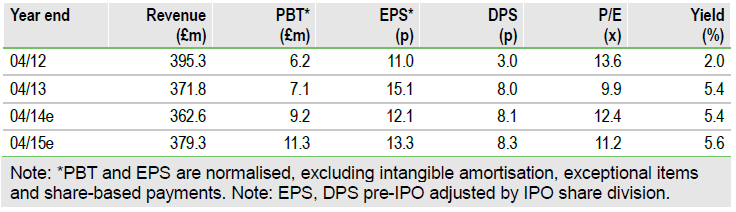

Conviviality Retail (CVR:LN) announced this morning it is acquiring the share capital of LCL Enterprises for £1.65m, paid out from the group’s existing cash resources. LCL Enterprises trades as Wine Rack, a specialist retailer of wines, spirits and general tobacco with 22 stores, predominantly located in the Greater London area. The acquisition adds c £5m to our FY14e and £10m to our FY15e revenue forecasts. At this stage we are not adjusting our earnings estimates. We see the acquisition as a positive long-term strategic step, consistent with the stated strategy of expanding CVR’s wine offering and expanding into the south of England from its roots in the north of England.

Wine Rack (www.winerack.co.uk) was acquired by its former owners as an expansion of their wholesale business in November 2009. Having grown the business from 13 to 22 stores, it is understood that the former owners wanted to return the focus to the wholesale part of their business. As part of a larger retailing chain, we see potential synergies from bulk purchasing and benefits of a management team focused on running general retail stores. In the near term the stores will continue to run on a managed basis, with existing staff and head of operations being retained. Wine Rack’s wine range has the opportunity to be sold into the Bargain Booze network as well, with the Wine Rack band being used in point-of-sale signage in a number of wine-heavy Bargain Booze stores within the next few weeks.

For the year ended March 2013, Wine Rack had revenues of £11.3m, EBITDA of £0.4m and PBT of £0.2m. At completion, Wine Rack had no indebtedness. Revenues have been consolidated on a pro-rata basis for our estimates. We expect to review our earnings estimates at CVR’s interims, once management has given a better overview of the synergy potential of this acquisition.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Conviviality Retail: Acquires Wine Rack, Potential Synergies Abound

Published 09/02/2013, 07:09 AM

Updated 07/09/2023, 06:31 AM

Conviviality Retail: Acquires Wine Rack, Potential Synergies Abound

Bolt-on acquisition of Wine Rack

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.