Could old Doc Copper be sending an important message about the overall health of the global economy and the stock market in the next couple of weeks? It appears it could!

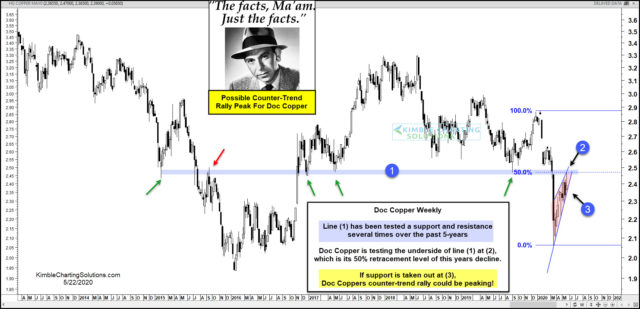

This chart looks at Copper Futures on a weekly basis over the past seven years. Doc Copper looks to have double topped in late 2017 and early 2018. After the double top, copper has continued to create a series of lower highs, which sends a bearish divergence message to stocks.

Numerous highs and lows have taken place along the line (1) over the past five years. The rally off the March lows has Doc Copper testing the underside of line (1) and its 50% Fibonacci retracement at (2) this week. While testing the underside of resistance, it is attempting to create a weekly bearish reversal pattern.

Commodity and stock market bulls would receive a positive message if Doc Copper can break above dual resistance at (2).

If Doc Copper finishes the week with a bearish reversal pattern and then it proceeds to break rising support at (3), it would send a negative message to the prospects of a global rebound in commodities and stocks!