Crude oil prices moved lower into the settlement of the December 2015 contract, and downward pressure appears to be poised to drive prices to lower levels. Crude supplies according to the Energy Information Administration are at 80-year highs and stocks continue to build in Cushing. The warmer than expected weather has put upward pressure on heating oil stocks, which could generate additional headwinds. The contango should continue to give investors clues to the direction of the petroleum complex, and investors should be cognizant of divergences between the term structure and the outright price.

Crude oil is priced per month and the difference between each contract month is referred to as the term structure. The difference can be charted in a spread format helping traders evaluate the balance of crude on a month to month basis. When demand is strong relative to current supply the prompt price will generally be higher than deferred (future) prices. When supply is robust and overwhelms demand, prompt prices will be lower than deferred prices. It is helpful to draw the spread as a positive number. The higher the spread move the wider the contango.

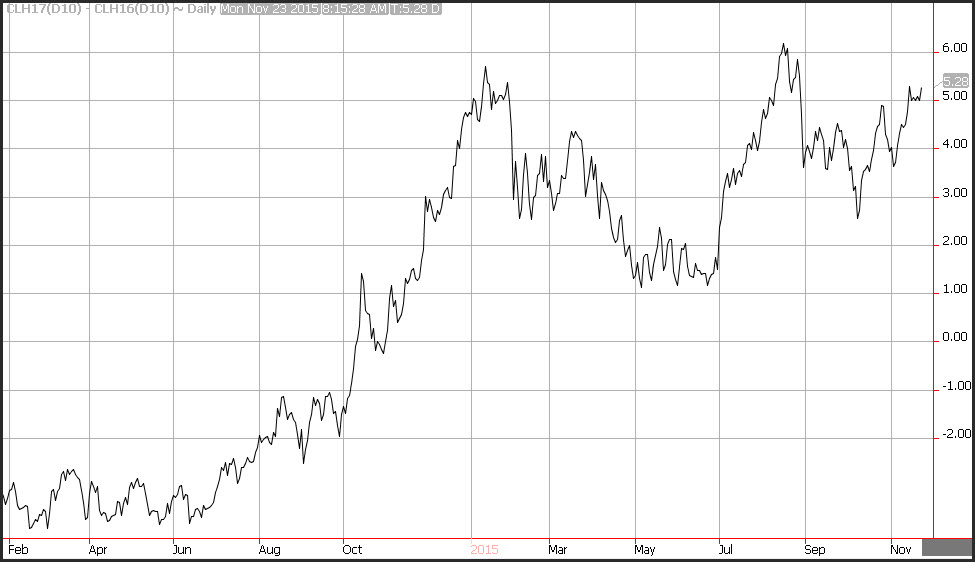

The current March 2016 versus March 2017 term structure (drawn as a positive March 17 - March 16), continues to point to a wider contango, which should put downward pressure on prices. This also means that storage facility operators can purchase crude oil and lock in a forward price at a higher level, generating an arbitrage. This further weighs on future prices.

Warm weather could substantially erode crude oil prices. If the heat crack drops, refiners will not be incented to run crude, and going into the driving season there could be a glut of crude to refine. Watch for any divergences between the term structure and the price.