“Fiscal Cliff” headlines have been flickering across the screens of cell phones, notepads and desktops every day. And depending upon the take-home message, investors have been quick on their collective trigger.

On Tuesday, Senator Reid expressed doubt about the ability of elected officials to craft an agreement. Stock assets promptly sold off, leaving the S&P 500 below the 1400 level.

On Wednesday, President Obama voiced hope that both sides of the aisle would come to terms by Christmas. The popular benchmark rallied 25 points off an intra-day low (1.8%) to finish 0.8% higher on the session.

It is easy to discuss the political environment and its “risk-on-risk-off” impact on broad-based U.S. equities. On the other hand, it may be more instructive to assess differences in the responses of unique Sector ETFs.

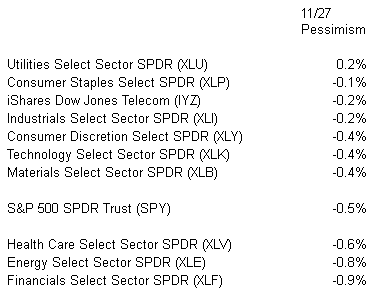

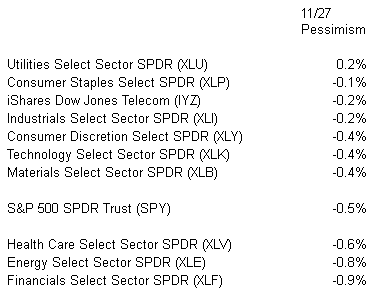

Consider the market activity on Tuesday, 11/27/12. Generalized fiscal fears coupled with Reid’s pessimism produced the following Sector ETF results:

Sector ETFs: Pessimism On The Fiscal Cliff

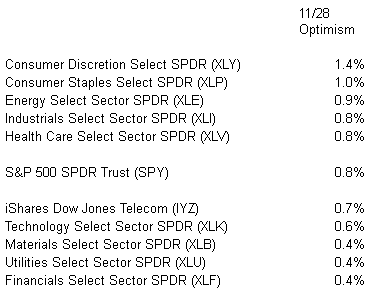

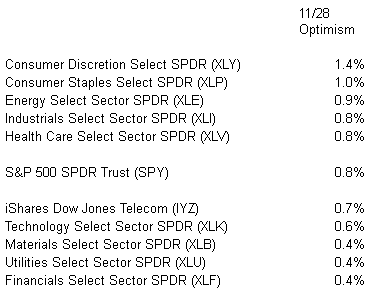

Now take a look at the rebound that occurred alongside the president’s communication. Here are Sector ETFs returns for the Wednesday (11/28/12) turnaround:

Sector ETFs: Optimism On The Fiscal Cliff

Energy (XLE) is the most “skittish” with regard to the ongoing dialogue in Washington. The investment community may view unresolved tax policy and automatic spending cuts as particularly painful for energy stocks.

Not surprisingly, Utilities (XLU) appear to be the least “skittish.” Not only is there an absence of cyclicality in the type of businesses that XLU represents, but the vehicle is the least correlated with the S&P 500. Indeed, it may be the most sensitive to changes in comparable treasury bond yields.

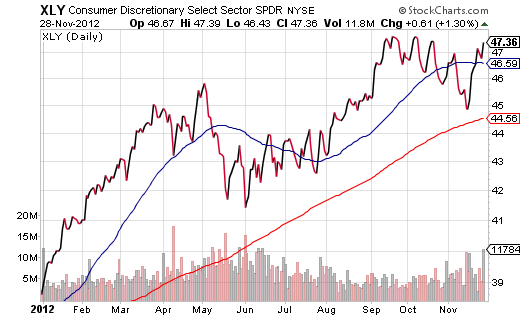

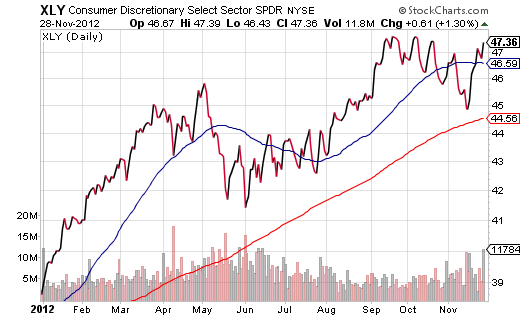

Most notably, SPDR Select Consumer Discretionary (XLY) and SPDR Select Consumer Staples (XLP) held up better during Tuesday’s sell-off; they also surged on Wednesday’s bounce-back. This may be a sign that resilience in consumer confidence readings, rising home values and substantive increases in retail sales are overriding the daily news-feed.

The success of consumer staples right now may seem like a no-brainer. After all, we need soap, butter and beer no matter what the economic landscape is. However, the success of XLY in the face of fiscal cliff headwinds likely tells us a thing or two about near-term consumer demand; that is, the Federal Reserve’s quantitative easing (QE) is still able to reflate asset prices and make people feel wealthier.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

On Tuesday, Senator Reid expressed doubt about the ability of elected officials to craft an agreement. Stock assets promptly sold off, leaving the S&P 500 below the 1400 level.

On Wednesday, President Obama voiced hope that both sides of the aisle would come to terms by Christmas. The popular benchmark rallied 25 points off an intra-day low (1.8%) to finish 0.8% higher on the session.

It is easy to discuss the political environment and its “risk-on-risk-off” impact on broad-based U.S. equities. On the other hand, it may be more instructive to assess differences in the responses of unique Sector ETFs.

Consider the market activity on Tuesday, 11/27/12. Generalized fiscal fears coupled with Reid’s pessimism produced the following Sector ETF results:

Sector ETFs: Pessimism On The Fiscal Cliff

Now take a look at the rebound that occurred alongside the president’s communication. Here are Sector ETFs returns for the Wednesday (11/28/12) turnaround:

Sector ETFs: Optimism On The Fiscal Cliff

Energy (XLE) is the most “skittish” with regard to the ongoing dialogue in Washington. The investment community may view unresolved tax policy and automatic spending cuts as particularly painful for energy stocks.

Not surprisingly, Utilities (XLU) appear to be the least “skittish.” Not only is there an absence of cyclicality in the type of businesses that XLU represents, but the vehicle is the least correlated with the S&P 500. Indeed, it may be the most sensitive to changes in comparable treasury bond yields.

Most notably, SPDR Select Consumer Discretionary (XLY) and SPDR Select Consumer Staples (XLP) held up better during Tuesday’s sell-off; they also surged on Wednesday’s bounce-back. This may be a sign that resilience in consumer confidence readings, rising home values and substantive increases in retail sales are overriding the daily news-feed.

The success of consumer staples right now may seem like a no-brainer. After all, we need soap, butter and beer no matter what the economic landscape is. However, the success of XLY in the face of fiscal cliff headwinds likely tells us a thing or two about near-term consumer demand; that is, the Federal Reserve’s quantitative easing (QE) is still able to reflate asset prices and make people feel wealthier.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.