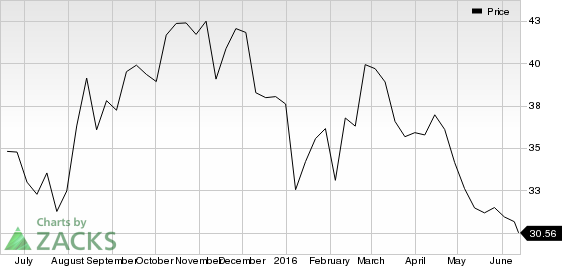

Shares of Cooper Tire & Rubber Co. (NYSE:CTB) hit a new 52-week low of $30.44 on Jun 13. The share price recovered marginally later in the day to close a notch higher at $30.56, down 2.02% from the previous trading session.

What's Weighing on Cooper Tire?

Cooper Tire has been facing weakness in revenues as its Chinese joint venture partner, Chengshan Group Company Ltd. decided to exercise its option to purchase the former’s 65% ownership stake in Cooper Chengshan (Shandong) Tire Company Ltd. (“CCT”). As a result, in Dec 2014, Cooper Tire sold its share for $262 million net of taxes. The sale of interest in CCT was primarily responsible for a year-over-year decline of 13.2% in the company’s 2015 revenues.

Cooper Tire’s first-quarter 2016 revenues also dropped 2% year over year to $650 million. Further, revenues missed the Zacks Consensus Estimate of $675 million. Revenues declined due to the adverse impact of price and mix, and currency changes, partially offset by an increase in unit volume.

Americas Tire Operations recorded a 3.2% decrease in revenues in the quarter to $579 million due to unfavorable price and mix, negative foreign currency impact, and lower unit volume. International Tire Operations reported a 3.6% fall in revenues to $103 million, mainly due to unfavorable price and mix, and negative foreign currency impact, partially offset by higher unit volume.

Cooper Tire had cash and cash equivalents of $434 million as of Mar 31, 2016, down from $449 million as of Mar 31, 2015.

Cooper Tire expects raw material costs in the second quarter to increase marginally from the first quarter of 2016.

Zacks Rank

Cooper Tire currently carries a Zacks Rank #3 (Hold). Some better-ranked automobile stocks include Autoliv, Inc. (NYSE:ALV) , Oshkosh Corporation (NYSE:OSK) and Superior Industries International, Inc. (NYSE:SUP) . All the three stocks sport a Zacks Rank #1 (Strong Buy).

AUTOLIV INC (ALV): Free Stock Analysis Report

SUPERIOR INDS (SUP): Free Stock Analysis Report

OSHKOSH CORP (OSK): Free Stock Analysis Report

COOPER TIRE (CTB): Free Stock Analysis Report

Original post

Zacks Investment Research