It has been said that this is a stockpicker’s market, or a market of stocks not a stock market. If you have to pick a place to look then, why not focus on the Consumer Discretionary Sector?

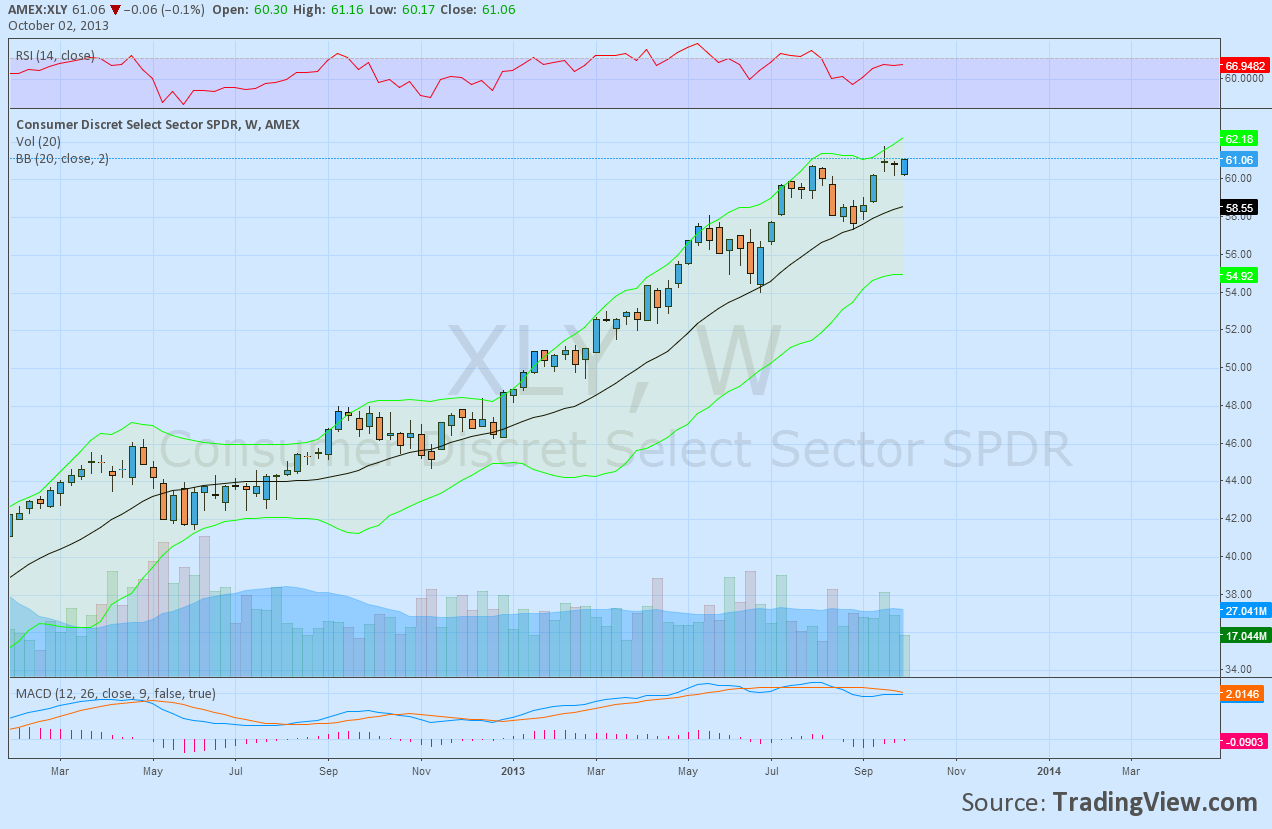

The Consumer Discretionary Select Sector SPDR ETF, (XLY), gives you ample reason for that or to just focus on this ETF. The weekly chart below shows that like every other sector ETF it printed a Shooting Star Candlestick three weeks ago and was confirmed with a lower close last week. But this sector is bouncing back and building an Bullish Engulfing Candle after 3 days. The RSI continues to hold in bullish territory and is moving up while the MACD is about to cross higher. These support the bull case.

Whether you just trade the XLY or use this knowledge to look for individual names within the Consumer Discretionary sector does not matter. Just make sure that you are trading and buying stocks with strength.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post