From this yesterday's gross domestic product (GDP) release, we learned defense spending grew 15% annualized, the fastest since 2003. Quarters immediately following double-digit gains are often much weaker, so we shouldn’t expect this sector to materially contribute to growth next quarter. However, private consumption patterns appear to be sustainable.

Here are a few points to keep in mind:

- Real final sales to private-sector domestic purchasers rose 3.2% annualized, as middle- and upper-income consumers had the cash to spend.

- Technology spending boosted Q3 capital expenditures as the artificial intelligence (AI) craze continues.

- Investors should closely monitor upper-income households for any leading signs of emerging trends.

- According to this morning’s report, inflation eased considerably throughout Q3, which increases the odds the Federal Reserve (Fed) will cut at both of the upcoming meetings this year.

Bottom Line is looking ahead, we should not expect government spending to contribute to growth as much as it did in Q3. According to a separate report from the New York Fed, well-heeled millennials are driving consumer spending. As long as they have the appetite and ability to spend, business activity will remain stable.

Well-Heeled Millennials Drive Consumer Spending

Consumer spending contributed 2.5 percentage points to topline Q3 growth of 2.8% annualized. According to a separate report from the New York Fed, well-heeled millennials are driving consumer spending. The chart highlighted in this week’s Econ Market Minute gives a bit of the backstory on how upper-income millennials are supporting retail spending.

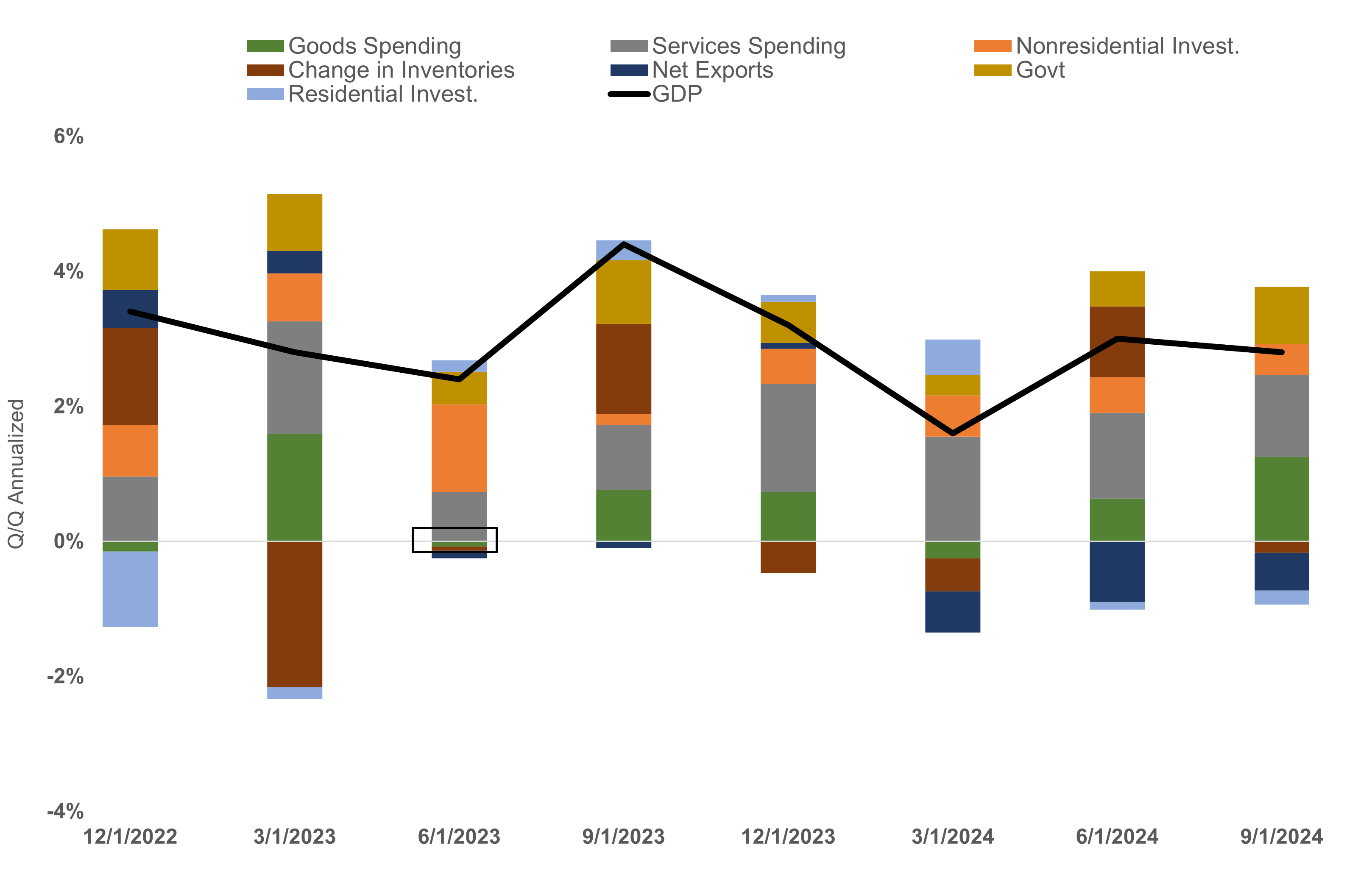

As long as they have the appetite and ability to spend, business activity will remain stable. Demand for both goods and services grew in Q3, but as the chart below reveals, goods spending often retreats after an outsized gain. Consider the first half of 2023 as an example.

Contributions to U.S. GDP Growth

Source: Source: LPL Research, U.S. Bureau of Economic Analysis, 10/30/24

Demand for services is a more stable driver of growth, and if consumers — especially the upper-income ones — remain healthy, we should expect services spending to contribute to growth in the coming quarters but goods spending to revert like it did in early 2023.

AI Boosted Technology Spending

Businesses invested in capital throughout the third quarter, especially in information processing equipment. This category within the GDP report grew almost 15% annualized in Q3 and up 9% from a year ago. We could expect this line item to continue to support overall growth, even when consumer spending starts to moderate. Investors should keep an eye on firms that could benefit from the build-out of the necessary infrastructure to support AI.

Conclusion

Not surprisingly, third-quarter business activity was strong, pushing third-quarter GDP growth up 2.8% annualized from the previous quarter. Looking ahead, we should not expect government spending to contribute to growth as much as it did in Q3.

According to a separate report from the New York Fed, well-heeled millennials are driving consumer spending. As long as they have the appetite and ability to spend, business activity will remain stable. According to this morning’s report, inflation eased considerably throughout Q3, which increases the odds the Fed will cut at both of the upcoming meetings this year.

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities. High valuations introduce risk if earnings don’t come through, but market momentum remains strong and seems to be telling us earnings will deliver.

That said, the Committee acknowledges the potential for short-term weakness, especially with lingering geopolitical threats in the Middle East and as the U.S. presidential election quickly approaches.