Convertible Securities (CV) Funds, an often-ignored classification in the mixed-assets funds space, have been on a tear in 2020. Given the stingy bond yields in the market and the red-hot stock market of late (ignoring the recent one-day meltdown in tech stocks), the stars have aligned for CV funds. The average CV fund posted a handsome 21.17% year-to-date return through the fund-flows week ended August 2, 2020, trailing the likes of Global Science & Technology Funds (+34.06%), Science & Technology Funds (+29.05%), Large-Cap Growth Funds (+25.75%), Multi-Cap Growth Funds (+24.83%), and China Region Funds (+23.23%).

CV funds invest primarily in convertible bonds and/or convertible preferred stock. These funds are hybrids of sorts, offering investors fixed income yields, but with a kicker of being able to participate in the success and accretion of the issuers’ common stock price if the conversion price is reached. These securities often carry a lower yield than other bonds with similar maturities because of their conversion feature. Given that some of the individual issuers come with lower credit quality ratings, these are the perfect asset class to purchase as a pooled investment, such as mutual funds and exchange-traded funds, where professional managers are keeping a close watch on the issuers and creating a well-diversified portfolio of holdings.

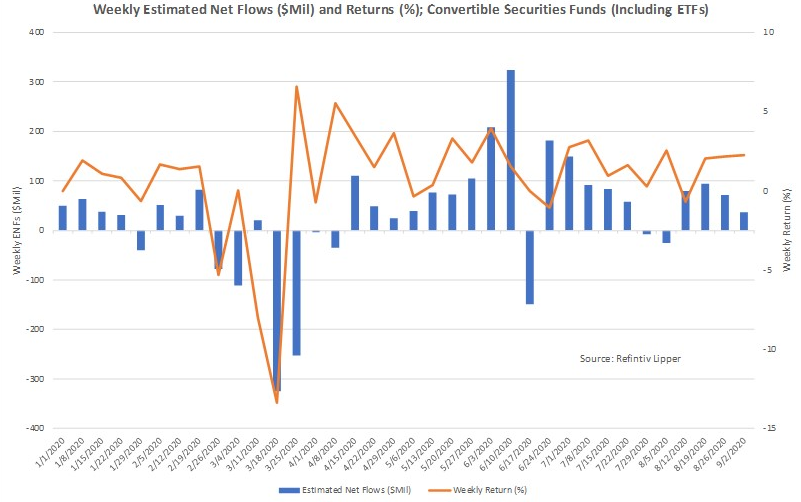

While warehoused in Lipper’s equity funds macro-group, CV fund flows have been more akin to those we have seen from fixed income funds (but obviously at a much lower magnitude). For the fund-flows week ended August 2, 2020, CV Funds (+$36 million) attracted net new money for the fourth consecutive week and posted a weekly return of 2.24%.

Year to date, CV Funds (including ETFs) attracted $780 million, with assets under management (+$24.9 billion) jumping to their highest point since 1992 (when Lipper began tracking weekly flows). The classification suffered net redemptions in each of the preceding five years, cumulatively handing back some $7.6 billion during that time period.

The top three attractors of net new money into the Convertible Securities Funds classification year to date were AllianzGI Convertible Fund (NYSE:NCV) (+$753 million, multiple share classes),iShares Convertible Bond ETF (NYSE:ICVT), +$328 million), and Columbia Convertible Securities Fund (+$204 million, multiple share classes).