Investing.com’s stocks of the week

--Copper ended the yesterday's trading session marginally lower taking negative cues from the weak housing starts data.

--For the day we recommend selling copper from the higher levels as the metal might take negative cues from the negative equities globally and weak manufacturing data from China which declined to 48.3 from 49.5.

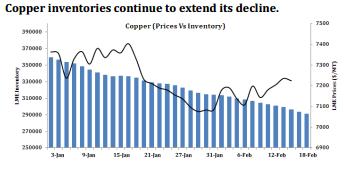

--On a positive side, yesterday we saw the metals stock falling marginally while its cancelled warrants enhanced by over 1% and suggest that there could be some bit of spot demand emerging in the commodity. However, we would wait for further updates on the same before building our stance onto the inventory front.

--In Intra-day the commodity is likely to get pressure from Fed minutes which was released yesterday. The Fed minutes stated that the Central bank would continue to taper its asset purchase program by $10 billion unless there is a drastic negative change in the US economy.