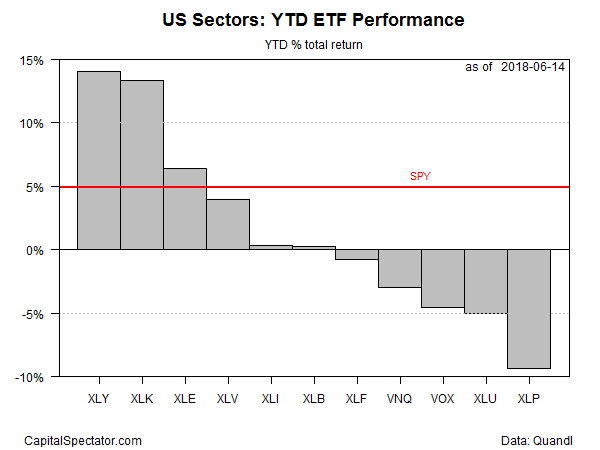

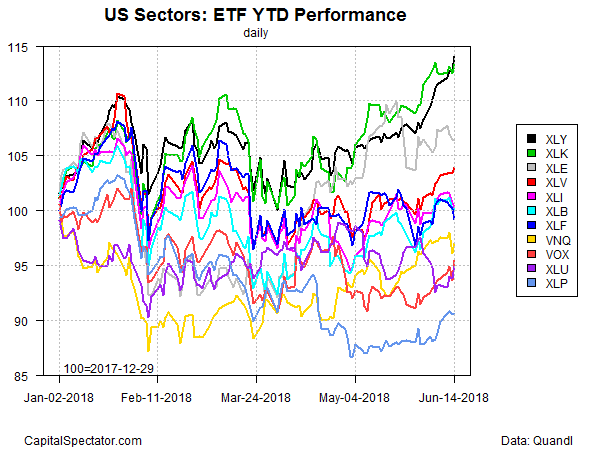

Consumer discretionary stocks are now the top-performing sector year to date, based on a set of exchange-traded funds through yesterday’s close (June 14). Although technology shares had been the leading sector in 2018, a strong rally this month in consumer discretionary companies has lifted this slice of the stock market to the top performance slot for the year so far. Tech shares overall, by comparison, have posted mild gains in June.

Consumer Discretionary Select SPDR (XLY) is up 14.0% so far in 2018, edging out technology stocks in the year-to-date horse race. Technology Select Sector SPDR (XLK) is now a runner-up sector performer with a modestly softer 13.3% return this year.

The biggest loss for US sectors so far in 2018: consumer staples. Consumer Staples Select Sector SPDR (XLP) is down a hefty 9.4% year to date.

The market overall, based on the SPDR S&P 500 SPY, is up a respectable 4.9% — a reminder that a decent tailwind is still blowing for US equities as the year’s mid-point approaches.

The performance chart below for the year so far shows that XLY has rallied in June (black line at top) to overtake tech (green line), albeit just barely for the year-to-date results.

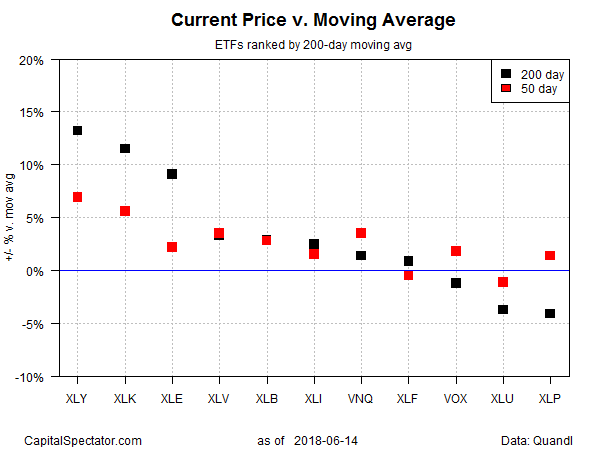

Ranking the sector ETFs by current price relative to 200-day moving average shows that the consumer discretionary fund has the strongest technical profile, edging out the second-place tech sector (XLK).

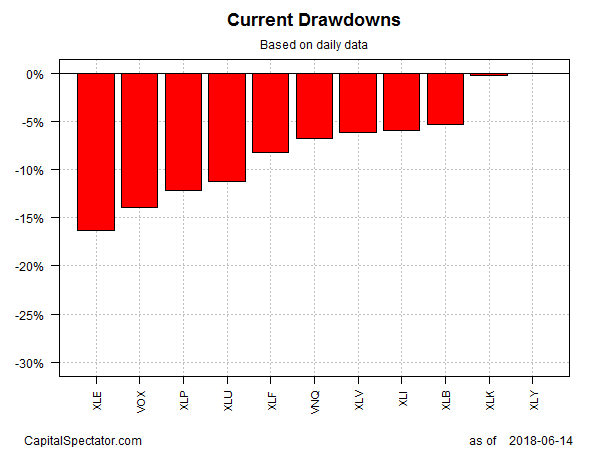

With XLY trading at a new high as of yesterday’s close, the ETF’s drawdown is nil. By contrast, the biggest drawdown at the moment for sector ETFs is in energy shares: Energy Select Sector SPDR (XLE) has fallen more than 15% from its previous peak.