Back in February’s Copper and Materials Not On Board, it was well documented that copper and basic materials were failing to participate fully in this year’s risk rally train, and despite big gains, having failed to reverse the intermediate-term downtrend plaguing both and something that was accomplished – briefly – by most of the other risk assets.

“Briefly” is the key word there, though, considering that most of those risk assets – notably equities and crude – have now begun to reverse back down from the intermediate-term uptrends that reversed the downtrends that copper and basic materials were unable to overcome.

Based on the currently very bearish charts of copper and the XLB, it seems that the reluctance shown by copper and the materials to reverse last year’s correction was a good reason to be reluctant about getting too excited about the risk-on trade despite very nice gains made this year.

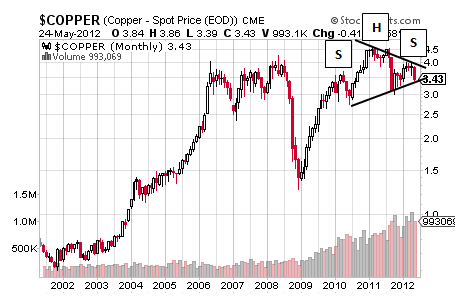

As can be seen above, copper is trading in a massive Symmetrical Triangle that can break up or down toward its conservative $6.05/lb upside target or toward its conservative $1.65/lb downside target but with copper’s multi-year Head and Shoulders pattern providing reason to think that copper’s Symmetrical Triangle will break down toward a similar sub-$2.00/lb target for a potential decline of about 52%. When this sort of potential decline is factored into the long-term monthly chart above, it suggests that copper is going to drop down toward the support of its 2008 and 2009 trough if not a bit below.

Should copper drop back toward those sub-$2.00/lb crisis lows, it will underscore why it was important to pay attention to the fact that copper was not fully on board the risk rally trading and a good reason to be reluctant about hopping on that ride as an indication that it was to be short-lived and particularly considering copper’s status as a leading indicator on the health of the economy.

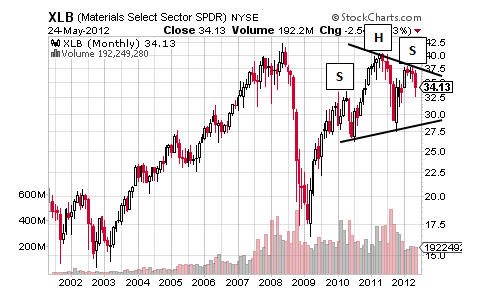

Interestingly, copper’s negative read on the economy back in February when investors were feeling pretty good about the economy ahead of the déjà vu-like employment and ISM numbers of late is supported by basic materials that represent many of the core economic companies considering this S&P sector also failed to reverse last year’s correction even as technology was partying like it was 1999.

Clearly the XLB is trading in a similar pattern set-up to copper, but what makes it so interesting is the fact that the XLB is far from the roughly $28 bottom trendline of its Symmetrical Triangle despite being down about 13% like copper YTD and this pattern discrepancy probably supports continued declines for both copper and the XLB with the XLB’s Symmetrical Triangle and H&S set-up carrying a shared target of about $15 for a potential decline of 56%.

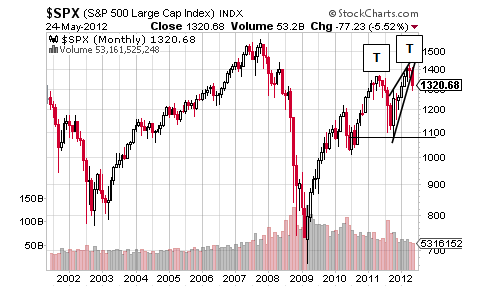

When the messages of these very bearish charts are applied to the S&P, it provides a negative read, not surprisingly, on the S&P and supports those same signals from a few months ago when copper and the materials refused to reverse up from last year’s correction and perhaps as a better read on the economy without the LTRO liquidity lens.

As can be seen above, the S&P’s Operation Twist LTRO party appears to be coming to an end with the index fulfilling its bearish Rising Wedge that carries a target of 1075. Should the S&P hit that Rising Wedge target of 1075, it will confirm a Double Top pattern that carries a target of 728 for a potential decline of 45%.

In turn, it seems fair to say that copper and materials were right – many months ago – about a big round of risk-off.

Sam’s Stash, Gold and the S&P

And where might investors flock on a big round of risk-off?

It would seem the relative safety of the US dollar based on the dollar index’s fulfilling Falling Wedge for a target of 88 while a large Rounding Bottom supports a move well above 100 within 3 to 5 years and something that may mean the upcoming flight to liquidity could carry a bit more longevity than the flight to safety of 2008 and 2009.

After all, copper and materials tell us that this potential dollar strength will not be driven by long-lasting economic strength but by a big round of risk-off.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Copper And Materials Were Right About A Big Round Of Risk-Off

Published 05/26/2012, 11:52 PM

Updated 07/09/2023, 06:31 AM

Copper And Materials Were Right About A Big Round Of Risk-Off

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.