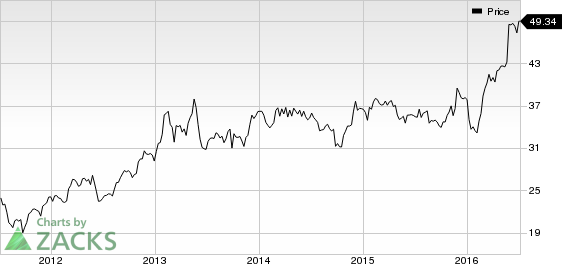

Copart, Inc.’s (NASDAQ:CPRT) shares gained 1.91% to close at $49.01 on Jun 30 after the company announced the expansion of its Orlando location to manage the growing business. The shares continued to increase further, rising 0.67% to close at $49.34 on Jul 1.

Copart is undertaking rapid expansion to grow its business. Recently, it announced the expansion of its location in Houston, TX. The company has been witnessing strong growth in Texas. As a result, last month, it also announced the expansion of its location in North Fort Worth, TX.

Further, Copart acquired two new locations in Texas in Apr 2016, taking its total locations in the state to 14. In the same month, CrashedToys, the company’s online auction division that specializes in the sale of used and repairable powersport vehicles, opened a new retail-entertainment-auction concept in Dallas. CrashedToys of Dallas sold 99 vehicles for a total of $375,000 on the opening day.

Apart from Texas, Copart is expanding in other locations as well. In Jun 2016, the company announced the acquisition of a new location in Candia, NH as well as the opening of its first location in the Republic of Ireland.

In May 2016, Copart announced the expansion of its location in Brighton, CO as well as the opening of its second location in Colorado at a 20-acre area in Colorado Springs. The company also expanded its operations to India, with the first auction in the nation held in Oct 2015.

Additionally, Copart has been focused on expanding in the Middle East over the last few years. The UAE ranks second in the international market for cars sold from the company’s North American yards.

Copart is a prominent player in online auctions and vehicle remarketing services in the U.S., Canada, U.K., UAE, Bahrain, India, Sultanate of Oman, Spain, Brazil, Germany, and the Republic of Ireland. Its peers in the auction and valuations services business include Sotheby's (NYSE:BID) , Ritchie Bros. Auctioneers Incorporated (NYSE:RBA) and Liquidity Services, Inc. (NASDAQ:LQDT) .

The company, with a Zacks Rank #1 (Strong Buy), provides a wide range of remarketing services to vehicle suppliers, primarily insurance companies, to process and sell salvage vehicles. This is done mainly over the Internet, through its Virtual Bidding Internet auction-style sales technology.

RITCHIE BROS (RBA): Free Stock Analysis Report

LIQUIDITY SVCS (LQDT): Free Stock Analysis Report

SOTHEBYS (BID): Free Stock Analysis Report

COPART INC (CPRT): Free Stock Analysis Report

Original post

Zacks Investment Research