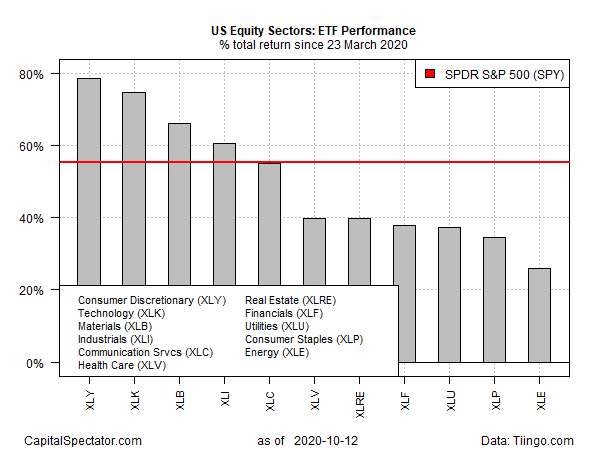

All the US equity sectors have bounced off the Mar. 23 broad-market low, with consumer discretionary shares leading the way, based on a set of exchange traded funds through yesterday’s close (Oct. 12).

Technology is a close second. On both fronts, the rallies have carried prices well above the broad market’s recovery since the depth of the coronavirus crash in late-March.

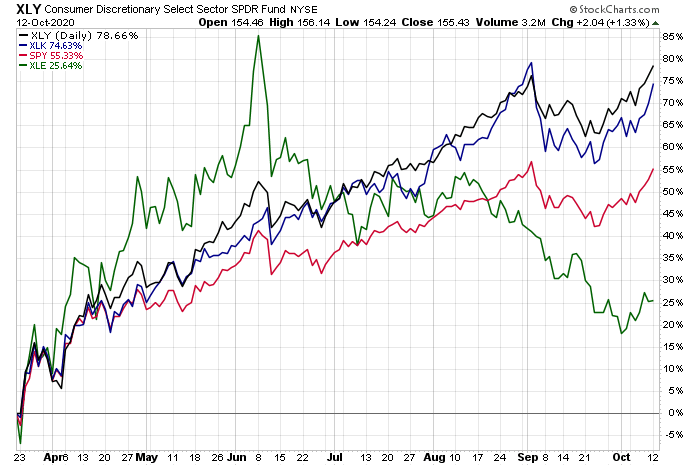

Consumer Discretionary Select Sector (NYSE:XLY)) continues to post the strongest return so far in the post-crash revival. The ETF is up a red-hot 78.7% since the market’s darkest hour at Mar. 23’s close. Powered by top holdings including Amazon (NASDAQ:AMZN) and Home Depot (NYSE:HD), XLY ended at a record high in yesterday’s trading session.

In close pursuit is Technology Select Sector (NYSE:XLK), which is up 74.6% from the Mar. 23 bottom.

Energy stocks are posting the weakest recovery. Although Energy Select (NYSE:XLE) surged early on after the broad market bottomed in late-March, the fund has stumbled in recent months and is currently up a comparatively modest 25.6% since Mar. 23.

The US stock market overall, based on SPDR S&P 500 (NYSE:SPY), is ahead 55.3% since the coronavirus-crash low. SPY’s bounce leads seven of the 11 sector returns for that period.

A key factor that’s been keeping stocks bubbly lately is the prospect that a new round of federal economic stimulus is in the works. Although negotiations between Republicans and Democrats have kept a breakthrough on ice for months amid tortured debates, some analysts predict that a second coronavirus relief bill will arrive at some point.

“The market has come to a realization that stimulus is going to be coming … no matter who is the president,” says Robert Pavlik, chief investment strategist and senior portfolio manager at SlateStone Wealth. “It’s probably going to be coming about a month out from now,” after the Nov. 3 election.

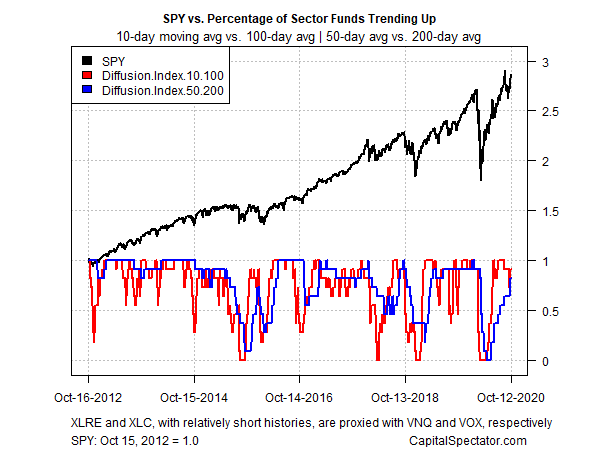

Ranking all the sector funds through a momentum lens reveals that most of the ETFs in this space are posting bullish profiles, based on two sets of moving averages. The first measure compares the 10-day average with its 100-day counterpart—a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represent an intermediate measure of the trend (blue line). Data through yesterday’s close shows that bullish short-term momentum continues to prevail for the majority of sector funds.