Cooper Tire & Rubber Company (NYSE:CTB) , engaged in the design, manufacture, marketing and sale of tires, delivered adjusted earnings of 50 cents per share in the fourth quarter of 2017 that missed the Zacks Consensus Estimate of 62 cents.

Revenues

Cooper Tire recorded net sales of $757 million, missing the Zacks Consensus Estimate of $770 million as well the year ago revenues of $783.9 million.

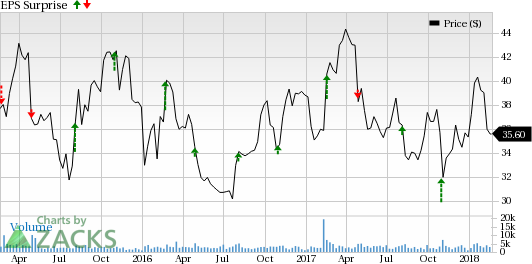

Estimate Trend & Surprise History

In third-quarter 2017, Cooper Tire reported positive earnings surprise of 38.8%. In fact, the company has beaten the Zacks Consensus Estimate in three of the trailing four quarters with an average beat of around 17.1%.

Zacks Rank

Cooper Tire currently has a Zacks Rank #2 (Buy), but that could change following its earnings report which was just released. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Key Stats/Developments to Note

During the quarter, Cooper Tire’s consolidated unit volume declined 1.9% year over year, with robust growth in the International segment that was more than offset by lower volume in Americas segment.

The company expects 2018 operating profit margin guidance at the low end of 9–11%.

Check back later for our full write up on Cooper Tire’s earnings report!

Can Hackers Put Money INTO Your Portfolio?

Earlier this month, credit bureau Equifax (NYSE:EFX) announced a massive data breach affecting 2 out of every 3 Americans. The cybersecurity industry is expanding quickly in response to this and similar events. But some stocks are better investments than others.

Zacks has just released Cybersecurity! An Investor’s Guide to help Zacks.com readers make the most of the $170 billion per year investment opportunity created by hackers and other threats. It reveals 4 stocks worth looking into right away.

Download the new report now>>

Cooper Tire & Rubber Company (CTB): Free Stock Analysis Report

Original post