We saw some volatility come into stocks this past week after the slow solid grin higher we’ve been enjoying since early November.

I do not think this is a top, rather, a little shakeout, or shake and bake.

Volatility comes on the upside and downside so we should see some more explosive moves to the upside after this little correction, if you can call it that.

The metals continue to show strength even while some miners were flashing weakness mid-week, which had me a but worried, but gold continues to act great.

Let’s take a quick look at the precious metals charts.

Gold gained 1.55% and is butting up against the 200 day moving average now.

Solid action on this gold chart which points to continued strength up to the $1,310 area where we should see a bit of a longer rest.

Silver moved higher by 2.09% and looks good for more upside.

Resistance above sits at $18.75 then $19 and we’re getting there in a hurry.

All good for now on this silver chart which continues to lead the gold chart.

Platinum rallied 2.26% as it breaks out towards $1,080.

This long base under $1,020 has lated since October and is finally starting to see a breakout.

I like the strong volume coming in Thursday and Friday to get this breakout going.

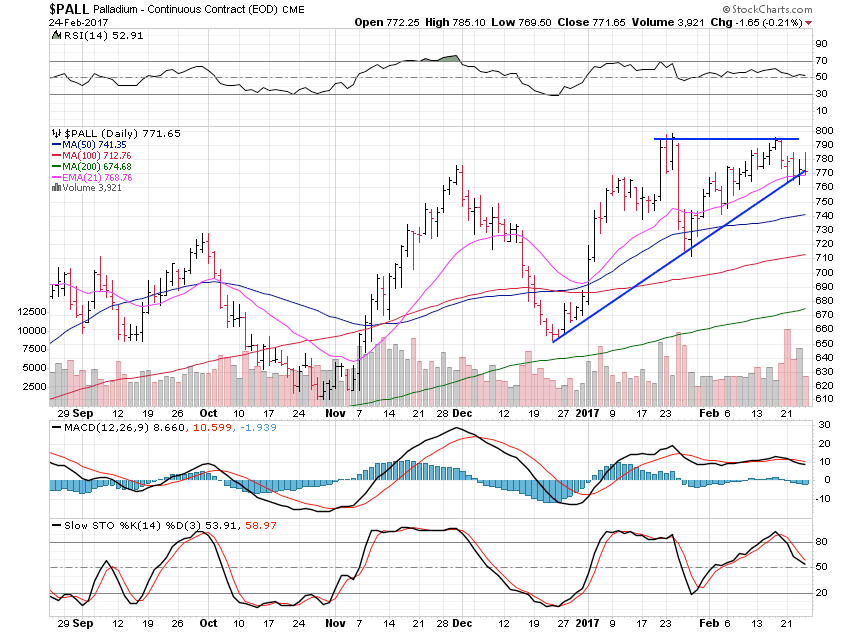

Palladium was the sole loser this past week falling 0.97%.

That said, it does look fine and ready to breakout above $795 this coming week.

All in all, metals continue to act great while markets seem to be giving us a rare quick dip buying opportunity, for now at least.

Things can quickly change and I’ll change with it if need be, but for now, I remain all in.