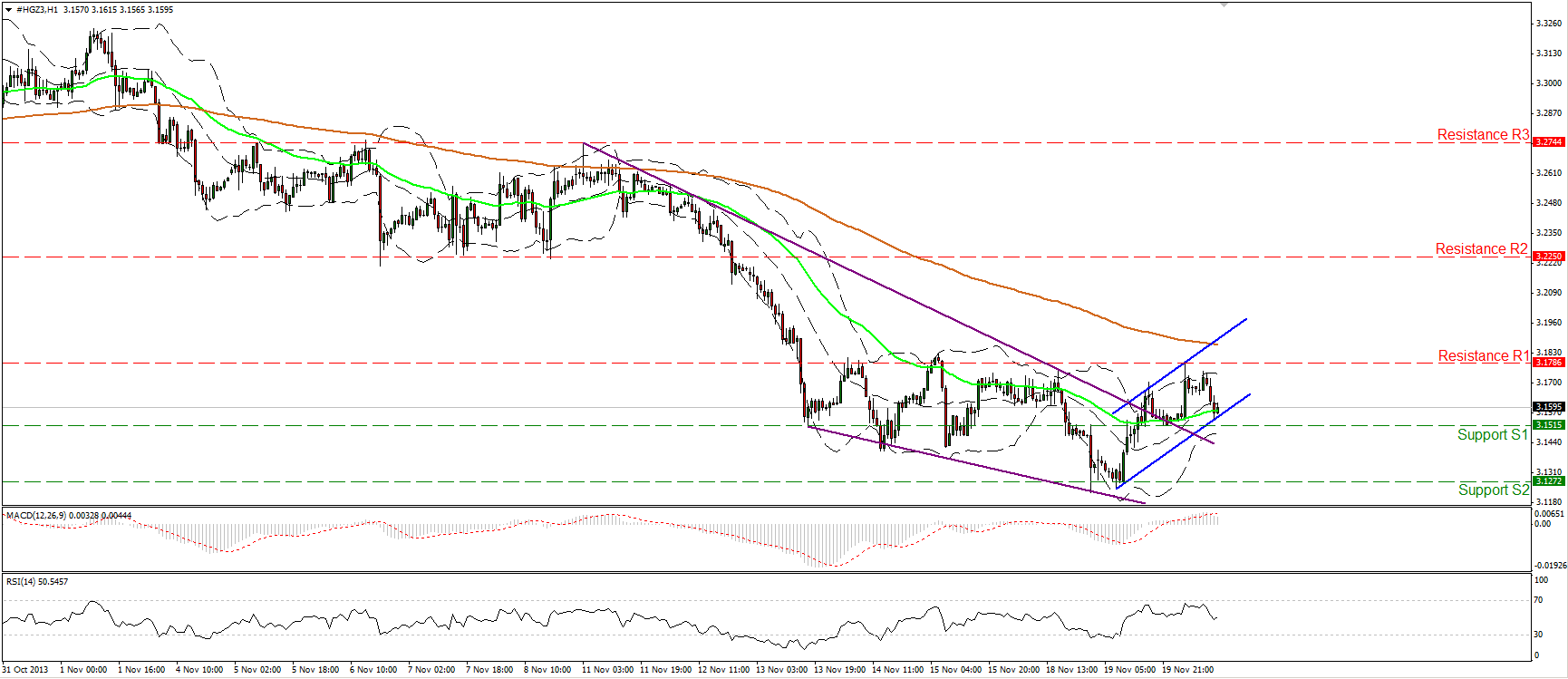

Copper escaped from a falling wedge formation, but after hitting the resistance of 3.1786 (R1) moved lower. The signals provided at the moment are not encouraging enough to declare a newborn uptrend. Firstly, we need to observe a rebound at the lower boundary of the short-term blue channel, and secondly the price should overcome the key resistance of 3.1786 (R1), in order to expect further advances. A violation of that resistance gives room to the bulls to drive the action higher, since the next important barrier is found at 3.2250 (R2). Both momentum studies confirm the recent weakness of the metal. The RSI moved lower after finding resistance near its 70 level, while the MACD, despite its positive reading, crossed below its trigger line.

Support: 3.1515 (S1), 3.1272 (S2), 3.1000 (S3)

Resistance: 3.1786 (R1), 3.2250 (R2), 3.2744 (R3)

Disclaimer: This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients’ orders. This material is just the personal opinion of the author(s) and client’s investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained.

Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited. Risk Warning: Forex and CFDs are leveraged products and involves a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. IronFx Financial Services Limited is authorised and regulated by CySEC (Licence no. 125/10). IronFX UK Limited is authorised and regulated by FCA (Registration no. 585561). IronFX (Australia) Pty Ltd is authorized and regulated by ASIC (AFSL no. 417482)