Those that view the message of the market on a daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

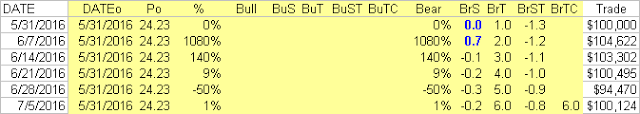

Copper's last signal, a focused bear opportunity from the fifth week of May and first week of July, produced a -39% annualized loss for the bears (see (NYSE:JJC) matrix). The JJC matrix, however, reveals that the bears that failed to recover at least their initial investment after 1080% annualized gain in the first week of June were pigs. Pigs get slaughtered in this business.

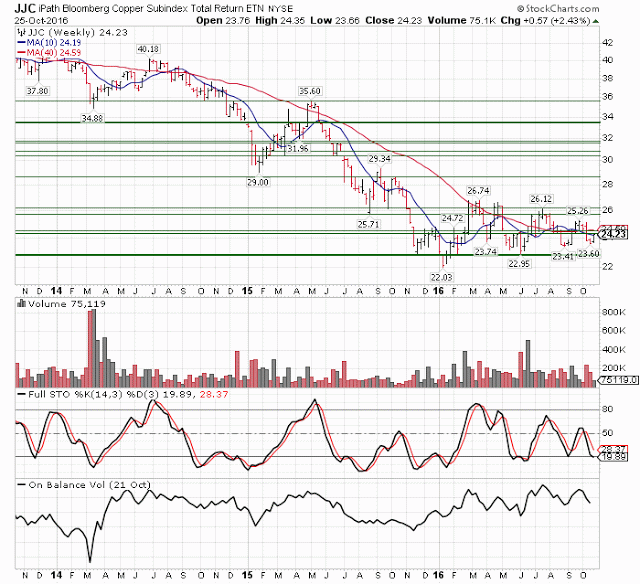

Smart money, a small minority listening to the message of the market, waits for copper to refocus before buying or selling. Copper has been in consolidation (against the down impulse) since the second week of July.

JJC Matrix

A weekly close below the January 2016 gap from 22.86 to 22.90 maintains the down impulse, while a close above the resistance zone from 25.71 to 26.59 could reverse it. A reversal favors testing of higher resistance.

On balance volume, a crude measure of trend energy, has been displaying higher highs relative to price since July. This positive divergence, an indication accumulation, favors the bulls. This message assumes greater importance under a focused bull opportunity.