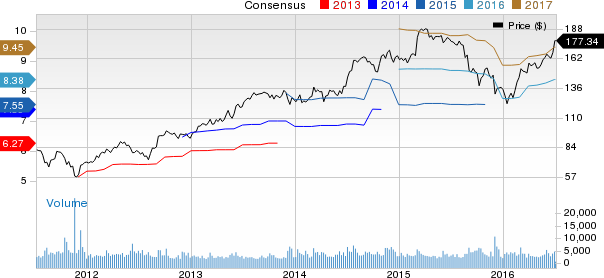

The Cooper Companies Inc. (NYSE:COO) is firing on all cylinders, buoyed by its expanding product portfolio and consistent earnings results. The momentum is boosting its share price, which is up 32.2% year-to-date as compared to the S&P 500’s return of 2.9%.

Cooper Companies through its operating companies – CooperVision (CVI) and CooperSurgical (CSI) – offer a wide range of contact lenses as well as medical devices and surgical instruments that are primarily utilized by gynecologists and obstetricians.

Cooper Companies’ policy of launching new products and updating the existing ones has been a key catalyst for years. The expanding product portfolio helps the company address user preferences, which are shifting from low-feature commodity lenses to more expensive single-use and specialty lenses, such as lenses with aspherical optical properties or higher oxygen permeable lenses (silicone hydrogels).

New Contact Lens

The growing usage of digital devices has created a new group of users who frequently complain of discomfort arising from prolonged usage of smartphones, tablets, laptops, in-car displays and other devices.

Despite the high usage, 90% of people do not feel that it is necessary to communicate the digital usage data with their eye care practitioners. The lack of awareness has been primarily blamed as the major reason behind tiredness, dryness and redness of eyes.

To address this condition, Cooper Companies recently launched Biofinity Energys contact lenses, which features Digital Zone Optics and Aquaform technologies.

According to Cooper Companies, “CooperVision Biofinity Energys contact lenses are designed for all-day wear, helping people’s eyes better adapt so they can seamlessly and continuously shift focus between digital devices and offline activities. After one week of wear, eight out of ten digital device users agreed that Biofinity Energys lenses made their eyes feel less tired.”

As the adoption rate of digital devices continues to rise, we believe that demand for Biofinity Energys will ramp up in the near future. The company has started rolling out the product in the U.S. on a phased manner beginning July. It is expected to enter the European markets later this year.

Growth Prospects

Apart from the CooperVision business, the company is also expected to benefit from the expanding CSI product portfolio. Management believes that CSI’s long-term growth will be driven by the fertility segment (a significant part of the women’s healthcare market), where Cooper Companies has gained a strong foothold driven by acquisitions (Reprogenetics, Genesis and Recombine).

Moreover, these acquisitions have provided Cooper Companies with a competitive edge in the women healthcare market. Boston Scientific (NYSE:BSX) and Johnson & Johnson (NYSE:JNJ) are two prominent players in this market.

A Peer

BioTelemetry (NASDAQ:BEAT) is a top-performing stock in the broader medical sector.

JOHNSON & JOHNS (JNJ): Free Stock Analysis Report

BOSTON SCIENTIF (BSX): Free Stock Analysis Report

BIOTELEMETRY (BEAT): Free Stock Analysis Report

COOPER COS (COO): Free Stock Analysis Report

Original post

Zacks Investment Research