All eyes have been watching the retail sector as of late, hoping for a resurgence of the American consumer. After all, consumer credit rose sharply in the most recent report by $20 billion even as the personal savings rate fell to 3.5%. So, while there is much less money in the bank - it did mean more money flowing into the economy. Those two data points do bode well for a stronger 4th quarter GDP report coming this month which we estimate should come in closer to 2.5% versus 1.8% in the 3rd quarter and 1.3% in the 2nd. That's the good news.

However, sustainability is the key. As we discussed in our recent report on the NFIB Small Business Optimism Index this morning, individuals react to what has occurred in the past more so than what they think will happen in the future. As the initial recovery from the shut down early last year due to the Japanese disaster trifecta (earthquake, tsunami and nuclear crisis); the subsequent, but nascent recovery, spawned confidence in consumers to spend money. In turn that uptick in spending induced more business activity. This is the natural order of things when the economy is left to its own devices.

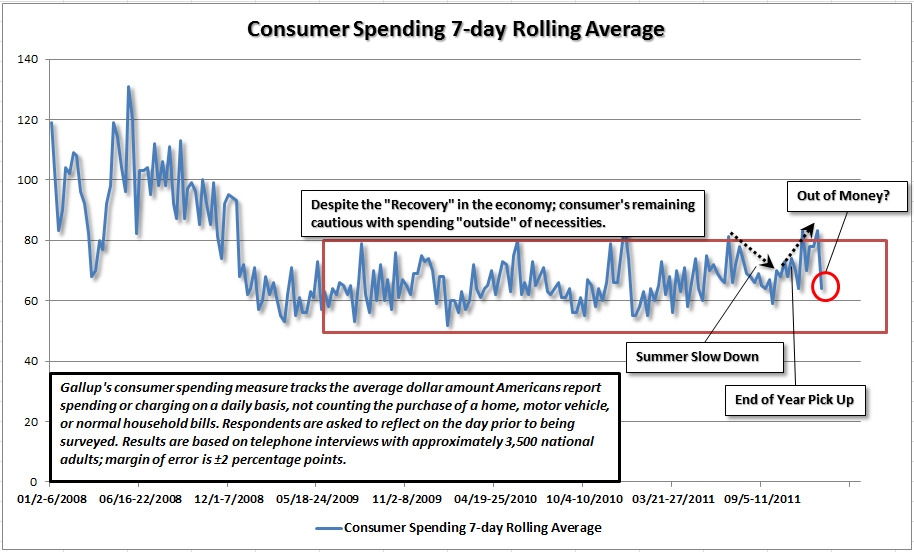

The potential issue is that the consumer may already be spent out. If you take a look at the most recent Gallup consumer spending survey a few things will immediately jump out at you. First, you can clearly see the slowdown in spending during the summer debacle and the recent 4th quarter uptick in consumption. You will also witness the sharp decline in the last week of December as consumers came to the realization that they are effectively "out of money". Finally, and very importantly, notice that spending on "necessities" has been constrained at very low levels since the onset of the financial crisis.

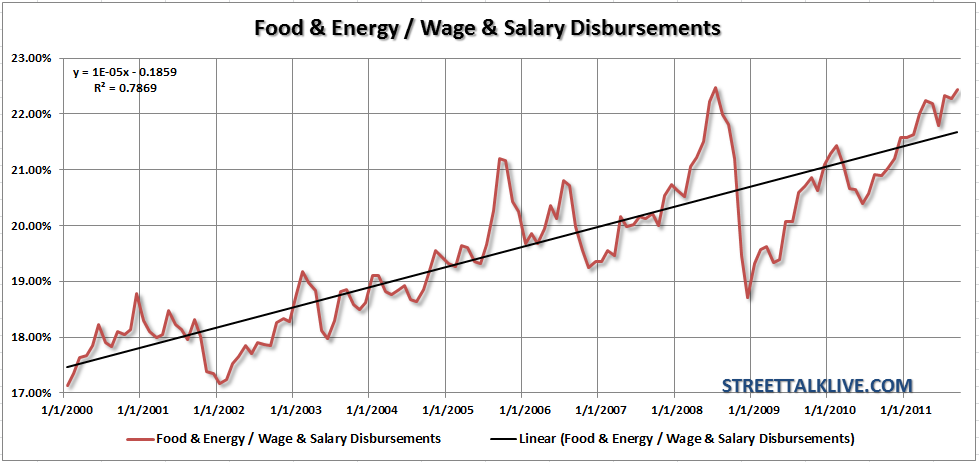

The last point is the most important. The "cost of living" has been rising sharply over the last few years as wage growth has been to slow to offset cost increases. In the past two quarters consumers have had an effective $60 Billion dollar tax reduction through lower gasoline prices. However, gasoline prices and energy prices are on the rise and that is an impact that is felt immediately by the consumer. Consumers only have a finite amount of income coming into their household. Therefore, with the costs of food and energy now consuming more than 22% of wages, it is going to be inherently more difficult for consumers to make purchases outside of "necessities" as wages decline.

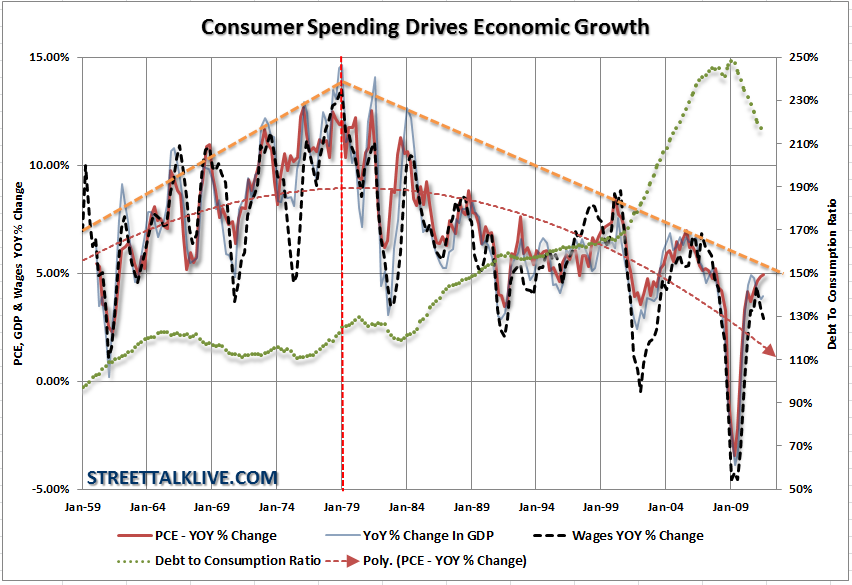

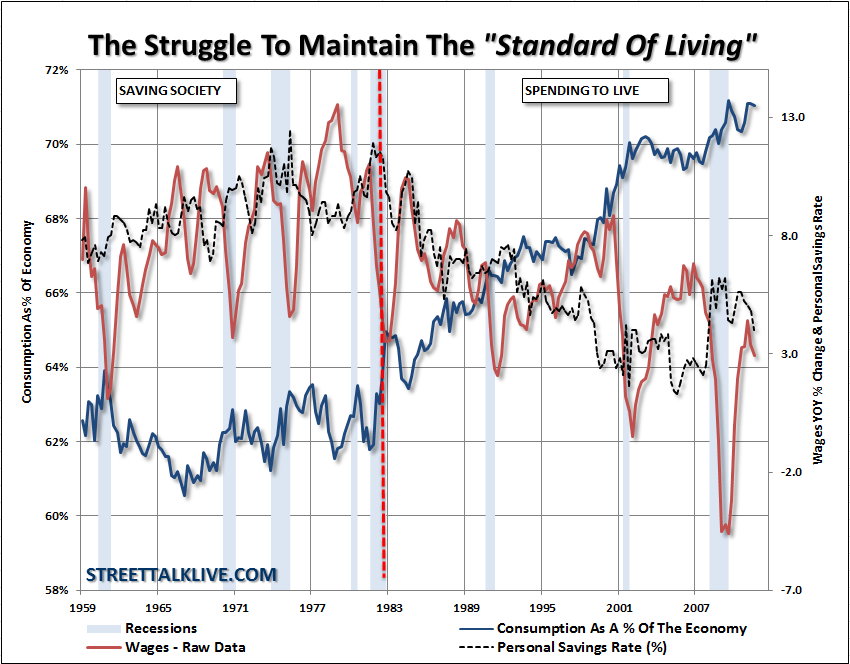

This is why we are seeing sharp declines in the personal savings rate as well as rises in consumer debt in order to support consumption. Consumption makes up roughly 70% of GDP (last chart) and has been fueled by increases in debt. As discussed, wages have not kept up with the rises in the standards of living and now looks like they may peaked in the declining wage growth trend going back to 1980.

Notice that prior to 1980 the debt-to-consumption ratio remained constrained 100 and 130%. This manageable level of debt service relative to consumption levels allowed for increases in wage growth to increase consumption and ultimately the economy. Rising personal savings rates led to productive investment and a fostering of the business cycle. However, post 1980, as the economy shifted from manufacturing and production to a service based economy, the use of debt to finance consumption exploded. In turn this cycle of leverage decreased personal savings and led to less productive investment which ultimately impacted wages as the economic growth rate declined. Debt, as a function, is a cancer on economic growth as the debt service diverts more and more income away from more productive uses.

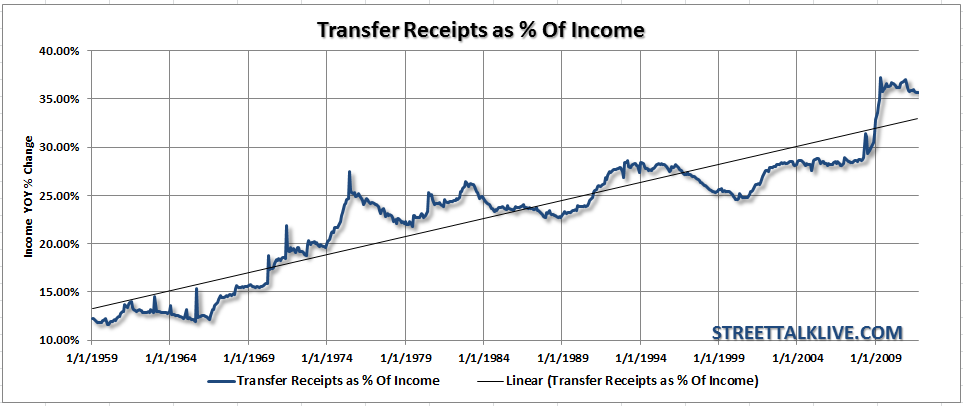

Another concern about consumer spending in the months ahead is that one of the support pillars over the last few years has been government transfer payments. Beginning in 2009 transfer payments as a percent of income exploded higher as the financial crisis set in. However, in recent months that assistance has begun to fade. This is a trend that will likely continue in the months ahead as the need to cut government spending and reduce deficits grows. Furthermore, with more and more cutbacks at the local and state levels this impact will be increased.

This brings us to the real issue for the economy in the coming quarters which will be the sustainability of consumption. As stated above, consumption comprises more than 70% of the economy, and it is unlikely the recent bouts in spending are sustainable. The decline in personal savings rates combined with weakening wage growth leads little discretionary wiggle room. Furthermore, in the current economic environment, it is unlikely that the recent increases in consumer credit are sustainable given tighter lending standards and an ongoing pattern of consumer deleveraging.

Looking forward in the coming quarters ahead we are highly suspect of the recent consumption trends and caution investors that the recent upticks in the data may be transitory related to the "pent up" demand and the inventory liquidation cycle that occurred last summer. We may very well be closer to the end of that restocking period than the beginning. If this is the case then any disappointment in consumer spending will mean two things for investors; 1) weaker than expected economic growth and; 2) weaker corporate earnings in the coming year. This will translate into potentially weaker equity performance as expectations are still very lofty but continues to bode well for bonds and income plays.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Consumer Spending May Disappoint

Published 01/11/2012, 01:55 AM

Updated 02/15/2024, 03:10 AM

Consumer Spending May Disappoint

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.