Is the American consumer genuinely spending? While the combination of rising home prices and higher 401k values may contribute to a temporary wealth effect, higher payroll taxes may begin to exact a toll.

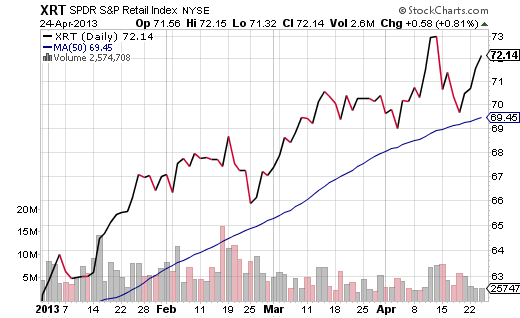

Consider the curious case of SPDR Retail (XRT). Its year-to-date 16.2% haul is better than most large and mid-cap benchmarks. Equally impressive, XRT has remained resilient, holding firmly above a near-term trendline.

On the other hand, the volume on down days is a great deal heavier than the volume of shares traded on up days. What’s more, 20% of XRT’s assets under management have disappeared in less than 1 month’s time. It seems that profit-taking investors are convinced that apparel, specialty and automotive retailers will struggle to generate revenue in the weeks ahead.

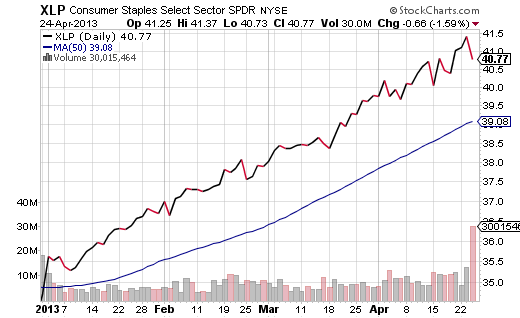

If retail falls into the area of discretionary spending, one might be more inclined to purchase the stock shares of toilet paper and toothpaste corporations. Indeed, it’s hard to argue against the technical strength of SPDR Select Consumer Staples (XLP). Fundamentally, however, the sector is sporting its highest multiple in a decade. Does the desirability of above-average dividend yields justify a 20% premium to the S&P 500 SPDR Trust (SPY)?

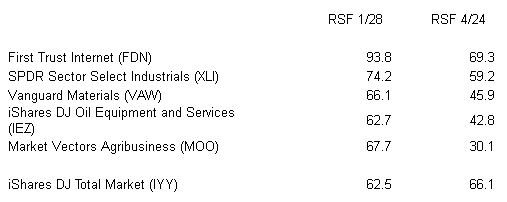

Some have suggested that now might be the perfect moment to rotate out of consumer discretionary and/or consumer defensive altogether. Yet these folks have been advocating the rotation since Q4 of 2012. Moreover, rotating into tech and energy because the sector P/Es are historically low ignores the economic slowdown that is gripping China, Europe as well as the United States. The rotation also ignores the weakening Relative Strength Factor (RSF) trends.

Quarter-Over-Quarter Relative Strength For A Variety Of Economic Sectors

Investors often benefit from rising relative strength coupled with “reasonably priced” growth and income. Admittedly, this has become increasingly difficult to find in a diversified exchange-traded vehicle. It follows that it may make the most sense to wait patiently for a pullback in equities of all stripes before committing new capital.

In all likelihood, you will not have to wait long for a meaningful sell-off to occur. U.S. stocks have fallen at least 5% in the first 5 months of every year since 1996. Indeed, now is the perfect moment to identify “wish list” candidates and the reasons each ETF might be worthy of purchase.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Consumer ETFs: If We Spend Less, Can They Keep Climbing?

Published 04/25/2013, 01:48 AM

Consumer ETFs: If We Spend Less, Can They Keep Climbing?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.