Ever since the post-crisis lows and S&P 500 bottom of March 2009, the consumer retail sector has been a juggernaut. Time and again, predictions of the US consumer’s demise have not just been countered, but steamrolled.

And yet now, in the early days of 2014, retail names are showing meaningful signs of weakness for the first time in years. An accumulation of earnings misses and poor guidance — coupled with extreme negative price reaction — threatens a sentiment sea change, which could in turn lead to investor exodus and lowered multiples for the whole sector.

The Spider S&P Retail ETF (XRT), is the premier bellwether for consumer retail. Let’s first consider the XRT monthly chart, to demonstrate the relentless rise:

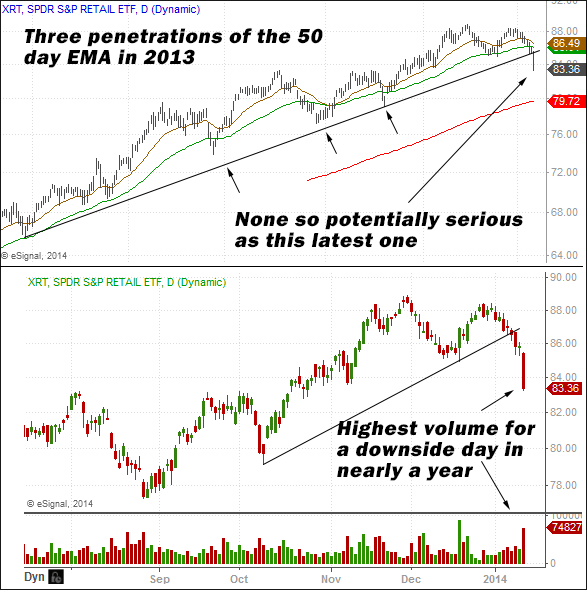

Now consider the same vehicle — XRT, the bellwether retail ETF — on a daily level, after enduring recent damage. The key concern here is penetration of the 50 day exponential moving average (the green line), and secondarily the broader trend. (There is nothing magical in a technical chart development — but charts are useful as a statistical and psychological proxy for investor positioning and sentiment.)

XRT saw only three breaches of the 50 day EMA (exponential moving average) in 2013. Each instance resolved higher relatively quickly, ultimately proving to be a buying opportunity. These breaches also coincided with broader macro weakness — points where the entire market was in temporary “risk off” mode (prior to verbal central bank support).

This latest breach is far more serious, for multiple reasons:

- It is much later in the trend – and trends have lifespans.

- The breach is volatility expansive, on surging volume – the largest volume for a downside day in roughly a year.

- The major trend is definitively broken – with a potential double top in place.

- The bearish drivers are internal to retail – rather than external to the broad market. The retail sector is getting hit by downside blowouts on earnings misses and poor guidance.

The threat to retail stocks at this juncture is not just mounting fear of downside (which will be the next widely held apparel name to be taken out and shot?), but a potential sentiment shift that results in steady capital outflows and follow-on multiple compression for the entire sector.

If this shift occurs, it will be rooted in a steady drumbeat of high profile disappointments… and the beat has already grown loud.

On January 10th, Bed Bath & Beyond (BBBY) kicked off the carnage with a violent drop on poor guidance.

The WSJ gave an overview in its piece, “Sour Outlooks Slam Retail Stocks:”

It’s turning out that Santa left a lump of coal for retail stock investors. In the wake of a disappointing holiday season for many retailers, analysts are continuing to lower earnings forecasts.

Family Dollar, Bed Bath & Beyond, Gap Inc. and L Brands Inc. are just a few of the retailers that have announced disappointing news about their year-end performance this week, leading analysts to cut their estimates for industry profits.

…Apparel retailers saw the sharpest forecast cuts over the past week. Analysts now expect the industry to report that apparel retailers’ fourth-quarter profit declines were 45% wider than expected, according to Thomson.

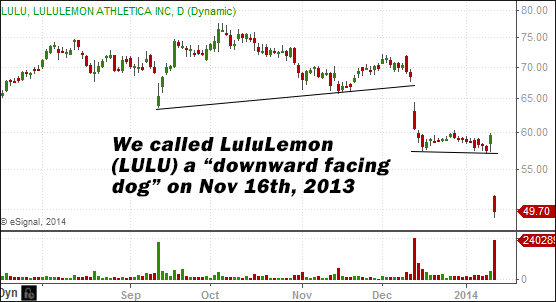

The bloodbath really got underway on January 13th, though, when the yoga apparel maker Lululemon (LULU) took a swan dive:

In the case of LULU, the retailer’s troubles were readily apparent. On November 16th we wrote up the short case for LULU, titling the piece: “LuluLemon is a Downward Facing Dog.” Our conclusion was as follows:

LULU has been an excellent case of “right place, right time” as the company masterfully rode the yoga craze to dizzying heights over the past few years. All hot growth stocks eventually flame out, however – such is the nature of things – as markets mature, competition muscles in, and customers move on. We are short LULU as of this writing and see good potential for extended downside decline, on the order of 20% in a conservative scenario and possibly much more if broad market drivers turn bearish.

We were short LULU heading into this week’s precipitous drop, and have established “starter position” shorts in a number of other faltering high-flyers like Ulta Cosmetics (ULTA) and Five Below (FIVE). All of these are prime examples of what we call “Icarus Stocks” — one-time growth darlings subject to flameout, and substantial decline, as overly lofty expectations inevitably adjust back toward reality.

For the bulk of the Bernanke years, “shorting” stocks — positioning to profit from declines — was an exercise in pain and wasted time. The combined driving forces of Quantitative Easing (QE), corporate share buybacks fueled by low-interest borrowing, robust sentiment, profit gains from suppressed wages and corporate cost-cutting, and a gradually improving US economy, all combined to create a seemingly bulletproof environment for longs. Positive sentiment was further reinforced by quick resolution to any and all downdrafts via central bank intervention (if only psychological).

But like the seasons, all trends end, and a season of shorting may soon be upon us. All the key drivers that propelled stocks to higher climes are either ending or exist in some stage of twilight. Bernanke himself is stepping down. Corporate profit margins well above historic highs are juxtaposed with a strong outpacing of negative versus positive pre-announcements. And a break in the stride of the retail juggernaut could be an early sounding of the alarm.