Metals and energy futures in India more or less mirror the movements in global exchanges as they are benchmarked likewise. For example, US Gold futures with MCX Gold, US Silver with MCX Silver and so on.

Therefore it is not surprising to find below in the two charts, the LME three month copper and MCX Copper November contracts witnessing a rebound from lows. LME Copper has solid support at $7536 per ton while intermediate support is seen at $7613 per ton.

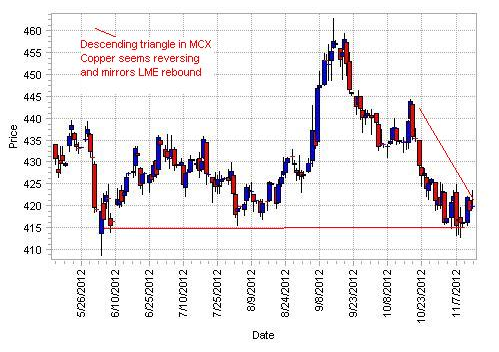

On the other hand in MCX, Copper November contract has witnessed a steep decline in recent times but looks set to gain strength for a move upwards supported by China manufacturing data, outcome of US elections although contraction in eurozone manufacturing output causes concern for the metals complex.

A reversal pattern in both LME and MCX copper can take prices to intermediate highs in the near-term but not to levels seen earlier during the year.

MCX Copper November has maintained Rs 419 levels from this month beginning and strong support is evident at Rs 415 per kg with reasonable good volumes and open interest.

Investors should closely watch both LME Copper, MCX Copper for further clues about its upward movement in the coming days and initiate buy position accordingly. According to leading analysts, it is very important to enter trade at the beginning of an uptrend and hold on and start booking profits before it hits resistance level and starts climb down. There are no major news triggers as in September when QE3 announcement by US Fed Reserve helped commodities to make a broad based rally.

By Sreekumar Raghavan

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Copper May Be Gaining Strength To Move Upwards

Published 11/15/2012, 06:56 AM

Updated 05/14/2017, 06:45 AM

Copper May Be Gaining Strength To Move Upwards

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.