• Consumption in Canada disappointed in 2012Q1. This translated into 12-month growth of 1.9%, its weakest showing since 2001, not counting the recent recession. What’s more, retail sales are not boding well for Q2.

• The current climate of uncertainty might suggest that the softness is attributable to a loss of consumer confidence. However, the fact that the savings rate is trending down and that non-discretionary consumption is presently declining faster than discretionary consumption does not support this hypothesis.

• On the other hand, in the past year, employee compensation registered its weakest growth since 2002, not counting the last recession. What’s more, in real terms, Canada was outpaced by the United States in this regard for the first time since 2004.

• While inflation should give consumers a break for the rest of the year, we expect no notable improvement in the job market. The unemployment rate has stalled since September, which suggests wage pressures should remain subdued.

• Aside from these cyclical elements, one trend has taken root: a notable moderation in consumer credit growth will likely continue to hold back household spending. Under the circumstances, we are forecasting consumption growth of 1.5% y/y at yearend 2012, well short of the Bank of Canada’s potential GDP growth projection.

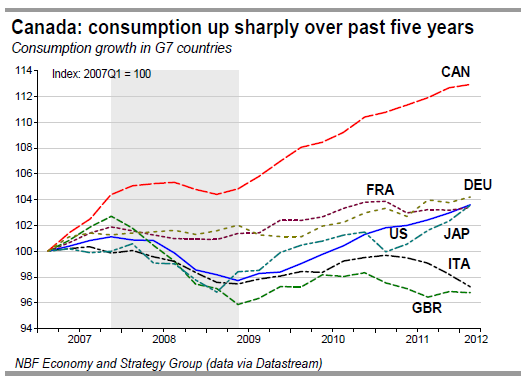

Taking a look at consumption in Canada Canada’s solid economic showing in recent years can be explained by strong consumption. This is not surprising in that consumption accounts for roughly 60% of the economy. Each year since 2005, consumption has grown faster in Canada than in the United States. Within the G7, Canada has performed egregiously in this regard since 2007, posting 12.9% growth against an average 1.5% for the other countries (Chart 1). Accounting for this is a stronger job market performance and the fact that Canadian household balance sheets have benefitted from a wealth effect derived from a buoyant housing market.

However, like most other countries, Canada has seen consumption slow down lately. In 2012 Q1, it grew 0.9% annualized, its weakest showing since the last recession. This made for 12-month growth of 1.9%, its lowest level since 2001, not counting the recent recession. What’s more, retail sales are not boding well for Q2.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Consumption Slowdown In Canada: Transitory Or Trend?

Published 07/17/2012, 08:47 AM

Updated 05/14/2017, 06:45 AM

Consumption Slowdown In Canada: Transitory Or Trend?

Summary

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.