Vehicle and parts online auction platform Copart (NASDAQ:CPRT) stock is has been plunging with the benchmark indexes despite blowout earnings. The Company is capitalizing on the global chip shortage leading to supply chain disruptions in new and used vehicles.

The inflation in car prices has been a boon to the famous auctioneer of used cars and parts as demand is heavy. Supply chain and raw materials costs did squeeze some of the margins, but that is more than offset from the soaring demand that produced a 36.6% top-line growth in its fiscal Q1 2022 earnings.

The post-pandemic return to average trend continues to be a tailwind that gets a longer runway as COVID cases rise. Prudent investors seeking to capitalize on supply chain and logistics disruption in the auto sector can watch for opportunistic pullback levels in shares of Copart.

Fiscal Q1 2022 Earnings Release

On Nov. 17, 2021, Copart released its fiscal first-quarter 2022 results for the quarter ending October 2021. The Company reported an earnings-per-share (EPS) profit of $1.07 excluding non-recurring items versus consensus analyst estimates for $1.07, a $0.07 beat. Revenues grew 36.6% year-over-year (YoY) to $810.13 million, beating consensus analyst estimates for $747.74 million.

Conference Call Takeaways

Copart CEO, Jeff Liaw set the tone,

“Hundreds of us from around the country spent our Labor Day weekend on the ground and many weeks thereafter, managing the retrieval of vehicles, receiving imaging them, and navigating the vehicles through the titling process to their eventual sale. As is often the case with major storms, we experienced an operating loss from the event in the quarter of a few million dollars. We view our pre-storm prep and our robust response to catastrophic events as investments in the strong and durable partnerships we have with our insurance sellers.

Our storm-related costs, as you know from prior experiences, include lease expenses for temporary storage facilities, premiums for towing, labor costs and overtime for our people, travel expenses, and lodging, among others. These expenses are of course offset by revenue from incremental unit volume. Financially speaking, the impact of the storm in the quarter was approximately 100 to 150 basis points of gross and operating margin rate compression. You all know we haven't provided further specifics in our press release or included adjustments in our non-GAAP earnings schedule for the catastrophe.

We believe that providing excellent service in difficult times is an intrinsic aspect of our value proposition to our customers and that these storms will become -- will increase in frequency and severity over time. The second thing I wanted to tackle is our unit volume growth and our auction liquidity. We experienced a global unit sales increase of 21% year-over-year, of which approximately 2 points were explained by the hurricane itself. A US increase of almost 24% and again, 2 or 3 points of that growth was explained by Hurricane Ida.

We grew our international unit sales by just shy of 8%. The COVID responses in countries outside the US, as a general matter, continue to be more aggressive and more pronounced than what we've experienced here at stay side. Our insurance business grew, relative to the first quarter of last year, at 23%.”

He continued,

“Total loss frequency has increased steadily, including during the pandemic. The [Indiscernible], as many folks on the phone already know, the strong used car price environment almost certainly is an inhibitor to assignment volume to Copart auctions. Turning to our non-insurance volume. When we exclude lower-value cars, such as wholesalers and charities, our non-insurance business grew 7.5% year-over-year with our dealer unit volume up slightly approximately 1% versus last year and strong growth in our Copart direct business.

I'll note and you'll note that this represents solid absolute performance, but arguably the strongest relative performance in our history to other vehicle marketplaces given what is the pronounced shortage of available supply in the industry. We think this is a testament to the power of Copart's marketplace. And we said it before, but it's worth reiterating. The cars we earn the right to sell on behalf of insurance companies along with rising total loss frequency, enable us to achieve superior returns for progressively more non-insurance cars as well. And it's also true in reverse.”

CEO Liaw concluded,

“Copart plays a critical role in the automotive circular economy, enabling the reuse, recycling, and responsible disposal of vehicles around the world. We sell well over 3 million vehicles per year. And by matching those vehicles with our optimal owners, we enable the return to service of automobiles that would otherwise have been scrapped, the re-use of parts that otherwise would have ended up in landfills. As a result, the re-use and recycling that Copart enables displace what otherwise would have been de novo resource extraction and energy-consuming manufacturing as well.

As climate events themselves increase in frequency and severity, Copart will play a growing role in assisting communities and recovering from them as we have in our past by removing vehicles from roadways and storage facilities and repair shops enabling the free flow of people and goods and services and economies in which we do business. And finally, because so many of our vehicles are ultimately purchased by buyers outside the U.S., our auctions contribute to the physical and economic mobility of residents in countries of emerging economies, including in Central and South America, the Middle East, Africa, and Eastern Europe.”

Opportunistic Pullback Levels

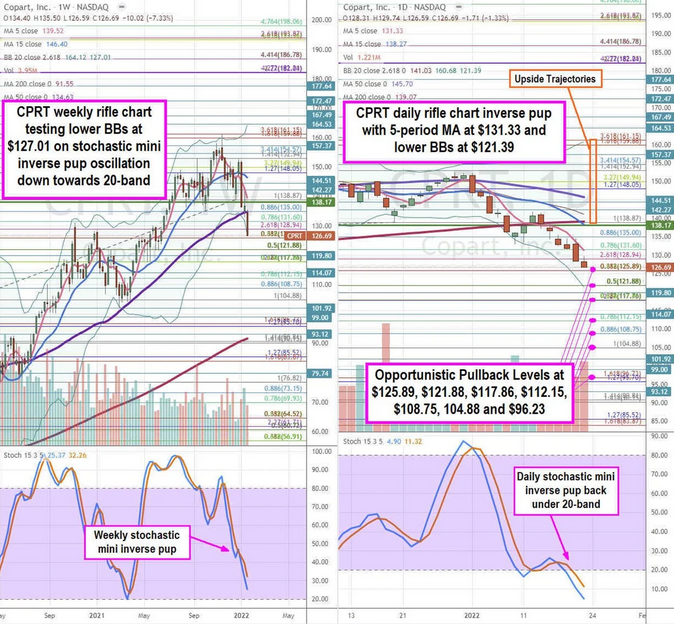

Using the rifle charts on the weekly and daily time frames provides a clear view of the price action playing field for CPRT stock. The weekly rifle chart peaked at the $161.15 Fibonacci (fib) level before selling down to the weekly lower Bollinger Bands (BBs) at $127.01. The weekly rifle chart has a downtrend led by the 5-period moving average (MA) at $131.33, followed by the 15-period MA at $138.27.

The weekly stochastic has a mini inverse pup falling towards the 20-band. The weekly 50-period MA resistance is at $134.63. The daily rifle chart has an inverse pup breakdown with a falling 5-period MA at $131.33, followed by the 15-period MA at $138.27. The daily lower BBs sits at $121.39 as the stochastic falls back under the 20-band.

The daily market structure low (MSL) buy triggers a breakout through $138.17, but the daily 200-period MA resistance is at $139.07 just above. Prudent investors can watch for opportunistic pullback levels at the $125.89 fib, $121.88 fib, $117.86 fib, $112.15 fib, $108.75 fib, $104.88 fib, and the $96.23 fib level. Upside trajectories range from the $138.87 fib to the $161.15 fib level.